Almost a week ago, the CEO of Microstrategy ( MSTR ), Michael Saylor, announced that the company is the proud owner of 38,250 Bitcoin. This equates to roughly an aggregate sum of $425 million dollars. Despite the CEO believing that Bitcoin is currently less riskier than holding Cash or Gold, what type of market risk could Microstrategy encounter with BTC holdings of this magnitude?

Before we do any analysis, let’s define what we mean by the term Market risk. Market risk is simply defined as the fluctuation in value that arises from changes in market pricing. If you own any asset, you are exposed to market risk or systematic risk. Since MSTR is a publicly traded company, one might wonder, “Is it possible to estimate MSTR’s potential loss on a day to day basis arising from the market risk of its BTC position?”

Ok, before we go any further, it is prudent to acknowledge that in a range of possible outcomes, there is a higher than zero chance that BTC could go to $0 tomorrow. Although the probability of that happening may seem quite slim, new regulation(s) banning BTC or other unpredictable circumstances could occur; and therefore it is impossible to completely rule out.

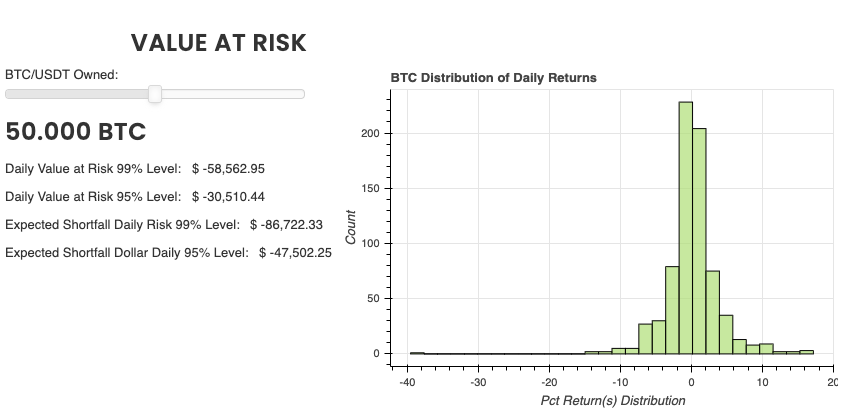

However, if we put the absolute worst case aside (losing everything), we can use a technique called Value at Risk (VaR) to estimate the potential loss arising from a position of this size. There are two main methodologies used for estimating VaR: parametric and non-parametric methods.

Parametric methods will assume a type of statistical distribution, and then use the mean & standard deviation of the data to estimate what would constitute an “extreme value”. The parametric approach has several shortcomings that we will not get into here. Suffice to say, we will be using a non-parametric approach, which is also known as a “historical simulation.” Large banks and regulated financial institutions will use the historical simulation approach to manage the market risk of their trading portfolios.

A historical simulation will take into account all of the daily returns over the last one to two year period on a rolling basis, and use a statistical threshold to determine how often a loss past that threshold is to be expected. The typical thresholds used are the 99% threshold and the 95%.

So what does a 99% 1-day Value at Risk mean? This is the minimum expected loss that will occur roughly 1% of the time. Or said another way: “Losses in BTC will exceed the 99% VaR threshold roughly 1% of the time.” Or another: “There is a 1% chance on a daily basis of BTC experiencing a loss greater than this threshold amount”.

Conversely, 95% 1-day VaR is the minimum expected loss to occur roughly 5% of the time. It is worth mentioning that (but we will not analyze here) there are often longer periods of time analyzed in the VaR framework (5day and 10day are common) due to liquidity and other transactional concerns in any given marketplace.

So What Is The 99% Value At Risk For BTC Held At Microstrategy ?

Currently, BTC VaR at the 99% 1-day threshold is -10.96%. Using current market pricing of ~10,700, MSTR’s BTC VaR at the 99% level is ~$44,856,540! Microstrategy could expect to lose this amount or more on any given day roughly 1% of the time!

If you are interested in applying this technique to your own custom BTC amount or portfolio, we provide an interactive reporting on our site CryptoDataDownload.com that tracks daily VaR and other metrics here.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.