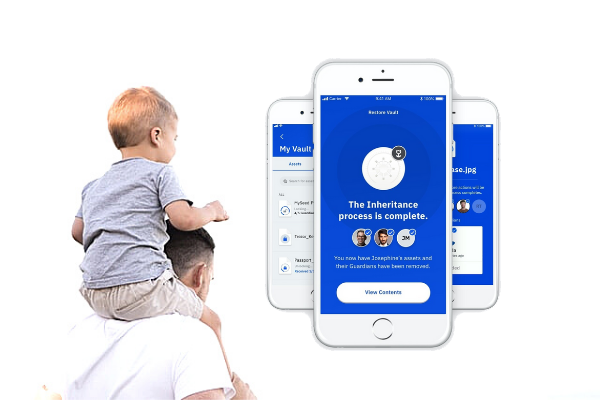

Vault12 is a leading personal digital asset security platform. On October 22, 2020, the company announced that it had launched Digital Inheritance. The solution makes it possible for people to pass on digital assets of all types to the next generation.

How Digital Inheritance Works

Digital Inheritance allows users to designate an executor, beneficiary, or trustee for their digital assets. The designated recipient will gain access to digital holdings that are securely stored in a vault when the owner passes on. It is a solution designed to eliminate the risk of permanent asset loss. Additionally, it eliminates the need to continually make inventory updates and issue updated instructions.

The digital assets that can be added to Vault12 include legal documents, financial data, medical data, and other types of digital assets. Protection of the vault is via a network of Guardians. These Guardians are trusted people that can be family, friends, or business associates.

Through Digital Inheritance, the vault owner can designate recipients of the assets. The owner digitally signs a declaration of intent. It is then sent to the designated recipient. The declaration can also be shared with lawyers when needed. When the recipient is ready to access the assets, a pre-set number of Guardians will confirm the request, and the assets will be released to them.

How Digital Inheritance Reduces Risk

Digital Inheritance is a solution designed by Vault12 to reduce risk in three major ways during digital assets transfers. These are:

Comprehensive Digital Asset Inventory

The solution accepts all types of digital assets. When used to secure and back up a full range of assets, it offers an up-to-date asset inventory that is easy to inherit.

Direct Access for Recipients

Recipients of the digital assets will have direct access to digital assets. It eliminates the need to petition multiple organizations, financial firms, or government agencies.

Privacy Protection

Unlike multi-sig solutions, the data on the digital assets will remain private and secure.

What the Leadership Team Had to Say

According to Max Skibinsky, the Vault12 CEO, while around 90% of crypto investors expressed concern regarding an unexpected death, less than 25% had a plan to deal with such an eventuality. As a result, crypto worth millions of dollars was lost annually.

Skibinksy added that there was no real, cryptographically secure option when it came to passing on crypto assets. He said that the company had recognized the challenges of passing on crypto to the next generation. As a result, they came up with a decentralized P2P solution that would make it easy to pass on digital assets.

Commenting on the development, the Chairman of Privacy and Cybersecurity Practice Otterbourg P.C., Philip C. Berg, said that inheritance planning with digital assets could be quite complex. He noted that besides privacy concerns, maintaining control over the assets is crucial, as it is hard to accomplish later. Berg concluded by stating that any solution, which protected the privacy while giving direct access to the beneficiary, executor, or trustee, was welcome.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.