The U.S. stock market kicked off the trading week under pressure on Monday, November 17, 2025, as investors weighed mixed signals across the technology and consumer sectors. While major indexes declined, a standout performer emerged in the form of Alphabet (GOOG, GOOGL), which gained momentum following a high-profile investment move by Warren Buffett’s Berkshire Hathaway (BRK.A, BRK.B).

According to analysts at Servelius, Monday’s session reflected broad-based declines across major U.S. stock indexes, highlighting cautious investor sentiment ahead of key earnings reports. The Nasdaq fell 0.8%, the S&P 500 slipped 0.9%, and the Dow Jones Industrial Average dropped 1.2%, as investors digested mixed signals from the technology and consumer sectors while positioning ahead of critical earnings announcements.

Market Focus on Upcoming Earnings

Market attention is focused on upcoming earnings from artificial intelligence chipmaker Nvidia (NVDA), whose results are expected to provide insights into demand trends for AI technology. Investors are also watching reports from several major retailers, which could influence consumer sentiment and set the tone for trading later in the week.

Analysts’ Outlook on Tech and Economic Conditions

Analysts note that these earnings will be critical in gauging both tech sector momentum and broader economic conditions, as investors balance optimism about AI-driven growth with caution over inflation and supply chain pressures.

Dell Shares Decline Following Analyst Downgrade

Shares of Dell Technologies (DELL) dropped sharply after Morgan Stanley analysts warned that rising memory chip prices could pressure the company’s profit margins. The investment firm downgraded Dell from “overweight” to “underweight”, citing the potential impact of higher component costs on gross margins. Following the downgrade, Dell shares fell over 8% in Monday trading.

Hardware Sector Feels the Impact

Other PC manufacturers also felt the squeeze. Hewlett-Packard Enterprise (HPE) was downgraded to “underweight” from “equal weight,” and shares of the company declined roughly 7%. Analysts emphasized that surging memory costs are creating headwinds across the hardware sector, potentially squeezing margins for multiple PC and server makers.

Supply Chain Pressures and Investor Considerations

The warnings underscore the sensitivity of hardware companies to component price fluctuations, highlighting the importance for investors to monitor supply chain trends and cost pressures. In the near term, rising memory prices could continue to weigh on earnings, affecting overall sentiment in the technology hardware segment.

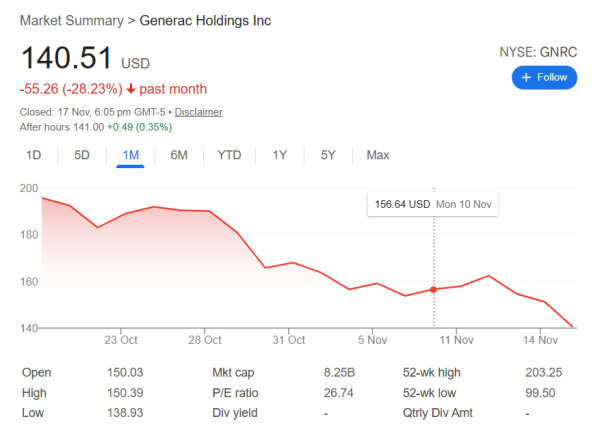

Losses Extend Beyond Tech Hardware

Beyond the tech hardware space, other sectors also experienced losses. Generac Holdings (GNRC), a leading provider of standby power generation equipment, fell around 7% following weaker-than-expected third-quarter results. The company cited fewer power outages during the period as a drag on sales of its residential generators.

Crypto-Related Stocks Continue to Slide

Cryptocurrency-related stocks continued their downward trajectory. Bitcoin (BTCUSD) dropped to its lowest level since April, while shares of Coinbase Global (COIN), the largest U.S. cryptocurrency exchange, fell roughly 7%. Market volatility and concerns over crypto adoption trends weighed on investor sentiment.

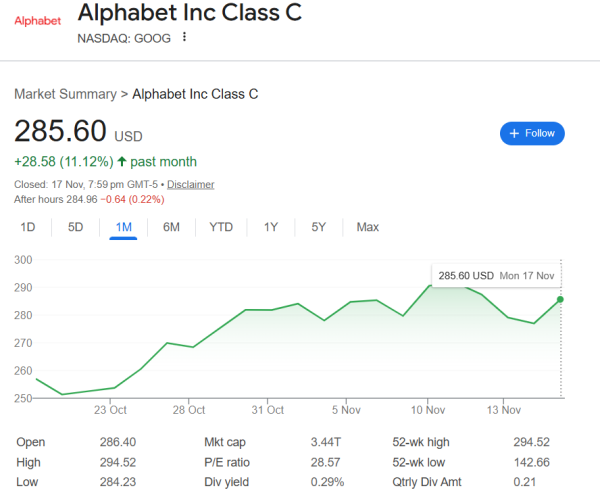

Alphabet Leads Market Gains

While many tech names declined, Alphabet shares jumped 3%, leading gains on the S&P 500. The surge came after a regulatory filing revealed that Berkshire Hathaway acquired a new stake in the Google parent, signaling confidence from one of the world’s most respected investors.

Operational Tailwinds Boost Alphabet

Alphabet also benefited from strategic operational developments. YouTube TV resolved a carriage dispute with Walt Disney Co. (DIS), restoring access to ESPN and other Disney channels after several weeks of disruption. The resolution is expected to support subscriber retention and advertising revenue.

In addition, Alphabet continues to expand its AI capabilities across consumer-facing products, recently launching AI-enabled travel tools. These services allow users to build customized itineraries by integrating flight and hotel searches with event bookings and restaurant reservations. The announcement put pressure on competitors in the online travel space, with Expedia Group (EXPE) shares dropping nearly 8%, while Booking Holdings (BKNG) and Tripadvisor (TRIP) also posted losses.

Diverging Market Forces

Monday’s session underscores the divergent forces at play in the market. Hardware and component-reliant companies like Dell are vulnerable to input cost pressures, while large tech firms with diversified revenue streams and strategic investments, such as Alphabet, are benefiting from investor confidence and operational resilience.

Analyst Perspective on Alphabet and Hardware Stocks

Brokers and analysts at Servelius note that Alphabet’s combination of AI innovation, advertising dominance, and strategic content partnerships positions it well for long-term growth, particularly when supported by investments from heavyweight institutions like Berkshire Hathaway. On the other hand, investors in PC hardware stocks should remain mindful of margin risks and cost pressures, which could weigh on short-term performance.

Market Takeaway: Innovation vs. Cost Pressures

In conclusion, Monday’s market action reflects a broader theme in 2025: highly diversified, innovation-driven tech companies are attracting capital, while hardware-reliant firms face headwinds from supply chain and component cost challenges.

Alphabet’s gains demonstrate the market’s confidence in long-term strategic positioning, whereas the struggles of Dell, Generac, and cryptocurrency-related stocks highlight the impact of sector-specific risks. For investors, identifying companies with durable competitive advantages remains key in navigating a volatile market environment.