In a recent report by PwC, the world’s largest consulting firm believes that blockchain technology could take the global economy to new horizons by 2030. Their analysis shows that global gross domestic product ( GDP ) could increase by $1.76 trillion over the next 10 years. What industries does PwC believe blockchain technology will thrive in, and what geographic regions will benefit the most?

PwC Blockchain Technology Report

PwC recently published a report on blockchain technology that shows significant growth opportunity over the next decade. The report was titled “Time for trust: The trillion-dollar reason to rethink blockchain.”

Within the analysis, PwC took a look at how blockchain technology is being leveraged now, and how the global economy could benefit significantly in the foreseeable future. According to their research, blockchain technology is on pace to fuel global gross domestic product ( GDP ) by $1.76 trillion in the next 10 years. In terms of the job market, PwC also sees blockchain enhancing 40 million jobs globally by 2030.

When comparing individual countries, the United States and China are on pace to see the highest potential net benefit. It is believed that the United States will see a net benefit of $407.2 billion, and China will see a net benefit of $440.4 billion.

Blockchain Uses Driving Adoption

By studying industry research and trends, PwC outlined the top 5 blockchain uses that should ultimately drive adoption moving forward.

Payments

Payments in the blockchain space can include the use of digital currencies, or the involvement in cross border and remittance payments. PwC believes that payments and financial service markets could contribute $433.2 billion to global GDP by 2030, with the United States benefitting the most.

Lucy Gazmararian from PwC Hong Kong advisory stated that:

“Blockchain has the potential to cut costs, speed up transactions and promote greater financial inclusion by streamlining cross-border and remittance payments. These powerful innovations will transform payments infrastructure.”

Provenance

Provenance deals with the tracking and tracing of products and services, which has witnessed significant demand during the global pandemic. Provenance is now expected to see the highest economic potential from blockchain in the next 10 years. PwC estimates it to contribute $961.6 billion to global GDP by 2030, with China seeing the most value.

Anthony Bruce, Pharmaceutical and Life Sciences Leader, PwC United Kingdom, stated that:

“For healthcare organisations, blockchain can ensure patient safety is at the heart of the pharmaceutical supply chain. It has the potential to give patients confidence in the authenticity and origin of drugs.”

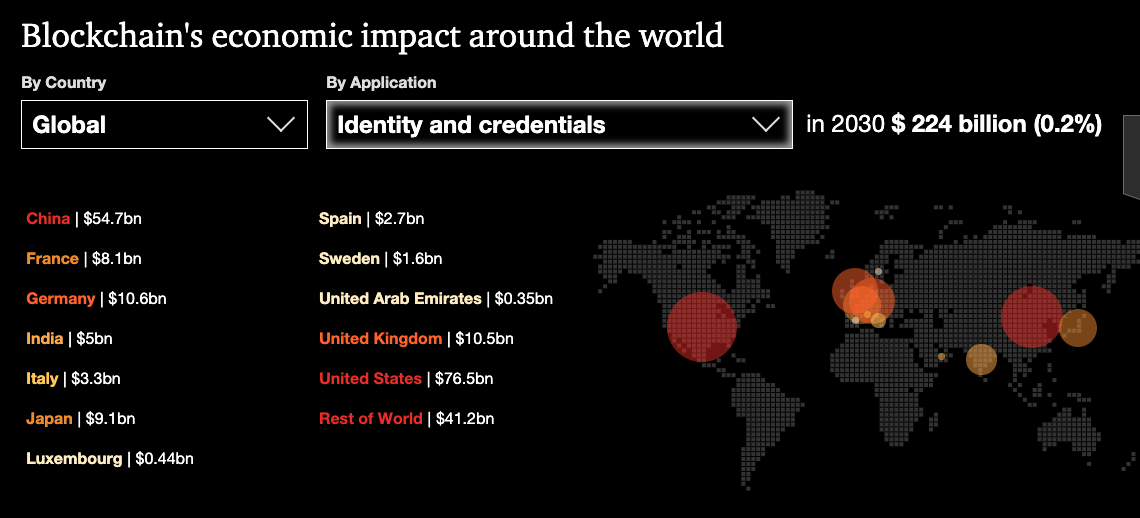

Identity Management

With privacy and security being some of the biggest concerns across the globe, blockchain technology is paving the way to a more transparent society. In a push to eliminate fraud and identity theft, blockchain is being leveraged for personal IDs, certificates, and professional credentials. PwC believes that the use of blockchain in Identity and credential markets will contribute $224 billion to global GDP by 2030, with China seeing the most value.

Caitroina McCusker, Partner and Education Consulting Leader, PwC United Kingdom, stated that:

“As the education sector accelerates its move into digital learning, it is embracing new technology with greater urgency and freeing us all from time-consuming, inefficient, paper-based credentials systems, which are so easily violated.”

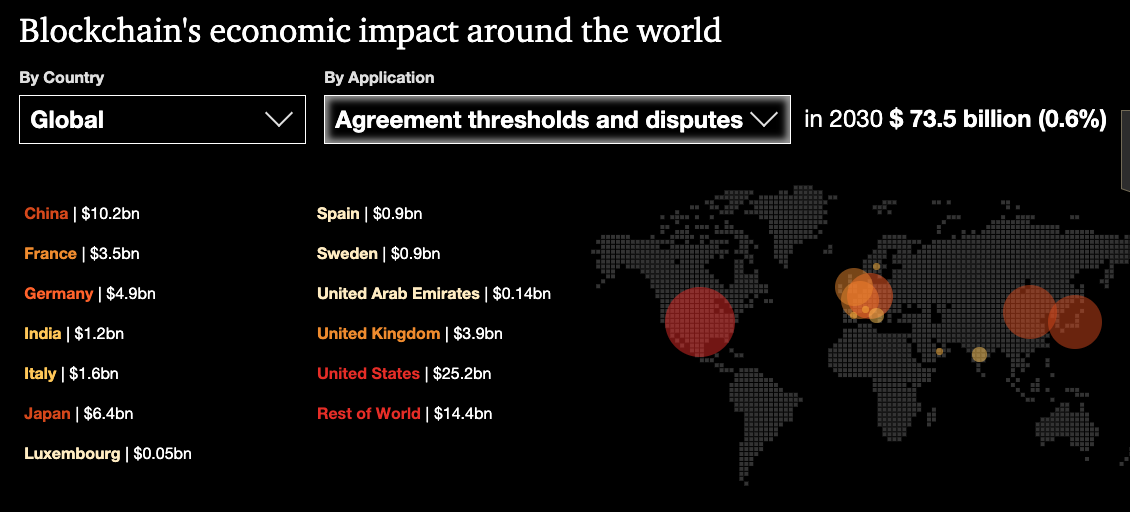

Contracts & Dispute Resolution

By implementing the blockchain, smart contracts can be enabled to create an environment where contracts and dispute resolutions can be cost-effective and efficient for all parties involved. This use case can ultimately help blockchain multiply into various public and private sectors. This area could provide a $73.5 billion dollar boost to global GDP by 2030.

Guenther Dobrauz, Global Leader, Financial Services, PwC Switzerland mentions that:

“If a dispute occurs, blockchain can help by automatically blocking payments and triggering alerts that automate dispute processes. With its tracking abilities, the technology can help quickly unwind disputes and exposures in a trusted way.”

Customer Engagement

With customer engagement having many different avenues, PwC outlines the benefits of applying blockchain technology to loyalty programs. Smart contracts could help businesses around the globe slash their system management costs, in addition to many other benefits pertaining to loyalty programs. Loyalty and rewards are expected to add $53.7 billion to global GDP by 2030.

Haydn Jones, Senior Blockchain Market Specialist, PwC United Kingdom, stated that:

“Blockchain could prevent loyalty programmes from falling out of use. With digital payments now the norm, consolidation of these programmes is inevitable, and blockchain is key in unlocking value, in a fair way, for all involved.”

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.