Walmart will transfer its stock listing from the New York Stock Exchange to Nasdaq on December 9, 2025, maintaining its WMT ticker symbol but fundamentally repositioning how markets perceive the world’s largest retailer.

The exchange switch follows third-quarter earnings that beat expectations, with revenue climbing and e-commerce posting impressive growth rates. Lead market strategist at Nexdi analyzes why this move reveals more about competitive positioning than ceremonial relocation.

The timing positions the listing change as a strategic statement rather than an administrative adjustment. Walmart’s CFO framed the transition as “partnering with Nasdaq on this next chapter of our growth story,” diplomatic language that masks calculated repositioning.

The company wants Wall Street to value it like Amazon rather than Target, and listing on Nasdaq’s tech-forward exchange begins the narrative shift required to close valuation multiples that currently favor pure-play technology platforms.

The Amazon Competition Nobody Discusses

Walmart’s e-commerce business grew 25% in the U.S. during the most recent quarter, driven by same-day delivery that now reaches 93% of U.S. households. The company’s third-party marketplace has become central to its strategy, increasing profits faster than sales by collecting fees without holding inventory. The model directly mimics Amazon’s marketplace dominance, which generates higher margins than first-party retail operations.

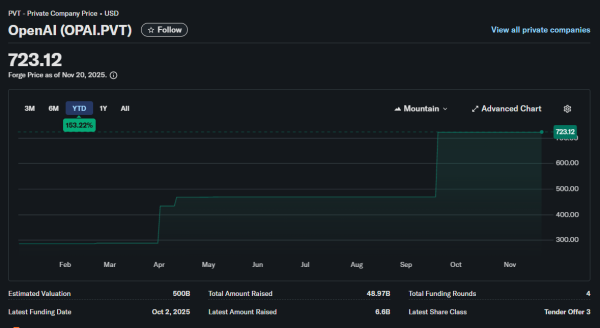

Amazon trades at roughly 3.1x sales while Walmart trades around 0.9x sales despite comparable e-commerce growth rates. The valuation gap exists because investors perceive Amazon as a technology platform and Walmart as a retailer with technology capabilities. Listing on Nasdaq begins the narrative shift required to close that multiple, potentially unlocking billions in market capitalization if successful.

The SNAP Benefit Pause Impact

Walmart noticed a dip in same-day delivery volume during the week of November when SNAP benefits were paused due to the 43-day government shutdown. The company’s CFO specifically called out this impact, revealing Walmart’s customer base includes significant low-income households dependent on government assistance.

The exposure contradicts narratives of Walmart primarily serving middle-class suburban families shopping by choice.

Approximately 42 million Americans receive SNAP benefits, representing a $120 billion annual market that Walmart captures disproportionately through grocery dominance. The company’s ability to maintain 4.5% comparable store sales growth despite SNAP disruptions demonstrates resilience, but also highlights vulnerability to policy changes around government benefits that could resurface with budget negotiations.

The ChatGPT Integration Gamble

Walmart announced a partnership with OpenAI, allowing customers to shop Walmart’s catalog within ChatGPT, launching next week. The company claims it will be “one of the first retailers to offer the purchase of multiple items in a single transaction, fresh food purchases, and the ability to choose Drive Up and Order Pickup fulfillment options through this platform.”

The integration attempts to position Walmart at the intersection of AI adoption and commerce.

Target also announced an OpenAI collaboration this week, suggesting retailers are racing to establish AI shopping interfaces before consumer habits solidify. The risk is that conversational commerce doesn’t gain traction, leaving Walmart with development costs but no revenue benefit. Amazon debuted its Rufus shopping assistant in February 2024, giving it over a year’s head start on training consumers to shop via AI interfaces.

The Leadership Transition Timing

CEO Doug McMillon will step down on February 1, succeeded by John Furner, current CEO of Walmart’s U.S. business. The timing positions the exchange listing as Furner’s first major strategic announcement despite occurring under McMillon’s tenure. McMillon joined Walmart as an associate in the 1980s and has helmed the company since 2014, overseeing the e-commerce transformation that now defines competitive positioning.

Furner faces pressure to accelerate digital growth while maintaining brick-and-mortar profitability that generates $25+ billion quarterly revenue. The Nasdaq listing creates expectations of technology innovation velocity that traditional retailers struggle to deliver. Target’s struggling performance, with comparable sales declining 2.7% in the same quarter, while Walmart grew 4.5%, demonstrates how quickly retail leadership shifts when execution falters.

The $5 Billion Investment Signal

Walmart plans $5 billion in capital expenditures for 2026, a 25% year-over-year increase focused on new stores, remodels, technology enhancements, and digital fulfillment capabilities. The investment level matches Amazon’s physical retail expansion and signals a commitment to an omnichannel strategy rather than prioritizing either digital or physical channels exclusively.

Walmart’s full-year sales outlook increased to 4.8%-5.1% growth, up from prior expectations of 3.75%-4.75%. The raise came despite macroeconomic headwinds, including tariffs, inflation, and government shutdown impacts. The resilience supports premium valuations if Wall Street accepts the technology narrative rather than traditional retail categorization.

Rewriting the Narrative

The exchange move won’t immediately change Walmart’s fundamentals, but it changes the conversation. Markets value stories as much as numbers, and Walmart just rewrote its narrative from “retail giant adapting to e-commerce” to “technology platform with physical distribution assets.” Whether investors accept the framing determines if the Nasdaq listing proves tactical genius or expensive symbolism.

The strategic calculation recognizes that perception drives valuation multiples as much as operational performance. By repositioning alongside technology leaders rather than traditional retailers, Walmart signals confidence that its digital capabilities justify technology company valuations. Success requires sustained execution on e-commerce growth, marketplace expansion, and AI integration to validate the narrative shift beyond superficial exchange migration.