21Shares launched a spot Solana ETF under the ticker TSOL on the Chicago Board Options Exchange, opening with approximately $100 million in assets under management and joining a rapidly expanding field of regulated Solana investment products. The fund charges a 0.21% management fee while tracking the spot price of SOL, providing U.S. investors access to Solana’s ecosystem without directly holding cryptocurrency.

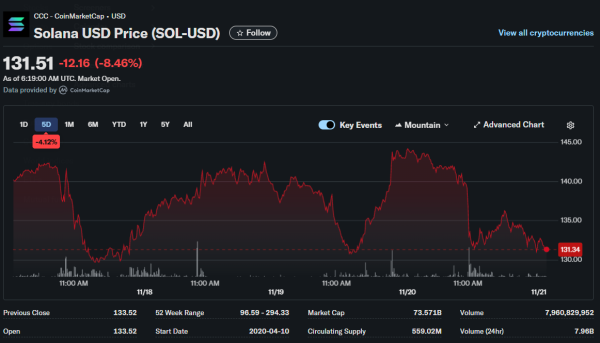

Senior ETF analyst at Nexdi examines whether multiple Solana ETFs can sustain momentum amid broader crypto market weakness that saw SOL decline 8.44% alongside Bitcoin’s 7.37% drop and Ethereum’s 7.53% fall. The launch timing appears questionable, given recent cryptocurrency market turbulence erasing substantial gains from earlier peaks.

However, inflows into Solana-related funds remained strong, with one recent day showing $26.2 million of net new investment despite broader market softness. The resilience suggests institutional demand for altcoin exposure extends beyond Bitcoin and Ethereum, though sustainability depends on whether Solana’s technical advantages translate to sustained price appreciation supporting premium valuations.

TSOL Enters Crowded Field

TSOL reportedly becomes the sixth U.S.-listed spot Solana fund, entering a market already active with competing products from major asset managers. Bitwise’s BSOL fund gathered more than $420 million in early inflows, demonstrating substantial appetite for regulated Solana exposure. Fidelity’s FSOL debuted just days earlier with a 0.25% fee and the added feature of staking rewards, creating immediate differentiation among products.

The proliferation of Solana ETFs mirrors the spot Bitcoin ETF launch wave in January 2025, when multiple issuers, including BlackRock, Fidelity, and Grayscale, simultaneously introduced competing products. Bitcoin ETF competition drove fee compression with some providers temporarily waiving management fees to attract assets. Solana ETF fees range from 0.21% to 0.25% positioning products below typical equity ETF costs but above minimal-fee index funds.

Why Solana Attracts Investment

Solana’s blockchain architecture delivers high throughput, making it the preferred choice for decentralized finance applications, stablecoins, gaming, and identity systems. The network processes transactions faster and cheaper than Ethereum, though it sacrifices some decentralization for performance. Developers building on Solana benefit from lower gas fees and faster confirmation times, attracting projects that Ethereum’s congestion and costs made economically unviable.

As investors seek alternatives to Bitcoin and Ethereum, Solana emerged as an appealing target for diversification within cryptocurrency allocations. SOL ranks among the top cryptocurrencies by market capitalization, providing sufficient liquidity for institutional-sized positions, unlike smaller altcoins. The combination of technical capabilities and market depth positions Solana as a leading “Ethereum alternative” despite competition from Avalanche, Polygon, and other Layer 1 blockchains.

The Staking Feature Differentiation

Fidelity’s FSOL offering staking rewards creates an important competitive distinction from products like TSOL, which lack this feature. Staking allows SOL holders to earn yields by validating network transactions, typically generating 4-7% annual returns depending on network conditions. ETFs incorporating staking can pass these rewards to shareholders, effectively providing yield on otherwise non-income-producing crypto assets.

The staking feature complicates tax treatment as rewards may constitute taxable income when received rather than only upon sale. Investors must evaluate whether staking yields justify added complexity versus simpler spot ETFs tracking only price appreciation.

Institutional investors, particularly sensitive to tax efficiency, may prefer non-staking products, avoiding ongoing income recognition, while retail investors might prioritize total return, including staking rewards.

The Competitive Landscape

VanEck, Canary Capital, and other asset managers race to provide regulated Solana access, creating a crowded field where differentiation determines winners. Fee competition appears inevitable as issuers fight for market share in a relatively limited total addressable market of investors specifically wanting Solana exposure. Bitcoin ETF fee wars drove costs below 0.20% for leading products, suggesting Solana ETFs may face similar pressure.

Brand recognition and distribution relationships often matter more than minimal fee differences for ETF success. 21Shares benefits from early mover status in European crypto ETPs, though it lacks the household name recognition of Fidelity or BlackRock in U.S. markets. Bitwise’s early $420 million asset gathering demonstrates that specialized crypto asset managers can compete successfully against larger financial institutions when execution proves superior.

Evaluating Investment Merit

Solana ETFs provide convenient access for investors who believe the network’s technical advantages will drive sustained adoption and price appreciation. The 0.21-0.25% fee range appears reasonable for gaining exposure to a volatile asset class without operational hassles of self-custody. However, SOL’s 8.44% recent decline reminds investors that convenience doesn’t eliminate the underlying volatility inherent to cryptocurrency markets.

Choosing between competing Solana ETFs requires evaluating fee structures, staking features, issuer credibility, and liquidity. TSOL’s lower 0.21% fee versus FSOL’s 0.25% but with staking, presents a classic cost-versus-feature tradeoff. Bitwise’s $420 million early gathering suggests a market leader emerging, creating potential liquidity advantages from tighter spreads and better tracking.

Investors should monitor how these products perform over the coming months before committing substantial capital to relatively untested structures.