eToro and The Tie released a Q3 2020 report on the fundamentals driving cryptocurrency prices. The latest research argues that speculation is not the only catalyst behind price action. Based on data from the past quarter, what fundamentals are causing directional moves in Bitcoin and other altcoins?

Significant Developments

In eToro’s and The TIE’s most recent Q3 2020 report, the TIE leveraged its “significant development” and sentiment data to assess how significant developments are correlated to the price of cryptocurrencies. The companies “SigDev” platform commingles real time information from 1,500+ sources. These sources can include token issuer blogs, forums, SEC filings, Central Bank announcements, Chinese publications, court cases, global regulatory rulings, media sources, crypto exchange blogs, and others.

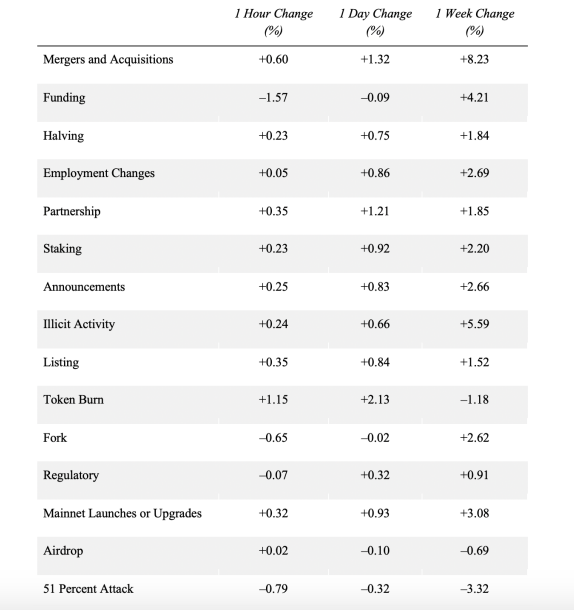

Some of the top significant developments driving prices are seen below.

Listing and Partnerships

According to the data, listing and partnership announcements have “immediate, large, positive influence on price.” This hype tends to wear off within a week. An example would be Aragon ( ANT ), which gained +24% in the first 24 hours following the listing on OKex. Despite this initial hype, the token sold off and has fallen below its listing price.

Mergers and Acquisitions

For longer term price effects, announcements regarding mergers and acquisitions have more substance. These positive effects typically extend more than week. When FTX acquired Blockfolio, the price of FTX rallied +33% the following week. This was fueled by new users that were discovering the announcement and entering the FTX ecosystem for the first time. Based on the data accumulated by The TIE, there was a 90% chance of positive returns after a week following merger and acquisition news.

Token Burns

With significant developments around token burns, there was a 100% probability that the price of a cryptocurrency would go up within the day. The average return was right around +2.13%, but it is important to note that these gains were only temporary.

Every Significant Development – Average Price Changes

The Probability Of Price Increases For Different Events

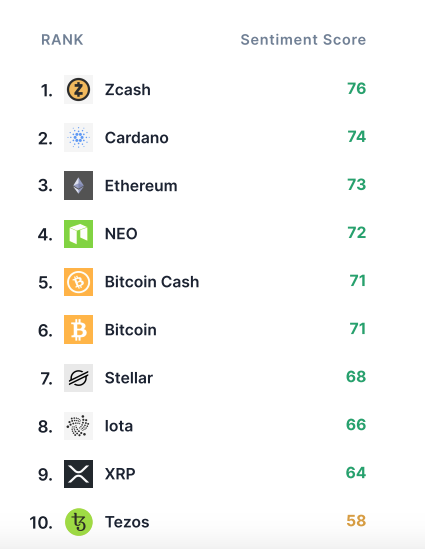

Crypto Sentiment

Within the report, eToro and the TIE also ranked the top cryptocurrencies in terms of long-term sentiment. These sentiment scores were based on Twitter activity. To gauge future sentiment, the data being pulled on Twitter took a look at sentiment over the last 50 days compared to the previous 200 days.

If a cryptocurrency received a score higher than 50, this denotes the conversation on Twitter being more positive over the last 50 days compared to the previous 200. On the contrary, a score below 50 means that sentiment is getting weaker, and conversations are becoming more negative.

As we can see from the figure above, Zcash has the highest sentiment score in Q3. eToro and the TIE believe surging sentiment can be related to Gemini’s support for shielded Zcash transactions. In addition, it was outlined by Visionary Financial that Zcash’s upcoming halving was also creating some bullish momentum. The halving in the next month will slash Zcash’s inflation rate in half, which has been a huge concern regarding ZEC value.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.