Ethereum price has outperformed Bitcoin over the last 24 hours, as the 2nd largest digital asset by market cap attempts to test key resistance levels. Based on current technicals, why could Ethereum price experience ~ 10% upside in the short-term?

Ethereum Price

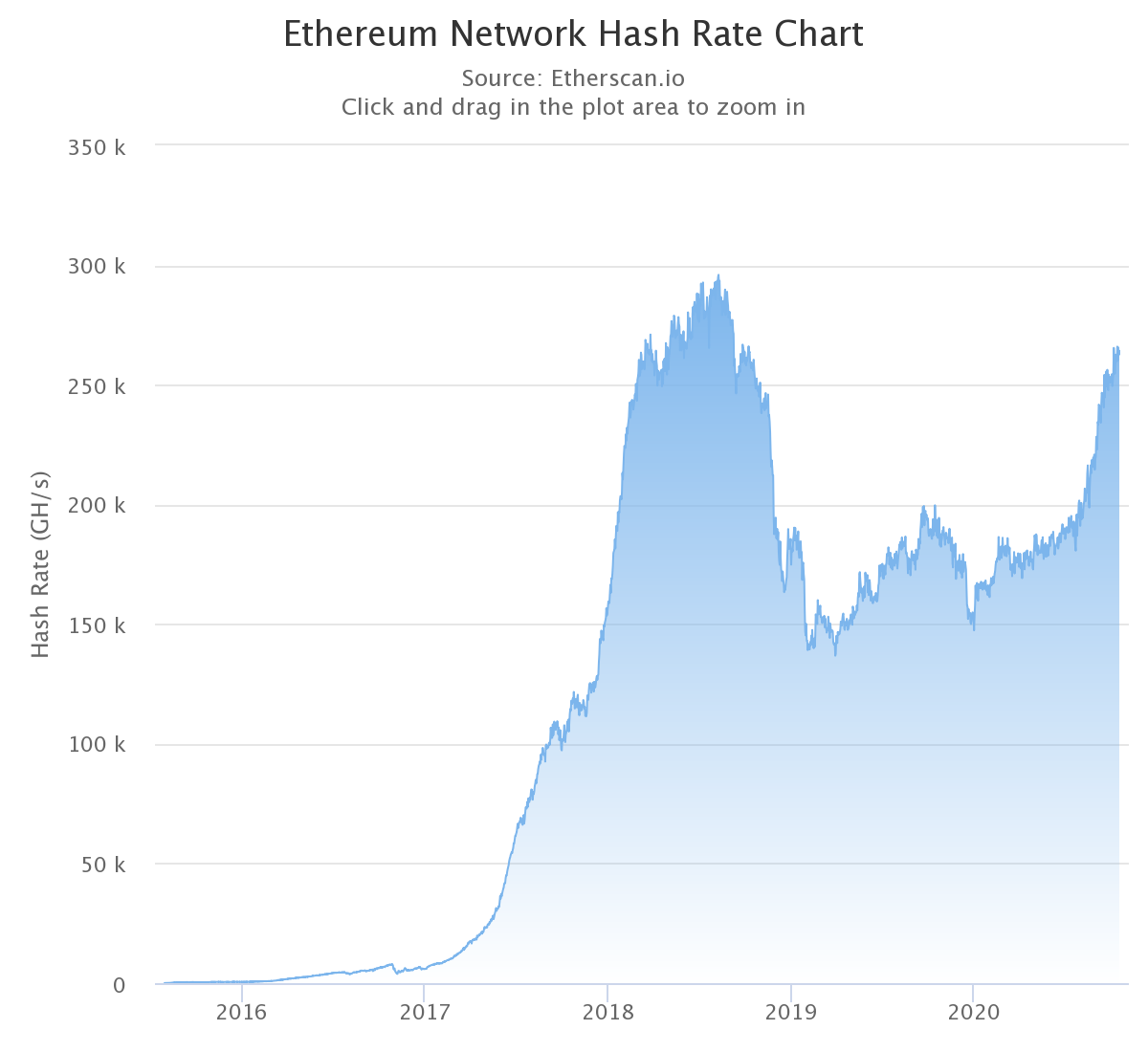

Over the last 24 hours, ETH price has rallied ~ 2.34%, which is outperforming Bitcoin ( ~ 0.93% ). At the time of this report, Ethereum is currently trading at $376.30, with a total market capitalization of $42,520,957,114. Historically speaking, ETH’s price and hash rate have been highly correlated. Despite OKEx developments injecting fear into the market last week, ETH price has recovered quite well, with hash rate being a catalyst. As we can see from the chart below, Ethereum hash rate continues to build upward momentum, which should continue to have a positive effect on price action.

Ethereum Technical Analysis

Over the last few weeks, ETH price has built strong support around $350 levels. Even during the market sell-off last week, ETH did not come close to rejecting this support level.

The strong recovery since last week is setting up ETH for a rally in the short term. As we can see above, ETH price temporarily dipped below the 100 day moving average, but quickly hovered back above, which is a bullish indicator. In addition, Ethereum rate of change ( ROC ) is still positive, which is indicating positive momentum.

In the short-term, ETH should attempt to test $411 resistance as long as $350 support is not rejected. From current levels, this would represent potential ~ 10% upside in the short term. On the contrary, if ETH did end up rejecting $350 support, we would expect bears to take over for the time being.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.