Nvidia reported $57 billion in third-quarter revenue, crushing analyst expectations, yet watching shares tumble as broader market anxieties override exceptional performance. The chipmaker’s data center segment delivered record results, with Blackwell chip sales described as “off the charts,” yet investors sold aggressively into the news. Lead market strategist at Nexdi examines why blockbuster earnings couldn’t sustain a rally, revealing deeper concerns about AI valuations and Federal Reserve policy.

The disconnect between earnings quality and price action suggests markets are anticipating either slowing growth ahead or acknowledging current valuations already reflect perfection. When the strongest performer in the AI trade can’t rally on stellar results, weaker names have nowhere to hide. This earnings paradox signals a fundamental shift in how investors are approaching the artificial intelligence sector, regardless of near-term fundamentals.

The Numbers That Should Have Mattered

The chipmaker delivered $57 billion in revenue, surpassing analyst expectations of $54.92 billion and representing a 62% year-over-year surge. The data center segment alone generated $51.2 billion, obliterating forecasts of $49.09 billion and accounting for roughly 90% of total revenue. CEO Jensen Huang declared Blackwell chip sales “off the charts” with cloud GPUs sold out, painting a picture of unstoppable AI demand.

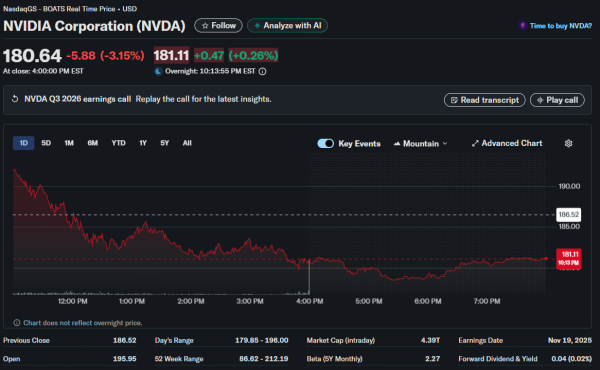

Yet by Thursday’s close, Nvidia shares fell 3.2% after surging as much as 5% in after-hours trading. The reversal dragged the Nasdaq down 2.16% and erased what should have been a decisive victory lap. The disconnect reveals something troubling: exceptional earnings no longer guarantee market confidence when macro concerns dominate sentiment and positioning.

The $500 Billion Visibility Problem

Huang’s October declaration that Nvidia holds $500 billion in orders for Blackwell and Rubin chips through 2026 should have provided market-moving reassurance. CFO Colette Kress confirmed this figure remains on track, noting it doesn’t even include recent deals with Anthropic’s $30 billion Azure commitment or expanded Saudi Arabian partnerships. The order book represents nearly ten times Nvidia’s 2023 revenue.

China H20 chip sales recorded just $50 million during the quarter, which Kress attributed to “geopolitical issues and the increasingly competitive market in China.” Some projections had valued China’s business at $50 billion annually. That billion-dollar discrepancy between expectation and reality exposed how much speculative positioning had inflated AI valuations beyond sustainable levels.

Market Structure Breaking Down

The Technology Select Sector SPDR Fund lost 1.6% Thursday, with AI momentum stocks like Palantir dropping 5.5% and Oracle falling nearly 5%. This wasn’t sector rotation; this was indiscriminate selling across the AI trade that powered 2025’s gains. The S&P 500 fell 1.56% after being up 1.9% earlier in the session, a 3.46 percentage point intraday reversal that signals institutional unloading.

Bitcoin dropped below $87,000, its lowest level since April 21, losing roughly 2% on the day. The correlation between crypto and AI stocks has tightened as both attract the same momentum capital.

When one breaks, both bleed. The VIX volatility index remains elevated despite Nvidia’s reassurances, suggesting options traders are pricing in continued turbulence regardless of earnings beats.

The Fed’s Shadow Over Tech

Thursday’s session coincided with growing acceptance that December rate cuts now carry just 35-40% probability, down from 97% a month ago. The Federal Reserve’s October minutes revealed “strongly differing views” among policymakers, with “many” suggesting rates should hold through year-end. Higher-for-longer rates make future earnings less valuable in present-value calculations, particularly for growth stocks trading at elevated multiples.

Nvidia’s forward price-to-earnings ratio remains above 30x despite the selloff, compared to the S&P 500’s 22x multiple. The premium demands continuous outperformance. Missing China revenue by $49.95 billion annually creates questions about whether $500 billion in future orders can compensate for lost market access and geopolitical headwinds.

What the Reversal Actually Signals

The PHLX Semiconductor Index is up 33% year-to-date but down 9% from recent highs. The pattern suggests sector leadership is exhausted rather than pausing for breath. When the strongest performer can’t rally on stellar results, weaker names have nowhere to hide. SoftBank’s $5.83 billion Nvidia stake sale, disclosed this week, adds institutional validation to exit decisions.

Ray Dalio’s advice to not sell just because there’s a bubble misses the point. Markets don’t need bubble recognition to correct. With Bank of America’s fund manager survey showing just 3.7% cash positions and investors most overweight equities since February, the technical setup favors sellers over buyers regardless of underlying fundamentals.

Excellence Becomes the New Baseline

Nvidia’s performance wasn’t the problem; the company delivered exactly what it promised. The issue is that excellence has become table stakes rather than a catalyst in a market repricing AI valuations for a higher-rate environment. When $57 billion in quarterly revenue can’t sustain a rally, the message is clear: investors have stopped buying the growth story at current prices.

The market’s rejection of Nvidia’s stellar results serves as a warning shot for the entire technology sector. If the undisputed leader can’t generate buying enthusiasm with record revenue and massive order backlogs, what chance do secondary players have?

This dynamic suggests investors should prepare for continued volatility as markets reconcile stretched valuations with a less accommodative Fed and heightened geopolitical uncertainty around critical supply chains.