Chainlink Price has continued to struggle over the last month, falling -41.5%. The 7th largest cryptocurrency by market capitalization is flirting with key support that could propel it much lower if rejected. We take a look at LINK/USD on the one year chart to assess key support and resistance levels in the short-term.

Chainlink Price ( LINK )

As discussed above, LINK has struggled over the last month, falling -41.5%. Most recently, Chainlink has shown continued bearish sentiment, falling about -10% the last week. Despite the recent price action, it is important to remember that Chainlink Price is still one of the market outliers the last year, surging +610%. Bitcoins price for example has only seen +4% growth over the last year. Ever since LINK made its all-time high of $19.83 a month ago, the digital currency has seen a sharp sell-off. Based on historical trends, LINK is approaching a key support zone that could tell us a lot about price action in the near term.

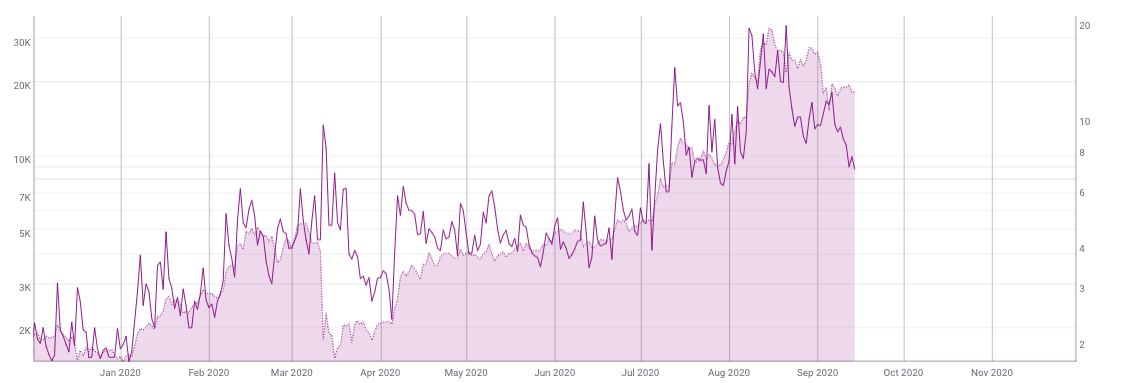

Chainlink Transactions

Historically, Chainlink price has been relatively correlated to transaction counts. As we can see from the chart below, the data from CoinMetrics shows this connection. Back in August when Chainlink was making all-time highs and trading significantly higher than current levels, transaction counts were in the 22K-30K range. As transaction counts started to plummet, so did the price of LINK. August transaction counts hit a high around 34,000 before tanking to current levels at 8,800. This -73% decline played a major role in Chainlink’s price swings over the last month.

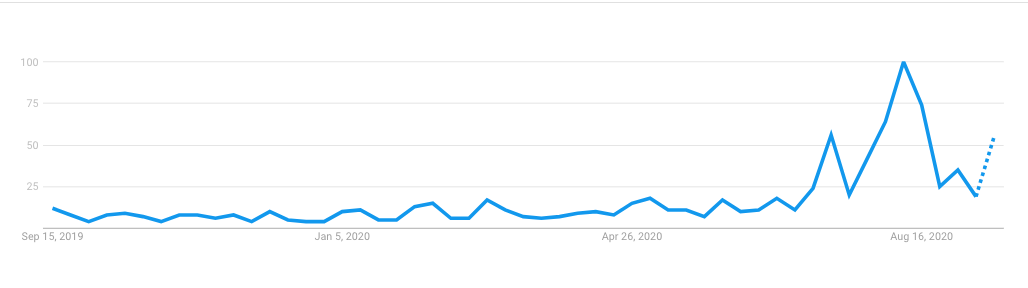

Chainlink Crypto Trends

In addition to transaction activity, it is also interesting to follow search data vs price action. According to Google Trends, search interest had skyrocketed back in August when Chainlink was putting in all-time highs. Following these all-time highs, search interest started to die off, hitting extremely low levels in early September. During this decline in search interest, Chainlink price was continuing to lose momentum.

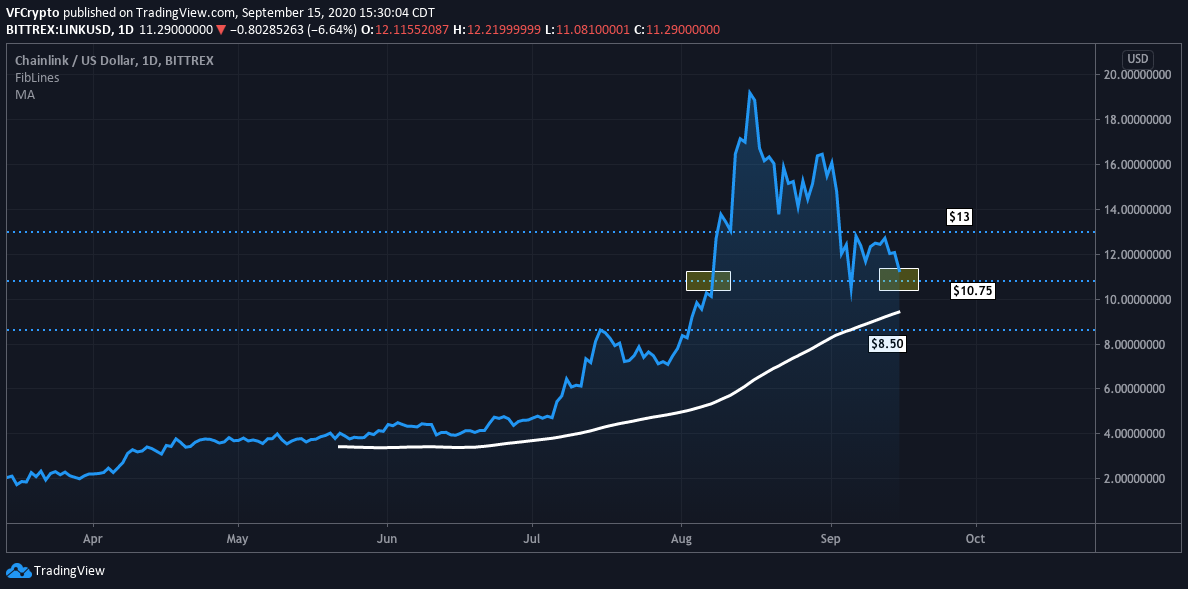

Chainlink Technical Analysis

As previously stated, LINK price is attempting key support zones that traders will be watching in the short term. As we can see from the chart below, $10.75 represents a strong support level that Chainlink needs to maintain moving forward. If the digital asset fails to do so, bears could push the prices to $8.50 levels. If this were to occur, it would represent -23% downside from current levels. If LINK rejected $10.75, it would also increase the chances of the price dipping below the 100 day moving average ( white line ) , which it has not done this year.

On the contrary, if LINK can maintain $10.75 levels, that will be its best chance to reverse sentiment, and attempt to retest resistance levels at $13. Based on the current price action, LINK will most likely need more bullish sentiment to flow into Bitcoin before it does so. In the event that Bitcoins price experiences a sell-off, LINK will then be looking for transactions to heat back up, which is something that has been putting downward pressure on prices as discussed above.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.