Federal Reserve Chair Jerome Powell wasn’t bluffing when he declared a December rate cut “far from a foregone conclusion.” Market expectations have collapsed from near-certainty to coin-flip odds as internal divisions within the Federal Open Market Committee intensify.

Senior financial analyst at Nexdi examines the fractured consensus emerging from the central bank’s latest minutes, revealing a committee at war with itself over monetary policy direction.

The sharp reversal in rate cut probabilities exposes deeper dysfunction within the Fed’s decision-making apparatus. Three consecutive meetings without unanimous decisions signal more than typical policy debates; they reveal philosophical rifts about whether inflation or employment deserves priority. As markets reprice expectations, investors face unprecedented uncertainty about the central bank’s reaction function heading into 2026.

The Probability Collapse

The numbers tell a stark story. Market expectations for a December rate cut have plummeted from 97% in mid-October to just 32% according to CME FedWatch. This represents one of the sharpest probability reversals in recent Fed-watching history.

What changed? The answer lies in a toxic combination of data blackouts, political pressure, and genuine economic uncertainty that has left policymakers flying blind at precisely the wrong moment.

The October meeting minutes, released on Wednesday, exposed deep fissures within the Federal Open Market Committee. “Several participants” pushed for continued easing, while “many participants” argued for holding rates steady through year-end. This isn’t the typical dovish-versus-hawkish debate. Three consecutive meetings without unanimous decisions signal something more troubling: a committee that has lost its compass.

The Government Shutdown’s Hidden Cost

Here’s what investors are missing. The 43-day government shutdown didn’t just delay economic data; it fundamentally compromised the Fed’s decision-making apparatus. Policymakers approved their October quarter-point cut to 3.75%-4% without seeing September payroll figures, October inflation readings, or key manufacturing indices. The Bureau of Labor Statistics won’t release complete October jobs data until December 16, six days after the Fed’s final 2025 meeting concludes.

This creates an unprecedented information vacuum. The September jobs report showed 119,000 new positions, more than double expectations, but came with downward revisions totaling 33,000 jobs from prior months. Unemployment ticked up to 4.4% from 4.3%, a seemingly minor increase that carries outsized weight for Fed members focused on labor market deterioration.

The Dissenters Reveal the Battle Lines

The voting record tells you everything about the Committee’s fracture. Stephen Miran, a recent appointee, dissented for a 50-basis-point cut, arguing the labor market weakness demands aggressive action.

Jeffrey Schmid of Kansas City dissented in the opposite direction, preferring no cut at all. When you get dissents pulling in both directions, you don’t have a policy debate. You have a philosophical crisis.

The hawkish faction, including Susan Collins of Boston and Alberto Musalem of St. Louis, worries that additional cuts risk reigniting inflation, which has shown “little sign of returning sustainably to the 2% objective.” The doves, led by Christopher Waller and Michelle Bowman, see rising unemployment as the greater threat. Chair Powell and the moderates are stuck building consensus from contradictory data.

What the Minutes Really Mean

Reading between the lines of Fed minutes is an art form, and these contain telling phrases. “Strongly differing views” appears multiple times, a rarity in documents typically crafted for consensus. Several members noted that “setting aside tariff effects, inflation was close to target,” a curious qualifier suggesting the Committee knows inflation pressures are artificially elevated by trade policy but feels powerless to say so explicitly.

The Bank of America Global Fund Manager Survey flagged another warning sign. Professional managers are holding just 3.7% of assets in cash, triggering a “sell signal” from BofA strategists.

Investors are the most overweight in equities since February and most overweight in commodities since September 2022. This excessive bullishness creates a “headwind, not tailwind for risk assets,” particularly without a December cut to sustain momentum.

Markets Price in the New Reality

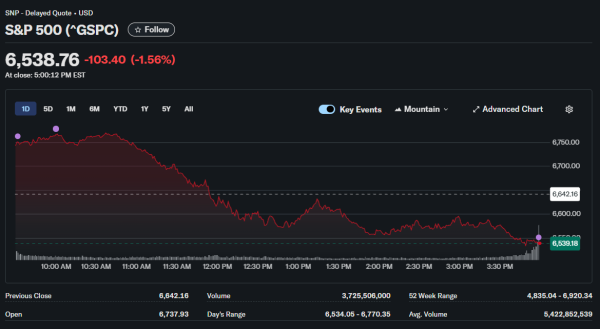

The S&P 500 dropped 1.56% on Thursday after initially rallying 1.9% on strong Nvidia earnings. The Nasdaq fell 2.16% after being up 2.6% earlier in the session. These aren’t normal corrections. They’re markets realizing that the dovish Fed narrative that powered the second-half rally might be dead.

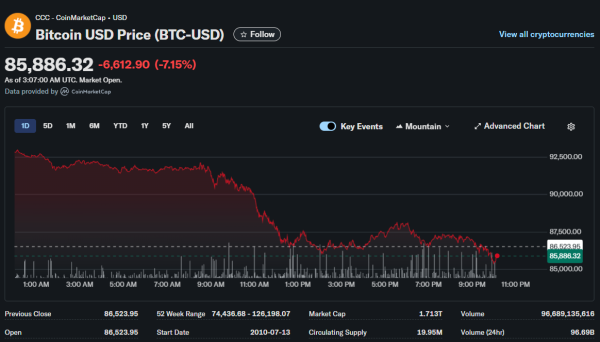

Bitcoin’s slide below $87,000 from near $100,000 reflects similar dynamics. Crypto markets had priced in easy money continuing indefinitely. The VIX volatility index jumped 14.2% to the 20 level, the largest single-day increase in over a month. Readings above 25 historically signal deeper market anxiety ahead.

The Path Forward

Here’s the scenario investors should prepare for. A December pause looks increasingly likely, with the committee waiting for January when better data will be available. But this creates its own problems. Former Fed Vice Chair Roger Ferguson noted the September numbers show “an economy that’s still hanging in there,” neither collapsing nor accelerating. That ambiguity is exactly what makes December’s decision so fraught.

The real question isn’t whether the Fed cuts in December. It’s whether this committee can rebuild the consensus required to manage 2026’s policy decisions. With dissents flying in both directions, political pressure mounting, and critical data missing, the Fed faces a credibility problem that transcends any single rate decision. Markets are beginning to price in not just a pause, but prolonged uncertainty about the Fed’s reaction function itself.