Global crypto markets fell $28 billion last week, with Bitcoin and other large altcoins seeing significant sell-offs. Traditional markets fell -3% last week as all eyes continue to be on the US Dollar while the Fed pushes for higher inflation.

Cryptocurrency Markets

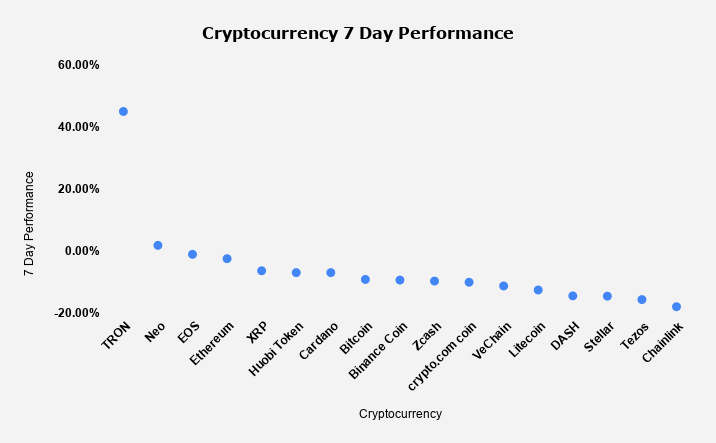

Global crypto markets took a big hit last week, as total market capitalization fell $28 billion dollars. At the time of this report, global market cap hovers around $349 billion. Over the last week, Bitcoins price has fallen -9%, peaking at $12,000 and falling all the way down to $10,400 levels. Despite most of the top cryptocurrencies following Bitcoin to the downside, TRON was the weekly outlier, surging +45%.

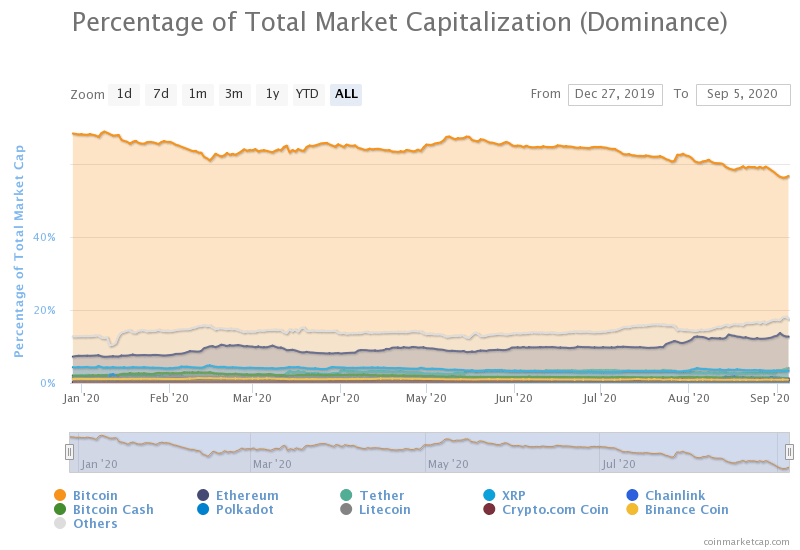

Bitcoin Market Dominance

Bitcoins market dominance fell about ~ 2% on the week, currently sitting at 56.7%. With TRON rallying +45% and other altcoins taking less of a hit on the week, it put some downward pressure on Bitcoins market share. It is important to note that Bitcoins dominance levels have fallen ~ 17% the last year. There can be many factors playing a role in this metric. Aside from significant money flowing into DeFi protocols, various altcoins like Chainlink have seen significant growth, surging more than +600%.

Bitcoin Price Action

As mentioned above, Bitcoins price took a heavy hit after rejecting $12,000 levels. Visionary Financial has stressed the importance of the US Dollar against Bitcoin. Historically, the Dollar and Bitcoin have been highly uncorrelated. Ever since the US Dollar ( DXY ) bounced off yearly lows of 92, Bitcoin has witnessed a nasty sell-off. DeFi protocols have also been putting a lot of stress on Bitcoin as well. With high yields enticing the market, investors are flocking to DeFi during market uncertainty. According to DeFi Pulse, Ethereum locked in DeFi protocols was up over +30% last week.

Other Reasons For The Market Sell Off

- Traditional market sell-offs last week

- Police raid South Korea’s largest crypto exchange, Bithumb

- Influx of BTC into crypto exchanges, most likely miners off loading some holdings

- TRON’s JustSwap witnessing significant activity in the DeFi space

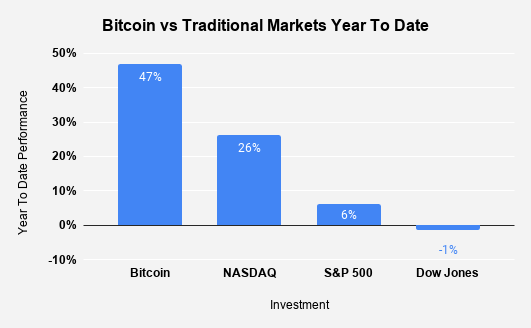

Bitcoin Vs Traditional Markets Year To Date

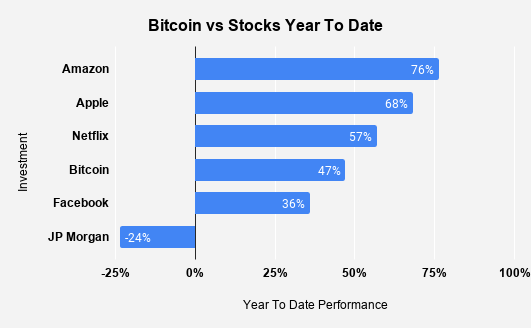

Bitcoin Vs Stocks Year To Date

Traditional Markets

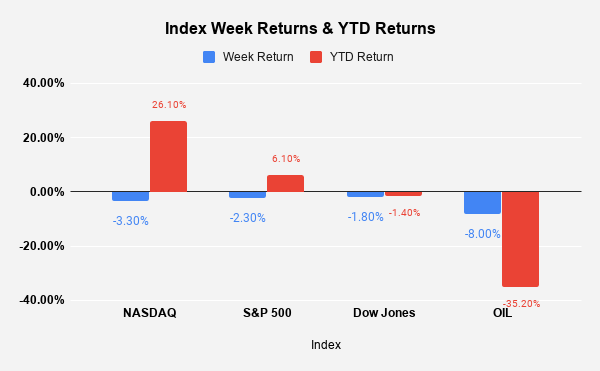

Markets took a big hit to end the week as the Dow Jones fell -1.80% on the week, and the S&P 500 fell -2.30%. It is worth noting that the 4 week rally for the S&P 500 unfortunately came to a halt. Earlier this year, COVID19 essentially shut down the economy, causing the market to take a -35% hit. With the government injecting unprecedented amounts of fiscal and monetary stimulus, the S&P 500 has seen an epic comeback, hitting all-time highs in prior weeks. The U.S. government has spent over $2.4 trillion during COVID19 in an effort to fund unemployment benefits, bail out industries, and assist failing small businesses. It is important to note that $2.4 trillion exceeds the GDP of countries like Italy, Brazil, and Canada.

Unemployment Metrics

The reduction in unemployment is one of the indicators fueling the stock market the last month or so. The stock market is very “forward thinking,” as investors are betting on low unemployment come year end, based on the progress this far. During the economic shutdown, unemployment surged to 14.7%. If we fast forward to last week, unemployment has come down to 8.4%. Despite this still being significantly high, last weeks data shows notable progress, outlining the creation of 1.4 million jobs in August.

Federal Reserve And Interest Rates

Federal Reserve Chairman Jerome Powell recently announced that despite the positive job data, the government still needs to keep interest rates low, in order to fuel more government spending. In addition, the Fed is committed to buying nearly $1 trillion in securities per year. As Visionary Financial outlined in previous reports, the Feds push to increase inflation is putting clear pressure on the US Dollar. With Bitcoin and the US Dollar being highly uncorrelated, all eyes are on the US Dollar. With the Fed planning to push inflation higher than the 2% target in a 0% interest rate environment, many investors continue to fear the direction of the Dollar.

Image Source: Unsplash

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.