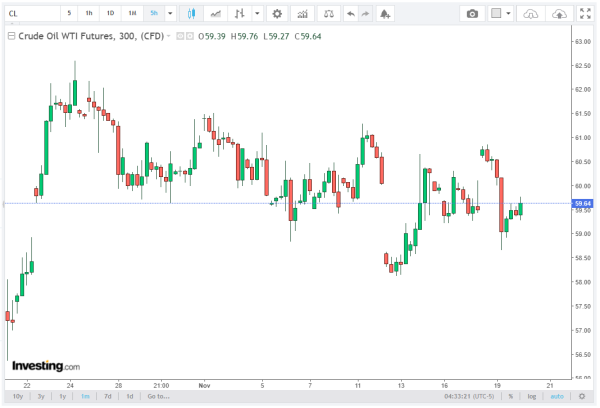

WTI Crude Oil continues to face pressure, hovering below the $60.00 per barrel mark despite attempts to recover from midweek lows. On Thursday, oil prices managed to trim earlier losses, rising from Wednesday’s bottom at $58.65 to session highs above $59.60 at the time of writing. In their latest publication, Fimatron experts explore the central elements of the topic in depth.

However, despite these developments, the overall sentiment remains bearish, with persistent oversupply concerns weighing on a stronger recovery. Analysts highlight that while geopolitical developments may provide short-term support, structural market factors, particularly global supply dynamics, continue to cap WTI gains.

US Sanctions on Russia Provide Temporary Support

The upcoming US sanctions on Russia have injected some optimism into the oil market. These measures are expected to restrict Russian oil exports, potentially tightening the global crude supply in the near term. Traders are pricing in the possible impact, which has contributed to the modest uptick in WTI Crude observed on Thursday.

Nevertheless, market reactions remain muted, partly due to rumors of secret US-Russia negotiations aimed at ending the Ukraine conflict. Such reports have raised doubts about the sanctions’ long-term effectiveness, reducing the likelihood of a sustained price rally. As a result, WTI Oil remains trapped in a narrow trading range, with investors wary of overcommitting amid uncertain geopolitical outcomes.

Conflicting Inventory Data Adds to Volatility

Recent inventory reports have added further complexity to the market outlook. On Wednesday, the US Energy Information Administration (EIA) released data showing a larger-than-expected withdrawal of Crude Oil Stocks, falling 3.426 million barrels during the week of November 14, surpassing forecasts of a 1.9 million-barrel decline.

This bearish signal was partially offset by figures from the American Petroleum Institute (API), which reported a 4.4 million-barrel build in oil stocks the day before, following a 1.3 million-barrel increase the previous week. The contrasting data sets underscore the volatile nature of oil markets and highlight how inventory trends can sway WTI price action in the short term.

Oversupply Concerns Keep Prices in Check

Despite the modest rebound, WTI Crude remains unable to reclaim the $60.00 threshold, reflecting lingering fears of a global oil surplus. Analysts emphasize that OPEC+ production increases, combined with slowing global demand, continue to exert downward pressure on crude prices.

The OPEC Supply Outlook, released last week, projected that world oil supply will meet global demand next year, countering prior expectations of a global oil deficit in 2026. This reassessment has triggered sharp declines in crude prices, as investors adjust to the likelihood of ample supply.

Market participants are particularly attentive to production signals from key oil-exporting nations, which indicate a willingness to boost output even amid softer demand metrics. Such moves reinforce the oversupply narrative, capping WTI upside potential despite geopolitical support from US sanctions.

Technical Levels and Market Sentiment

From a technical perspective, WTI Crude is navigating a resistance zone near $60.00, with support levels around $58.50-$58.65. Short-term traders are cautious, balancing inventory data, geopolitical developments, and OPEC+ output forecasts to determine positions.

The 2.3% decline seen on Wednesday underscores the fragility of the current oil rally, with buyers hesitant to drive prices above psychologically important levels. Analysts suggest that until supply concerns ease or geopolitical risks escalate, WTI is likely to continue trading within its current range-bound pattern.

WTI Crude Outlook: Market Analysts Eye Supply and Geopolitical Risks

Looking ahead, WTI Crude Oil prices are expected to remain highly sensitive to global supply dynamics and ongoing geopolitical developments. Analysts highlight that oversupply concerns, driven by OPEC+ output hikes and resilient production from non-OPEC producers, could continue to limit upside momentum.

At the same time, the looming US sanctions on Russia and potential shifts in international energy trade may provide temporary support for crude prices. Investors are closely monitoring EIA inventory data, API reports, and market sentiment to anticipate future price movements and identify potential trading opportunities in WTI Crude.

Looking Ahead: Supply-Demand Dynamics

The broader oil market landscape remains shaped by oversupply risks, geopolitical uncertainty, and evolving inventory trends. While US sanctions on Russia may provide short-term support, the overarching supply-demand balance suggests limited upside in the near term.

Investors are monitoring OPEC+ production decisions, global consumption patterns, and EIA inventory updates for indications of market tightening. Any deviation from expected supply levels, whether from geopolitical disruptions or unexpected demand growth, could catalyze volatility in WTI Crude prices.

For now, WTI Oil is consolidating below the $60.00 mark, highlighting a cautious market that is highly sensitive to both supply data and geopolitical developments. Traders and analysts alike remain vigilant, recognizing that oil prices are likely to remain range-bound until more definitive supply-demand signals emerge.