On September 2, 2020, Brave New Coin, a company focused on digital asset data infrastructure announced that it would be working with LEVERJ. The two companies plan to roll out various tradable products for Leverj.io, which is the first scalable decentralized derivatives exchange in the world.

The Outstanding Team Behind LEVERJ

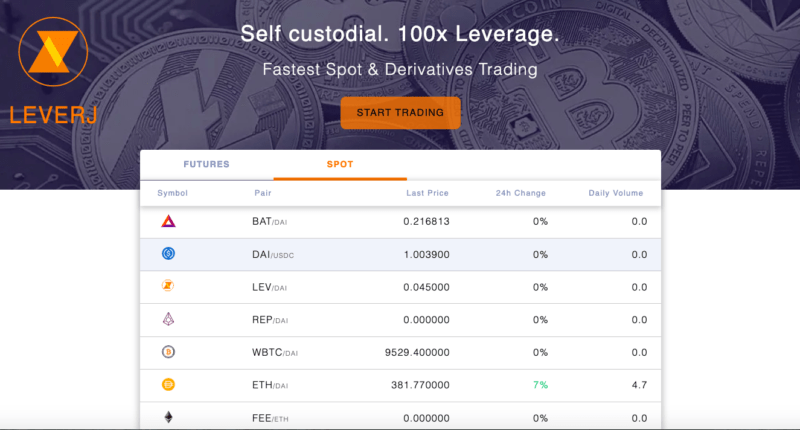

LEVERJ was launched by a team of financial experts that have years of experience on Wall Street working for firms such as Credit Suisse, Goldman Sachs, and J.P. Morgan. Leverj.io operates as a decentralized derivatives exchange, which is intended to mirror the functions of traditional exchanges. The platform also places a major focus on security. In a market where many crypto investors risk their assets with centralized exchanges, LEVERJ is powering a self-custody platform, which means that users are always in control of their funds.

Growing Increase In The DeFi Sector

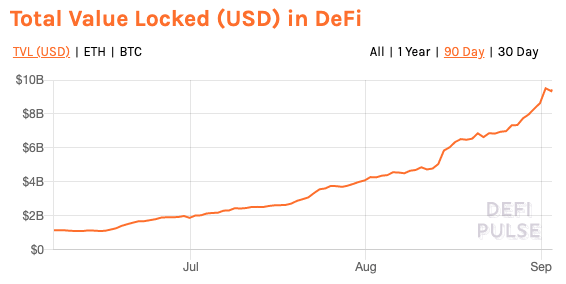

The DeFi sector has experienced significant growth this year, which has been fueled by lending protocols that offer much higher interest than traditional banks. According to DeFi Pulse, the decentralized finance industry has about $9.4 billion locked in DeFi smart contracts. LEVERJ is built to support the growing interest in DeFi markets, offering its users high frequency, multi-currency futures, and spot trading.

The Areas of Focus

For those who have been keeping up with development in the DeFi sector, the launch of the LEVERJ exchange has been a highly anticipated event. The reason for this is that LEVERJ will finally help to bring parity to the DEX world. LEVERJ will partner with Brave New Coin to introduce crypto derivative products to the masses.

For now, they will offer traders BTC-USD and ETH-USD perpetual swaps with more products being launched later. The two also plan to introduce subsector-specific tradable products such as a privacy coin index, DeFi index, volatility indices, and more.

The Challenges LEVERJ Wants To Solve

On centralized crypto exchanges, various problems have refused to go away. Some of the ongoing issues are performance and security. Various crypto exchanges around the world have been broken into with hundreds of millions of dollars lost. This is an issue that is pretty much unheard of with traditional exchanges.

To avoid these problems, the founders of LEVERJ believe that one of the solutions is for crypto exchanges to adopt standards similar to those of traditional exchanges. One of the ways LEVERJ solves these problems is via the Gluon sidechain. The sidechain is a protocol designed to prevent fraud, collusion, or compromise on the exchange without any extra limitations.

Gluon operates as an Ethereum Layer 2 chain, which gives LEVERJ low latency, and high-transaction throughput. It does this without compromising the critical function of instant finality. Developers will also be able to create decentralized apps on Gluon, including the creation of their own decentralized exchanges.

The Development of Gluon

The LEVERJ team has been working on Gluon for over three years. It is currently a one of a kind Layer 2 solution built for high throughput trading. Gluon also features support for conventional APIs, which is a feature advanced traders can use to provide a normalized experience without counterparty risk.

Why the Partnership is Important

When commenting on the issue, Bharath Rao, the co-founder of LEVERJ, said that by working with the Brave New Coin, it would offer users more transparency on various issues. For instance, they would gain more transparency in the benchmark methodology as well as the instrument design process. Rao concluded by saying that it was their goal to bring the best practices of the traditional markets into the DeFi space.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.