Yen Faces Safe-Haven Flows Amid Intervention Speculation

The Japanese Yen (JPY) continues to struggle to attract buyers, despite a modest intraday uptick against a softer US Dollar (USD). The currency remains near a nine-month low, reached earlier this week, as market participants weigh fiscal risks, BoJ policy uncertainty, and global economic sentiment. In this article, Orbisolyx brokers examine the key aspects of the topic with clarity.

Persistent concerns about the US economy have kept the USD subdued, allowing the Yen to attract safe-haven flows, particularly amid speculations that Japanese authorities might intervene to prevent further JPY weakness.

Market observers note that while the USD remains under pressure, any significant JPY appreciation is being restrained by domestic fiscal concerns and uncertainty over the Bank of Japan’s (BoJ) interest rate path. Investors are cautious, balancing the appeal of the Yen as a risk-off currency against the potential for policy shifts in Japan.

BoJ Rate-Hike Uncertainty Restrains Yen Bulls

The Yen’s recent struggles are closely tied to ambiguity surrounding the BoJ’s monetary policy. Prime Minister Sanae Takaichi has reiterated her preference for low interest rates and signaled support for expansionary fiscal policy, creating doubts over the BoJ’s willingness to embark on an aggressive rate-hike cycle.

A panel of lawmakers from Japan’s ruling Liberal Democratic Party recently proposed a supplementary budget exceeding ¥25 trillion to fund Takaichi’s stimulus initiatives, fueling concerns over government debt supply. Yields on the 40-year Japanese government bonds reached record highs, reflecting market unease over long-term debt sustainability.

Takaichi emphasized that Japan still faces risks of returning to deflation and called for inflation driven by wage growth, rather than food-price pressures. Her comments underscore a policy divergence: while the Yen could benefit from safe-haven flows, the combination of fiscal expansion and a cautious BoJ stance tempers JPY bullishness.

Meanwhile, speculation about government intervention has created a ceiling for JPY weakness. Traders wary of triggering official intervention have been hesitant to short the Yen aggressively. This, combined with a risk-off global environment, provides intermittent support for the safe-haven currency, keeping the USD/JPY pair in a narrow trading range.

USD/JPY Dynamics Ahead of FOMC Minutes

Global market attention has shifted to the US Federal Reserve as traders await critical macroeconomic data. USD bulls are monitoring the FOMC meeting minutes, due later this Wednesday, for insight into the Fed’s policy trajectory.

The backdrop reflects signs of a softening labor market alongside comments from Fed officials signaling cautious progress. Fed Vice Chair Philip Jefferson emphasized the need for gradual policy adjustments, underscoring a measured approach to monetary changes.

Meanwhile, Fed Governor Christopher Waller highlighted the potential for further rate cuts if economic conditions warrant, reinforcing the market’s attention on the Fed’s evolving stance and its implications for interest rate expectations.

The US Nonfarm Payrolls report for September, scheduled for Thursday, will likely provide additional directional impetus for USD/JPY. The interplay between Fed policy expectations and BoJ uncertainty is central to understanding near-term currency movements.

Technical Outlook: USD/JPY Poised for Further Upside

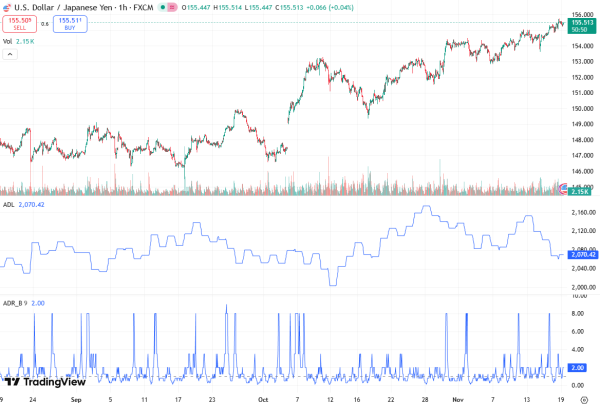

From a technical perspective, the USD/JPY pair has demonstrated back-to-back closes above the 155.00 psychological mark, indicating bullish momentum.

Positive oscillator readings suggest that the path of least resistance remains upward, with potential near-term targets identified. The 155.50–156.00 range represents the likely first level of follow-through strength, while the 156.50–156.60 zone marks the next significant hurdle, with a potential extension toward 157.00–157.35 if bullish momentum persists.

On the downside, any corrective pullbacks are expected to find support near 155.00, while stronger dips could attract buyers around 154.50–154.45, considered a pivotal horizontal support zone. A breach of this level may trigger a further decline toward 154.00, followed by the 153.60–153.50 area, and potentially 153.00, offering a roadmap for risk management in trading USD/JPY.

Key Drivers: Fiscal Concerns and Risk Sentiment

The Yen’s vulnerability remains influenced by several interconnected factors. BoJ rate-hike uncertainty keeps market participants cautious about aggressive monetary tightening, especially given the government’s fiscal stance. Fiscal expansion, highlighted by the proposed ¥25 trillion supplementary budget, raises concerns over long-term debt supply, impacting bond yields and currency sentiment.

While safe-haven dynamics support the JPY during global risk-off conditions, intervention fears constrain speculative positioning. Additionally, US macro data, including FOMC minutes and Nonfarm Payrolls, continues to influence the USD’s trajectory, placing further pressure on USD/JPY.

Conclusion: Yen Remains Vulnerable

Despite attracting safe-haven flows amid a softer USD, the Japanese Yen faces structural challenges that limit aggressive upside. BoJ policy uncertainty, coupled with expansionary fiscal measures, suggests that JPY gains may remain muted in the near term. Traders will likely focus on technical support and resistance zones while awaiting FOMC insights and US macro data to guide the USD/JPY trend.