Cryptocurrency markets added $7 billion in total value last week even with Bitcoin finishing the week -2.04%. Despite crypto markets being highly correlated to traditional markets this year, stocks saw losses last week due to various macro issues weighing down on investors. What do we expect out of Bitcoin in the short term?

Cryptocurrency Markets

Global crypto markets added $7 billion in total value last week, as markets closed out the week with a total market capitalization settling around $341 billion. Despite cryptocurrency markets gaining value, Bitcoin finished the week -2.04%. Various altcoins saw growth, which ultimately helped the markets see positive growth.

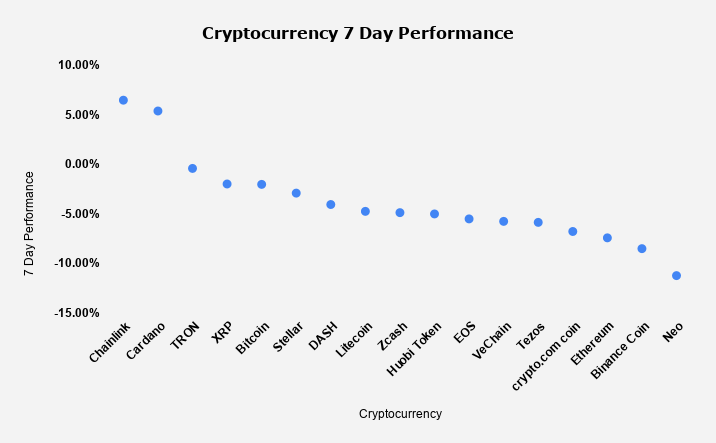

The markets started the week very poorly with Bitcoins price falling around -6%. This put additional pressure on altcoins, as many investors took a risk-off approach on Monday. Throughout the week, Bitcoin captured some of its losses, but was unable to fully recover. Chainlink and Cardano were the market outliers, seeing +5% and +6%, respectively.

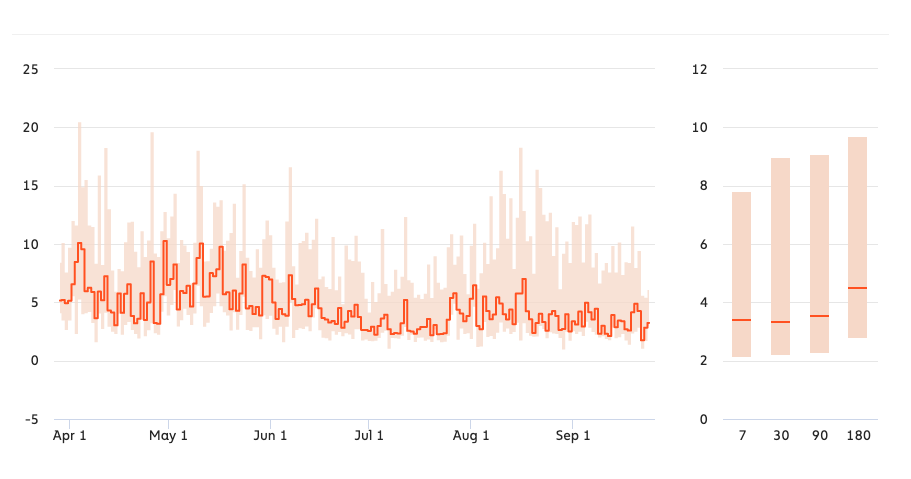

Bitcoin Trade Intensity

Most recently, Bitcoin trade intensity has been extremely week which is a concern going into next week. Historically speaking, elevated trade intensity in Bitcoin has represented an environment where market participants want to buy oppose to sell.

As we can see from Chainalysis metrics, Bitcoins trade intensity recently hit a new 180 day low. It recovered a bit to conclude the week, but this will be a metric that is definitely on watch next week.

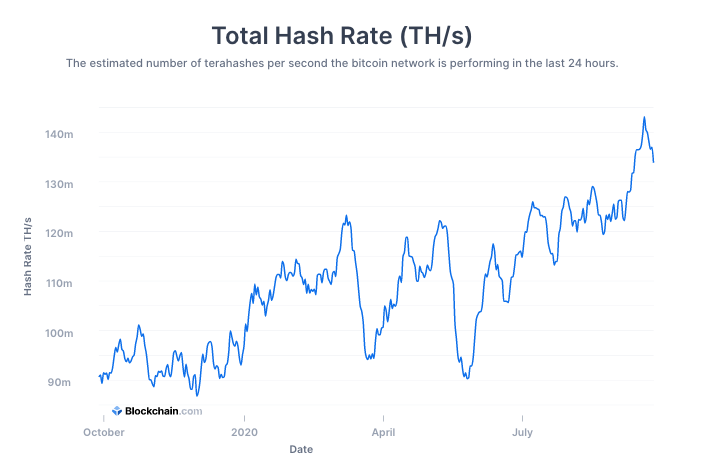

Bitcoin Hash Rate

Bitcoins hash rate recently hit new all-time highs on September 10th. As mentioned in previous reports, hash rate and price action are tightly correlated. After BTC hit new hash rate all-time highs on the 10th, it continues to increase which fueled Bitcoins price. This growth in hash rate was right around the time that BTC had rallied from $10,400 levels all the way to $11,000 resistance. After rejecting $11,000 levels, we saw that hash rate pull-back which ultimately lead to the BTC sell-off.

We will wait to see when Bitcoins hash rate reverses sentiment. In doing so, it could be an indicator that Bitcoin is ready for another leg up.

Bitcoin Technical Analysis

In recent Bitcoin technical analysis, it was mentioned that $10,600 levels were important to hold in the near term. During the large sell-off to begin last week, BTC rejected $10,600 levels and sold-off to $10,000 levels. This fell short of our original prediction of $9,200 , but it was still a solid risk management initiative, since selling at that $10,600 rejection saved traders from significant downside pressure.

Based on the current setup, we still believe in $10,600 serving as a strong support level. At the time of this reporting, Bitcoins price is trading at $10,756. If it can manage to hold $10,600 levels, then it could very well see significant bullish momentum next week. On the flipside, if $10,600 is rejected again, then we think traders would start to eye the $9,200 support levels.

Bitcoin Vs The Dollar Index

Visionary Financial has been stressing the importance of the Dollar Index for the last month pertaining to Bitcoins price action. Last week, VF published analysis that went further in depth in terms of the correlation and how the Dollar had more room to rally. Based on historical price action, this could put additional pressure on Bitcoins price. Check out the analysis above to see why the Dollar Index is so important moving forward.

Going into next week, we will continue to watch the Dollar. At the closing on Friday, the Dollar Index was still seeing upward momentum, fueled by growing concerns in coronavirus wave 2. Despite BTC closing out the week with some upward momentum, we are not sold on the trend just yet.

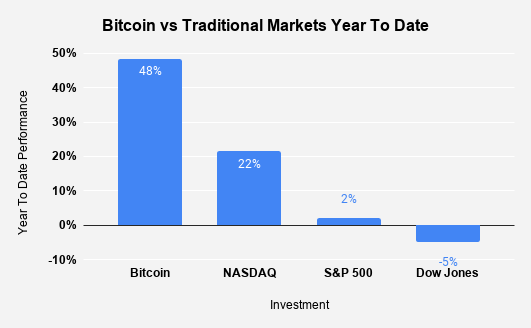

Bitcoin Vs Traditional Markets YTD

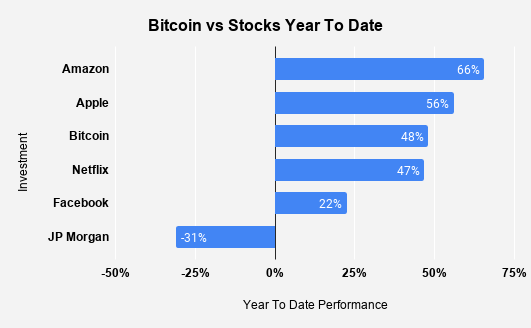

Bitcoin Vs Stocks YTD

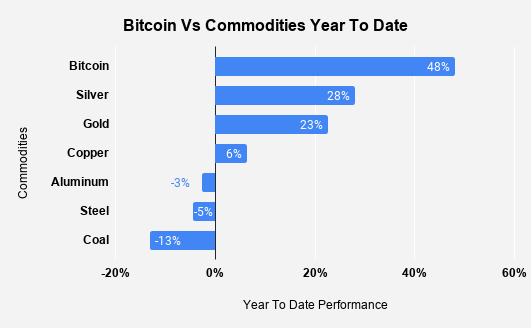

Bitcoin Vs Commodities YTD

Traditional Markets

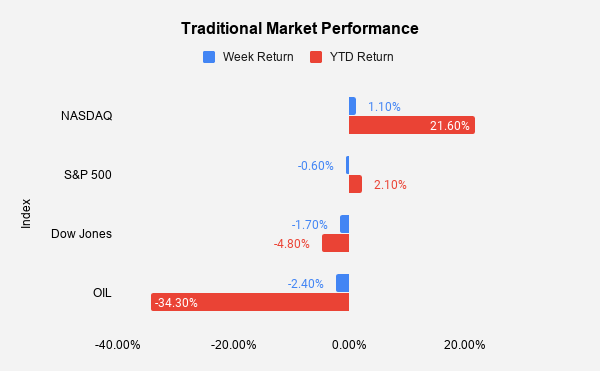

Stocks fell last week, as momentum has died down after a solid 6 month rally. The S&P 500 is now battling a ~ 10% correction. Technology stocks were originally the catalyst behind the market rally, but they have pulled back, causing the markets to inch lower.

Europe COVID 2nd Wave

There have been renewed fears with COVID-19, as Europe is experiencing a second wave. As many geographic regions started to relax COVID-19 restrictions, half of European countries started to experience significant increases in cases. In 7 countries they have even doubled. On Wednesday, the French Health Ministry imposed new restrictions, in response to a “2nd wave.” It is expected that traditional markets will be watching Europe next week, to assess overall sentiment. If Europe was to impose another lockdown, you could see investors in the U.S taking a risk-off approach again.

Additional Stimulus

With employment data coming in weaker than expected last week, it was another indicator that additional stimulus is needed in an effort to keep the economy afloat. With the passing of Supreme Court Justice Ginsburg, many investors fear that negotiations between Democrats and Republicans could come to a halt regarding fiscal relief. Consumers are still doing ok for the time being ( positive personal savings rates ), but this is expected to level out if additional stimulus is not injected.

In additions to the macro points above, volatility is still expected as we inch closer to the presidential election. There is no “slam dunk” right now in terms of elected POTUS, which has many investors on edge in terms of global policies pertaining to the overall economy.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.