In this article I discuss cost-effective order execution and how traders can avoid being arbitraged by bots when placing orders on centralized exchanges such as Binance.

Market makers and algo traders use custom scripts to take advantage of cryptocurrency investors who just go to an exchange website and click the buy/sell buttons. Have you ever placed an order on Binance only to be outbid instantly? It’s bots that react instantly to your position.

Putting a little time and effort into an order execution strategy can save between 1%+ on every trade depending on the volumes and liquidity. If you are making 5 trades a month with an average order value of 1 BTC that adds up to around $5000 USD a year.

Essential Order Execution

Market orders provide instant gratification for retail investors but smart traders will hold the leading bid price on a buy order and wait for someone to take the liquidity. This means they “make the spread” which is the difference between the leading bid price and the leading ask price.

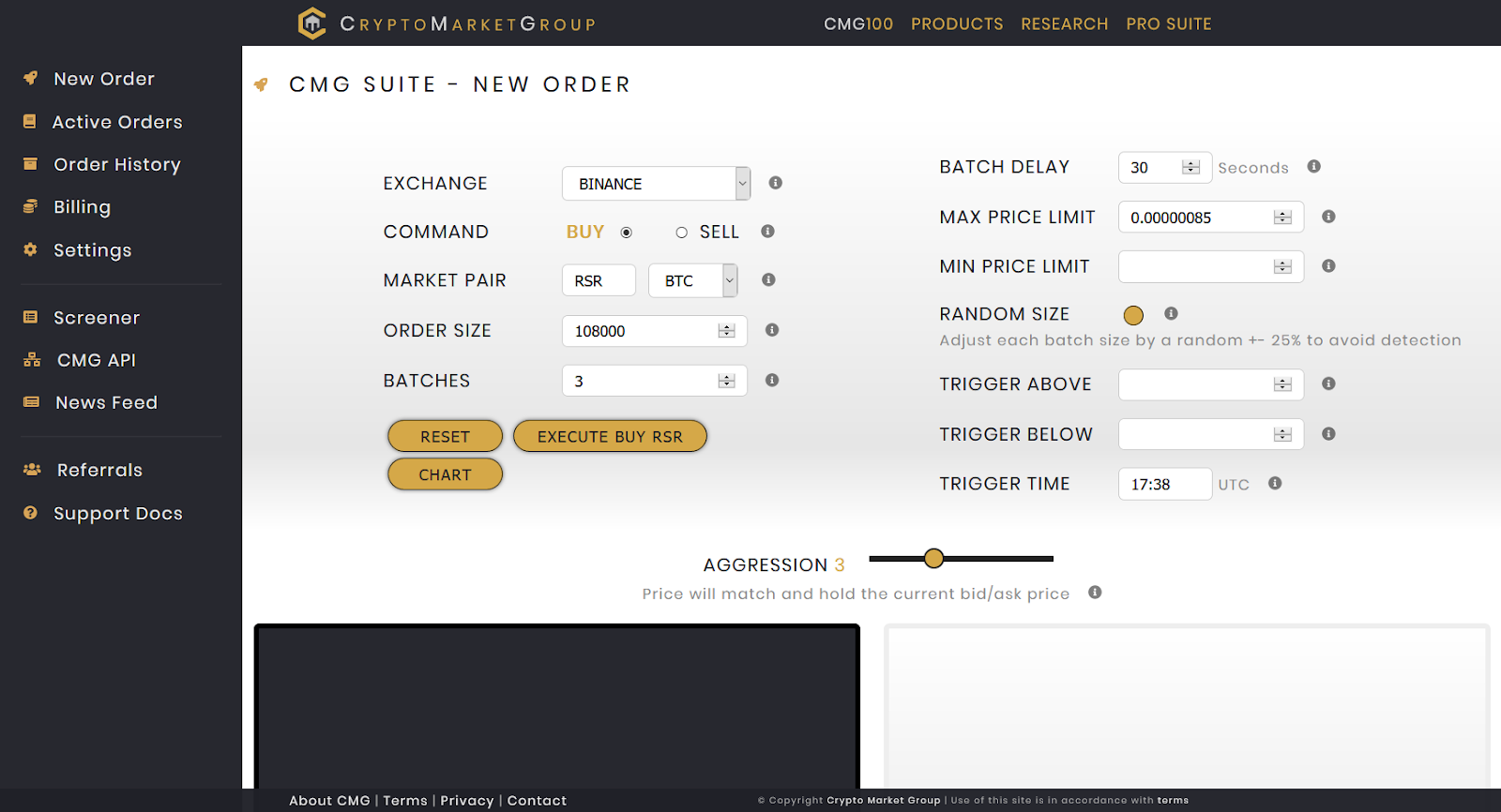

I use software like CMG’s Pro Suite to automate the bidding and batch my trades.

The app connects to an exchange using the official API’s and manages your orders. A large order gets broken down into batches and executed throughout the day or overnight (with price limits in place). Each batch is priced to match the leading bid queuing my orders up to be executed at the most optimal price.

I sometimes set price triggers to execute a trade once an asset reaches a target price. On other occasions I use the timed trigger to put through large trades on highly liquid markets at the same time. For example I might trigger a BNB/USDT trade at the same time as a BNB/BTC trade to leverage both market pairs.

The aggression factor settings allow me to execute trades slower at a better price or faster at a less optimal price when timing is an important factor.

How Much Can You Save

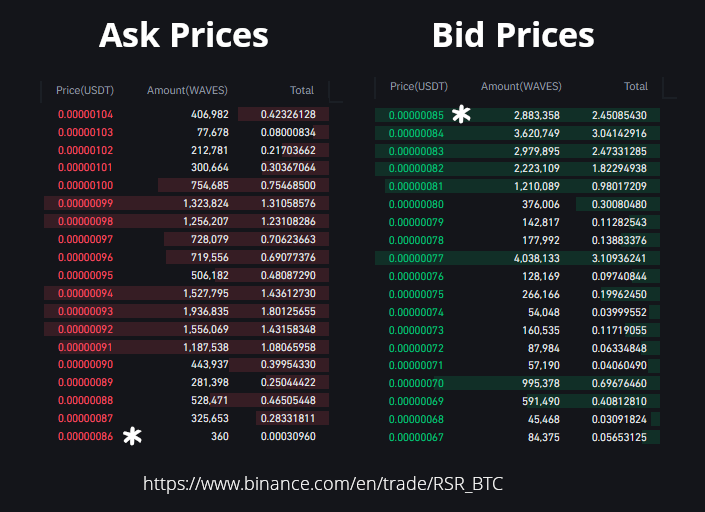

Let’s look at an actual trade right now on Binance. I want to buy in to $1000 position in RSR using Bitcoin.

If I placed a market order on the exchange, I would eat up the available liquidity and get an average price of 0.00000087

However from the trade history I can see trades are going through at both the leading bid and ask prices. I can take advantage of this using the CMG order execution platform to break our order down into batches of 50,000 RSR and matching the leading bid price.

I will get in line to make the spread at an average cost of 0.00000085 BTC.

If I had placed a market order directly on the Binance website it would have cost 2.29% more or $22.9 per $1000 traded.

Two percent is huge and this market is particularly well suited to market makers because of the low BTC pricing. On most markets the savings would be closer to 1%. Over the long-term these cost savings add up when trading even occasionally on centralized exchanges.

If you would like to take your order execution to the next level you can either start coding your own scripts or check out the CMG Tools which are highly recommended.

Find out more here: CMG Pro Suite

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was compensated to submit this sponsored article. Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.