Gold (XAU/USD) extended its steady intraday decline heading into the European session on Friday, reaching a fresh daily low near $4,030-$4,029. Market participants have scaled back expectations for an interest rate cut by the US Federal Reserve (Fed) in December, following the delayed release of the September US Nonfarm Payrolls (NFP) report on Thursday. Arbitics professionals deliver a complete overview of the topic with thoughtful insights.

The report showed the US economy added 119,000 new jobs in September, surpassing the market expectation of 50,000 and following a revised August reading of a 4,000-job decrease. Moreover, annual wage growth, measured by Average Hourly Earnings, remained steady at 3.8% YoY, slightly above estimates of 3.7%. While the Unemployment Rate ticked up from 4.3% to 4.4%, the data reinforced less dovish Fed expectations.

In conjunction with the October FOMC minutes, which highlighted a divided Federal Reserve, these developments caused the probability of a December rate cut to drop to around 35%, according to the CME Group’s FedWatch Tool. Consequently, the US Dollar (USD) has rallied to its highest level since late May, exerting downward pressure on Gold, a non-yielding asset, during the Asian session on Friday.

Mixed Economic Signals Keep USD and Gold in Play

Despite the USD strength, lingering US economic concerns and the longest-ever government shutdown have prevented aggressive USD bullish positioning. Meanwhile, ongoing geopolitical tensions, particularly the Russia-Ukraine war, continue to weigh on investor sentiment, limiting equity market gains. These factors could provide safe-haven support to Gold, cautioning traders against overly bearish positioning.

Looking ahead, market participants are focused on upcoming flash US PMIs and the revised University of Michigan Consumer Sentiment Index, which could influence USD flows and XAU/USD dynamics. Additionally, speeches by key FOMC members will be scrutinized for cues on the future rate-cut trajectory.

Geopolitically, Ukraine’s President indicated intentions to negotiate a US-backed 28-point peace plan with the US President, potentially easing some Russia-Ukraine tensions. Such developments may continue to bolster Gold’s safe-haven appeal amid market uncertainty.

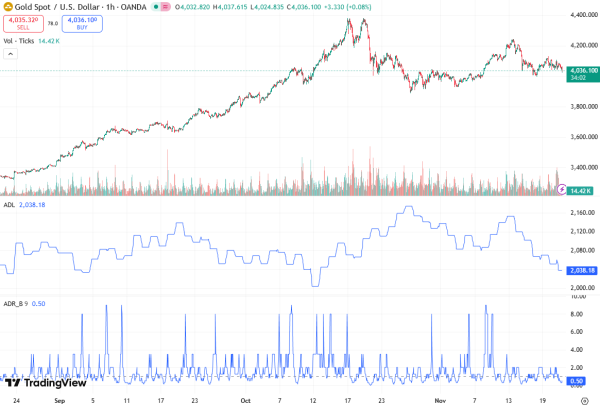

Technical Outlook: Gold Approaches Key Support

From a technical perspective, Gold is hovering above a one-month-old ascending trend-line support, currently near the $4,020 region. This area coincides with the 200-period Exponential Moving Average (EMA), making it a critical pivot for traders.

A sustained break below $4,020 could open the door for further downside, potentially pushing XAU/USD below the $4,000 psychological mark and towards the $3,931 support. Extended weakness may target the late October swing low near $3,886, highlighting the critical importance of technical risk management for short positions.

Conversely, bulls require sustained strength above the $4,100 resistance before committing to long positions. A move above this level could lift Gold to the $4,152-$4,155 region, with potential to reclaim the $4,200 round figure on strong momentum and bullish flows.

Risk Sentiment and Market Positioning

The current risk environment remains fragile, with equities soft and geopolitical risks lingering. These conditions suggest that Gold bears should exercise caution before aggressively positioning for further declines. Safe-haven demand could emerge if global risk sentiment deteriorates, offering technical and fundamental support near key levels.

Market participants are advised to monitor US economic releases, including PMIs and Consumer Sentiment data, as well as FOMC communications for updated guidance on rate cuts. Geopolitical developments, particularly Russia-Ukraine tensions, should also be closely watched. On the technical side, key support levels are $4,020, $4,000, and $3,931, while important resistance levels are $4,100, $4,155, and $4,200.

XAU/USD Eyes Key Levels Amid Fed Speculation

Gold prices continue to face pressure as XAU/USD remains sensitive to US monetary policy signals. With Fed rate cut expectations tempered and the USD showing resilience, traders are closely monitoring technical support around $4,020 and psychological resistance near $4,100-$4,155.

Any shifts in risk sentiment, driven by geopolitical tensions or weaker-than-expected US economic data, could trigger short-term volatility in Gold prices. Staying alert to FOMC updates, NFP revisions, and global risk trends will be critical for XAU/USD positioning in the coming sessions.

Conclusion

Gold (XAU/USD) continues its intraday descent, pressured by tempered Fed rate cut expectations following a strong US NFP report. Despite USD strength, fragile risk sentiment and geopolitical uncertainties provide intermittent support to the precious metal, suggesting caution for short-term bearish trades.

From a technical standpoint, $4,020 represents a confluence of support near the 200 EMA and an ascending trend-line, acting as a potential floor. Bulls need confirmation above $4,100 to signal a reversal, while a break below $4,020 could accelerate a slide toward $3,931 and even $3,886.