Silver (XAG/USD) extended its recent rebound on Wednesday, reaching intraweek highs above $51.50, as risk-off sentiment in global markets continues to favor safe-haven assets like precious metals.

This marks the second consecutive day of gains for XAG/USD, with investors closely monitoring both technical resistance levels and macro-economic data for potential catalysts. The brokers at Orbisolyx simplify complex points through a detailed and accessible breakdown.

Key Drivers Behind Silver’s Rally

The risk-averse environment has been the primary driver of silver’s bullish momentum. Recent concerns over a potential AI-related equity bubble have weighed on global equity markets, prompting investors to rotate into safe-haven metals. This flight-to-quality dynamic has underpinned XAG/USD, giving it the necessary support to climb above key resistance levels.

Adding to silver’s appeal, US employment data released on Tuesday was weaker than expected. The disappointing non-farm payroll figures have renewed market expectations for a potential Federal Reserve rate cut in December.

Historically, weaker labor figures correlate with lower interest rate trajectories, which reduce the opportunity cost of holding non-yielding assets like silver, further enhancing its appeal.

Technical Analysis: Bullish Momentum Builds

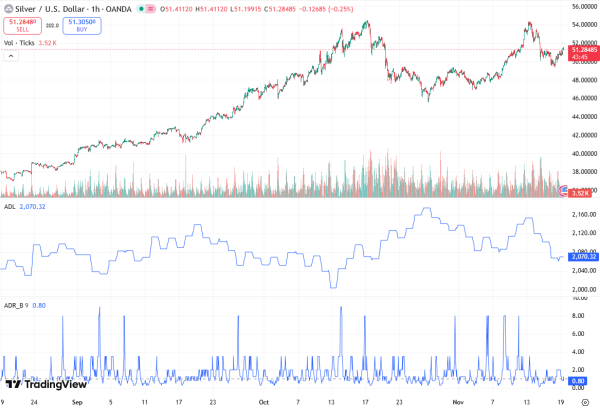

From a technical perspective, silver bulls are showing strong signs of control following a 2.5% rally over the last two days. XAG/USD successfully breached the resistance area around $51.25, representing highs from November 17 and 18, signaling potential for further upside.

The 4-hour Relative Strength Index (RSI) is consolidating above the 50 level, confirming that momentum favors buyers. This bullish structure suggests that XAG/USD could continue its upward trajectory towards near-term resistance levels, with $52.10 being the immediate target for traders.

If XAG/USD sustains above the $51.25 breakout zone, the next technical target lies at the November 13 low, around $52.10, before challenging the November 14 high at $53.65. Beyond this, traders may look to long-term resistance zones near $54.60–$54.80, which represent the October and early November highs.

Trading Strategies for XAG/USD Amid Risk-Off Markets

With XAG/USD exhibiting strong bullish momentum, traders are increasingly looking for strategic entry and exit points to capitalize on silver price movements. Intraday traders may focus on support levels at $50.70 and $49.60, using them as stop-loss zones to manage downside risk.

Conversely, breakout traders could target resistance at $52.10, aiming for profit-taking near $53.65 or long-term highs at $54.80.

Incorporating technical indicators such as the Relative Strength Index (RSI) and moving averages can help confirm trend strength and improve risk-adjusted trading decisions. By combining macro insights, like weak US employment data and risk-off sentiment, with technical analysis, traders can optimize their approach in the current volatile precious metals market.

Intraday Support Levels

For intraday traders, support levels are crucial in managing risk and identifying pullback opportunities. Key intraday support for XAG/USD is near the $50.70 area, acting as the first line of defense for bullish positions. Should silver retreat further, the trendline support derived from late October lows, currently around $49.60, provides a more robust technical floor.

Additionally, Tuesday’s low near $49.35 serves as a critical psychological and technical barrier, where buying interest may emerge in case of a deeper retracement. Maintaining above these support zones is vital for bullish continuation, as a breakdown below $49.35 could trigger a shift in market sentiment, potentially weighing on XAG/USD in the short term.

Market Sentiment: Risk-Off Dynamics

Investor sentiment remains a key driver for precious metals in the current risk-off market environment. Global equity volatility, fueled by AI sector uncertainties, has reinforced the safe-haven appeal of silver and gold. Traders are increasingly viewing XAG/USD as a hedge against equity market turbulence, especially with downbeat US economic indicators supporting expectations for looser monetary policy.

The combination of technical strength and macro-economic catalysts creates a favorable environment for silver bulls, with traders eyeing breakout opportunities above the $51.50 level. Momentum indicators, such as RSI and moving averages, confirm the current bullish bias, suggesting that upside potential could extend into mid-$52 levels and beyond if risk-off conditions persist.

Conclusion: XAG/USD Outlook

In summary, silver’s rebound from the $49.35 area has extended to session highs above $51.50, underpinned by risk-off market sentiment and weak US employment data. Technical analysis indicates that bulls are in control, with XAG/USD targeting resistance near $52.10, followed by the November 14 high at $53.65 and the long-term resistance between $54.60–$54.80.

Intraday support levels at $50.70 and $49.60, alongside Tuesday’s low at $49.35, are key zones to watch for potential retracements. As safe-haven demand persists amid equity market volatility, silver remains positioned for further upside, providing traders and investors with opportunities to capitalize on the ongoing bullish momentum in XAG/USD.