The 4th quarter of 2024 delivered a stark reminder that value investing requires stomaching periods of underperformance that feel deeply uncomfortable. While major indices climbed higher, portfolios focused on undervalued small-cap stocks stumbled through their worst relative performance in recent memory.

Senior market analyst at Rineplex has been examining why supposedly “cheap” stocks got cheaper while expensive growth names continued their march upward. The divergence raises questions about whether disciplined value investors should hold steady or reconsider their approach entirely.

The Numbers Behind the Pain

Aristotle Atlantic Core Equity Fund posted a fourth-quarter return that lagged its benchmark by a meaningful margin. The fund’s small-cap value orientation, typically a source of long-term outperformance, became a liability as market leadership concentrated in mega-cap technology names.

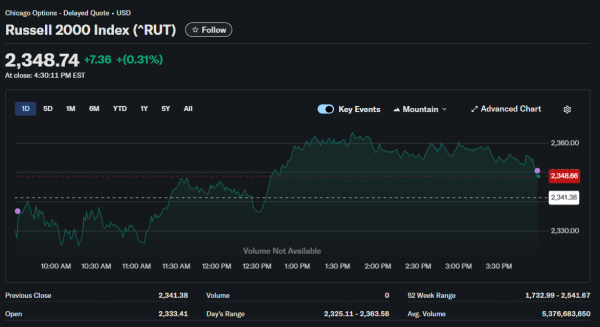

Small-cap stocks broadly struggled during the period. The Russell 2000 Index gained just 1.5% during the quarter while the S&P 500 surged ahead by double digits. This performance gap widened further when examining value-oriented small-caps specifically, which faced selling pressure from multiple directions simultaneously.

Fund managers maintaining discipline around valuation metrics watched their holdings decline not because business fundamentals deteriorated, but because market participants simply paid less for each dollar of earnings. Price-to-earnings multiples compressed across small-cap value stocks even as earnings estimates held relatively stable.

The magnitude of underperformance tested even experienced value practitioners. Portfolios constructed around companies trading at single-digit P/E ratios with strong balance sheets delivered negative absolute returns during a period when growth stocks with no earnings reached new highs. This inversion of traditional market logic creates cognitive dissonance that challenges investment discipline.

Historical data offers some comfort. Value investing typically experiences extended periods of underperformance followed by sharp reversions that recapture lost ground quickly. However, these historical patterns provide cold comfort during drawdowns when clients question strategy adherence and career risk mounts for professional managers.

Why Quality Struggled

The counterintuitive element frustrating value investors centers on quality. Analysts note that many underperforming small-cap value names actually demonstrated strong operational performance throughout 2024. Revenue growth met or exceeded expectations, profit margins expanded, and balance sheets strengthened.

Market participants weren’t rejecting these companies because of poor execution. Instead, sentiment shifted toward businesses promising exponential growth regardless of current valuation. The market rewarded potential over present reality, leaving profitable but modestly growing companies behind.

Interest rate dynamics played a supporting role. While the Federal Reserve cut rates during the period, long-term bond yields actually rose, creating headwinds for rate-sensitive small-cap stocks. Higher discount rates in valuation models mathematically reduce present values of future cash flows, hitting small-caps harder than established large-caps.

The disconnect between operational performance and stock price behavior reveals pure sentiment shifts rather than fundamental deterioration. Companies reporting 15% earnings growth traded flat or down while money rotated into names with revenue growth but persistent losses. This environment punishes value investors regardless of how well underlying businesses perform.

Currency fluctuations added another layer of complexity. Dollar strength hurts small-cap exporters disproportionately since they lack the hedging sophistication of large multinationals. Revenue generated overseas translated into fewer dollars, compressing reported results even when local currency performance remained solid.

Sector Selection Proves Critical

Healthcare and financial services holdings within value-oriented portfolios faced particularly challenging conditions. Healthcare stocks confronted regulatory uncertainty and changing reimbursement dynamics that kept investors cautious despite reasonable valuations.

Regional banks, typically core holdings in small-cap value strategies, struggled with net interest margin pressures as the yield curve flattened. These institutions generate profits from the spread between deposit costs and loan yields, and that spread narrowed uncomfortably during the quarter.

Industrial names fared somewhat better but still lagged growth-oriented peers. Manufacturing companies with solid order books and improving margins couldn’t overcome the gravitational pull of market momentum flowing elsewhere.

Energy sector exposure, often significant in value portfolios, provided mixed results. While oil prices remained relatively stable, energy stocks failed to participate in broader market gains as investors worried about demand destruction from slowing economic growth and increasing renewable energy adoption.

Consumer discretionary holdings in value portfolios faced dual headwinds. Weakening consumer sentiment combined with competition from e-commerce platforms compressed margins for traditional retailers even when they traded at historically low multiples. The structural challenges in retail overwhelmed valuation support.

Technology exposure within small-cap value portfolios is generally disappointing. These positions typically represented profitable but slower-growing software companies rather than high-flying cloud names. The bifurcation within technology sectors meant steady earnings growth couldn’t compete with momentum in artificial intelligence and semiconductor stocks.

What Patience Demands

Value investing always required tolerance for discomfort, but current conditions test even experienced practitioners. Quarterly underperformance can become multi-year performance drags when market leadership remains concentrated, forcing investors to choose between conviction and capitulation at precisely the wrong moments.

The psychological challenges shouldn’t be underestimated. Watching portfolios decline while benchmarks rise creates stress that affects decision-making quality. Successful value investors develop mental frameworks and processes that maintain discipline through inevitable difficult periods without ignoring genuine warning signs of strategy obsolescence.