Institutional investors are abandoning Bitcoin exposure at an unprecedented pace through exchange-traded funds. The largest spot Bitcoin ETF managed by a major asset manager experienced withdrawals approaching $523 million during Tuesday’s trading session alone. Junior finance experts at Unirock Gestion explore what these massive outflows signal about institutional appetite for cryptocurrency exposure and broader risk sentiment.

This single-day redemption represents the most substantial outflow since the product launched in January 2024. The magnitude reflects a dramatic sentiment shift among institutional participants who were previously seen as providing stability and long-term capital to cryptocurrency markets. Professional investors who entered through regulated ETF vehicles are now exiting with urgency.

Broad-Based Institutional Retreat

The outflow wasn’t isolated to one fund manager’s products. Across the entire spot Bitcoin ETF complex, investors extracted billions from crypto exposure as risk appetite evaporated. Multiple funds experienced simultaneous redemptions, suggesting coordinated de-risking rather than isolated dissatisfaction with specific product structures or management.

Tuesday marked a watershed moment when Bitcoin briefly dipped below $90,000, approximating the average entry price across all ETF inflows since inception. This technical threshold means that typical ETF investors found themselves holding underwater positions. Seeing paper losses likely accelerated redemption activity as institutional investors implement disciplined stop loss protocols.

The psychology of institutional selling differs fundamentally from retail behavior. Professional investors follow systematic risk management processes requiring position reductions when assets breach predetermined thresholds. This creates potential for cascading sales as mechanical selling begets additional price declines, triggering further systematic redemptions.

ETF structures enable institutional investors to exit positions with greater ease than direct cryptocurrency holdings, requiring exchange accounts and custody arrangements. This liquidity advantage during normal conditions becomes a disadvantage during stress periods when redemption mechanisms amplify selling pressure through authorized participant dynamics.

What Changed Institutional Minds

Several factors converged to shift institutional sentiment dramatically within a compressed timeframe. Mounting concerns about artificial intelligence stock valuations created nervousness across technology-focused portfolios. Bitcoin exhibits high correlation with speculative technology names, making it vulnerable when those segments face pressure.

Federal Reserve policy expectations shifted materially with the declining probability of December rate reductions. Cryptocurrencies typically benefit from accommodative monetary policy and suffer when central banks maintain restrictive stances. Rising real interest rates make non-yielding assets like Bitcoin less attractive on a relative value basis.

Some institutional investors questioned whether cryptocurrency exposure still serves portfolio diversification purposes. Bitcoin increasingly trades with a high positive correlation to risk assets rather than providing independent return streams. This correlation breakdown undermines a key pillar of the institutional investment thesis around cryptocurrency allocation.

Recent artificial intelligence bubble concerns extended into questions about all speculative growth assets, including cryptocurrencies. If investors are reassessing whether massive AI infrastructure spending will generate adequate returns, similar scrutiny applies to digital assets lacking clear cash flow generation or fundamental valuation anchors.

Retail Versus Institutional Dynamics

The composition of cryptocurrency ownership shifted substantially following ETF launches. Previously, retail-dominated markets now include significant institutional capital through these regulated vehicles. However, institutional participants bring different behavioral patterns, including strict risk management disciplines and performance measurement against benchmarks.

Retail investors typically exhibit greater conviction and willingness to hold through volatility. Many entered cryptocurrency markets with ideological motivations beyond pure financial returns. This creates natural price support during selloffs as retail buyers accumulate positions that institutions shed.

Leverage compounded selling pressure as $1 billion in positions experienced forced liquidation within 24 hours. More than 180,000 traders saw holdings closed involuntarily. This leverage washout predominantly affected retail traders using derivatives to amplify exposure rather than institutional spot ETF holders.

Contagion Across Crypto Markets

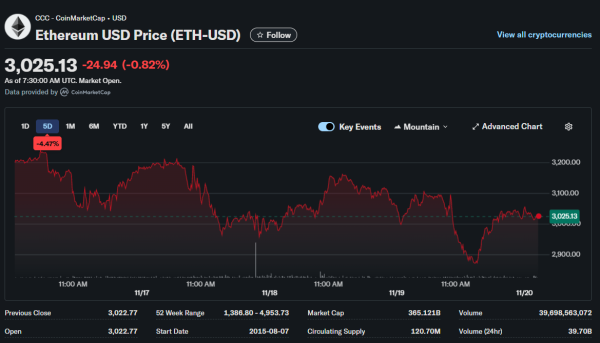

Bitcoin weakness cascaded through the broader cryptocurrency ecosystem, affecting alternative coins more severely. Ethereum, the second-largest digital asset by market value, declined nearly 9% during Tuesday’s session. Smaller tokens experienced even more dramatic percentage losses as liquidity evaporated.

The total cryptocurrency market capitalization contracted by over $1 trillion from recent peaks. This wealth destruction affected millions of individual holders and institutional allocators. Portfolio managers facing losses in cryptocurrency positions often reduce exposure to other risk assets to maintain overall risk budgets.

Historical Precedent and Context

Previous cryptocurrency cycles featured similar episodes of institutional retreat during bear market phases. The 2018 decline saw early institutional participants exit after Bitcoin fell from near $20,000 to below $4,000. Those who remained through that downturn generally benefited from the subsequent recovery.

The 2022 decline followed infrastructure failures, including exchange bankruptcies and algorithmic stablecoin collapses. That episode genuinely threatened the cryptocurrency market structure in ways current selling does not. Today’s selloff reflects sentiment and positioning rather than systemic threats to market infrastructure.

Current declines, while substantial, occur from much higher absolute price levels than previous cycles. Bitcoin falling from $126,000 to $88,000 represents a 30% decline but leaves prices well above most historical levels. This context matters for assessing whether current weakness represents an existential crisis or cyclical volatility.

Institutional adoption reached unprecedented levels during 2024 and 2025 before recent reversals. This progress isn’t fully erased by several weeks of outflows. Infrastructure supporting institutional participation, including custody solutions and regulatory framework, remains intact even as near-term sentiment deteriorates.