As cryptocurrency markets attempt to recover from last week sell-offs, we take a look at altcoins, and outline a large cap altcoin that is due to outperform the market in the short-term. When looking at a list of cryptocurrencies with market caps larger than $1 billion, which digital asset is gearing up for a bull run?

Defensive Mode

Following a Bitcoin sell-off last week, many of the top altcoins went into defensive mode. It was mentioned that OKEx was the main catalyst last week, restricting 20M+ users from withdrawing cryptocurrency on the platform. Prior to this announcement, many of the top cryptocurrencies by market cap were experiencing bullish momentum, but failed to maintain this sentiment following the exchange developments. Despite OKEx still not removing the withdrawal ban as of 2:00AM CST today, we expect one digital asset to outperform the markets in the short-term.

Cryptocurrency RSI ( Relative Strength Index )

CRO ( crypto.com coin ), is the large cap digital asset on radar right now. At the time of this report, CRO has a relative strength index of 23.67 . When assessing all digital assets with a market cap greater than $1 billion, CRO is the only cryptocurrency that has a RSI less than 30. Historically speaking, RSI has been a powerful technical metric whether you are trading equities or cryptocurrencies. When an assets RSI dips below 30, the asset is considered extremely “oversold.” On the contrary, when RSI hovers above 70, the asset is considered “overbought.”

With CRO’s relative strength index being well below 30, CRO has been extremely oversold. We expect a reversal to occur in the short-term, which could result in more upside than other digital assets based on the CRO technicals right now.

Why Is CRO Oversold?

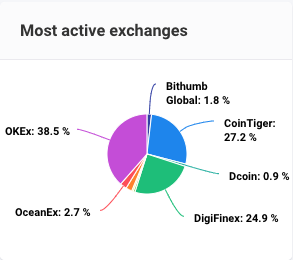

Over the last 24 hours, CRO has declined -8.15%. Additionally, CRO has fell -20% over the last 5 days. The sell-off seems to be highly correlated to the developments at OKEx. If we take a look at the most active exchanges for CRO, OKEx accounts for significant market share. Almost 39% of CRO trading activity occurs on OKEx. With the exchange causing a lot of discomfort in the market right now, assets that rely heavily on OKEx seem to be struggling at the moment.

Regardless, these sell-offs seem to be short-term. Leadership at OKEx has mentioned multiple times that they plan to re-enable withdrawals as soon as possible. Once the exchange opens back up 100%, we think you start to see a strong reversal in CRO, based on the heavy selling that has taken place.

CRO ( crypto.com coin ) Chart

As we can see from the chart below, CRO has experienced strong downside pressure, but we believe a reversal is in the pipeline pending positive news from OKEx. Once this reversal comes to fruition, we believe CRO will outperform most large caps in the short term.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.