You’ve almost certainly heard of it! Decentralized finance, or DeFi, is a new blockchain business that can potentially disrupt the financial system. DeFi refers to financial protocols, tools, solutions, and platforms that employ smart contracts to replace traditional financial infrastructure. DeFi apps are transparent and accessible to anybody with a blockchain wallet and an internet connection. There are no credit checks, KYC, or other obstacles required that traditional banks have.

In addition, by 2022, the global financial industry is anticipated to grow by $26 trillion. Decentralized Finance (DeFi) is a modern alternative economic system that does away with the need for trusted intermediaries that currently exist in the financial system. Blockchain technology has progressed significantly. Above all, growing demand for efficient financial systems to fill the gaps left by obsolete financial systems has emerged. DeFi is sure to become one of the essential words in blockchain technology.

What is Vortex Defi?

Vortex DeFi is a web-based platform to centralize all DeFi-related opportunities. It is a DeFi platform that acts as a one-stop gateway and aggregator, allowing users to access protocols including Compound Finance, Aave, and YFI via a single app.

The company’s creator, Rahul Singh, has brought his technical knowledge to the table, drawing on his more than 12 years of experience as a product manager in the aerospace and retail sectors. Vortex’s accomplishments in a brief period have backed up this assertion. The firm was in stealth mode when it originally started in September 2020, building out its minimal viable product. However, after obtaining a proof-of-concept, things changed dramatically. The firm decided to launch an initial DEX offering in February 2021. The change had an almost immediate impact, with a 25x return on investment.

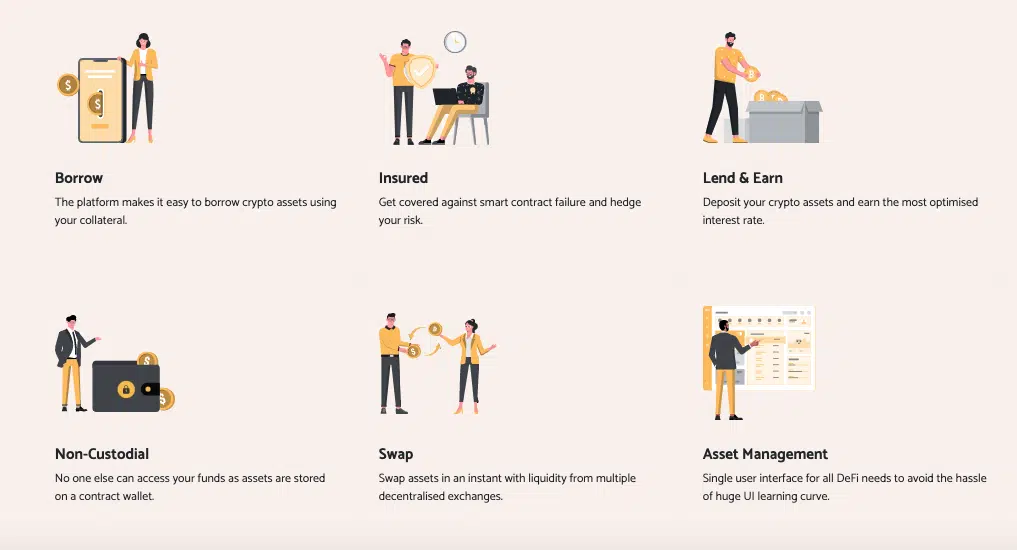

Vortex DeFi’s Features

Vortex DeFi is a one-stop simplified DeFi Asset management web-based application that will cut across multiple ecosystems (Ethereum, Polkadot, etc.) and bring together leading protocols and platforms to allow honest farmers to take advantage of decentralized finance’s full potential. The Vortex ecosystem includes a collection of applications that will enable users to do NFT asset tracking, lending, crypto-asset insurance, borrowing, and simple (cross-chain) exchanging of crypto assets. Furthermore, the Vortex ecosystem includes a collection of applications that allow users to do tasks such as NFT asset tracking, lending, crypto-asset insurance, borrowing, and simple (cross-chain) exchanging of crypto assets.

Vortex DeFi will also be driven by the Yearn Finance protocol, which allows the product to aggregate across many loan protocols and automatically gives the best and most optimal yield to farmers. The program offers an integrated solution to managing DeFi assets in a safe and straightforward platform that will be 100 percent non-custodial in nature, with the primary focus remaining on user experience, data security, and privacy.

Vortex DeFi Roadmap 2021

The purpose of the Vortex ecosystem and its products is to help solve all your daily tasks, primarily if you are engaged in yield farming. Below are the Vortex Ecosystem products according to the current roadmap:

V-YIELD: With the Yearn Finance protocol incorporated, yield farmers may take advantage of the best financing rates and optimize their earnings, as well as aggregation of Zapper.fi.

V-NFT: NFT asset management from within Vortex platform integration with Opensea Buying and Selling of NFT from Vortex.

V-SWAP: Aggregation with 1inch exchange; Swapping for ETH/Polygon/BSC chains.

V-INSURE: Integration with Nexus Mutual, allowing to ensure DeFi exposure within the Vortex ecosystem, with Vortex itself taking care by integrating with significant insurance protocols.

V-PAY: Integration of payment gateways to enable fiat-ramp on Vortex ecosystem.

Vortex promises to meet customers’ DeFi demands from A to Z by providing these upgraded functionalities. It enables cross-chain exchange starting with Ethereum and then Polkadot, in addition to essential features like lending and borrowing. Users expect to save a lot of money on gas because it provides all necessary services in one place. In the end, Vortex’s main objective is to make DeFi easy, accessible, simple, safe, and scalable for both end-users and developers.

Vortex’s Vision for the Future

Vortex DeFi aspires to be the ideal one-stop solution for DeFi asset management, offering essential features such as lending, borrowing, and cross-chain swapping, beginning with Ethereum and progressing to Polkadot. The VTX’s primary concept is to make DeFi easy, accessible, simple, secure, and scalable for end-users, protocols, and the developer community.

Vortex DeFi’s fundamental concept remains centered on one aspect: simplifying the end-user experience concerning managing their DeFi assets. Another essential feature of the Vortex DeFi platform ensures that all required services are available on a single integrated platform to save money on gas.

The main features of the decentralization idea are encapsulated in Vortex DeFi. That is why Vortex DeFi optimizes DAAS (DeFi-As-A-Service) to maximize its benefits for end-users on a single platform for all DeFi asset management use cases.

Most importantly, Vortex DeFi aspires to be the go-to platform for all levels of users (depending on their prior familiarity with cryptocurrencies) to enter the decentralized finance sector.

Final Verdict

DeFi wants to achieve what cryptocurrencies have done for payments in the banking industry. DeFi apps will replace the current financial infrastructure of banks, lenders, insurers, and other financial organizations. The crypto community is creating DeFi alternatives to almost every financial institution and some unique decentralized goods and services by harnessing the power of peer-to-peer blockchain technology. The rising popularity of these DeFi solutions reflects a desire to provide more services to a broader audience and innovation that has the potential to change the financial industry. As a result of this growing usage, DeFi-based financial services will become more widely available.

Platforms like Vortex make it easy for everyone to see their alternatives, thanks to the revival of DeFi. With so many DeFi protocols to choose from, it can be not easy to know where your money will be secure, how to get the highest APY returns, and even how to join. That’s where Vortex comes in.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.