Global crypto market cap took a solid hit on Wednesday, losing around $14 billion in value. Despite some cryptocurrencies showing signs of reversals, why are Tezos and Stellar still registering strong sell signals?

Cryptocurrency Markets

Global cryptocurrency markets had strong sell-offs yesterday as the market shedded about $14 billion in value. Bitcoins price witnessed a strong rejection at $12,000 which sent a strong sell-signal for altcoins as well. Here is how some of the largest digital assets are doing the last 24hr:

- Bitcoin: -2.90%

- Ethereum: -6.82%

- XRP: -6.59%

- Chainlink: -7.48%

- Tezos: -9%

- Stellar: -6.34%

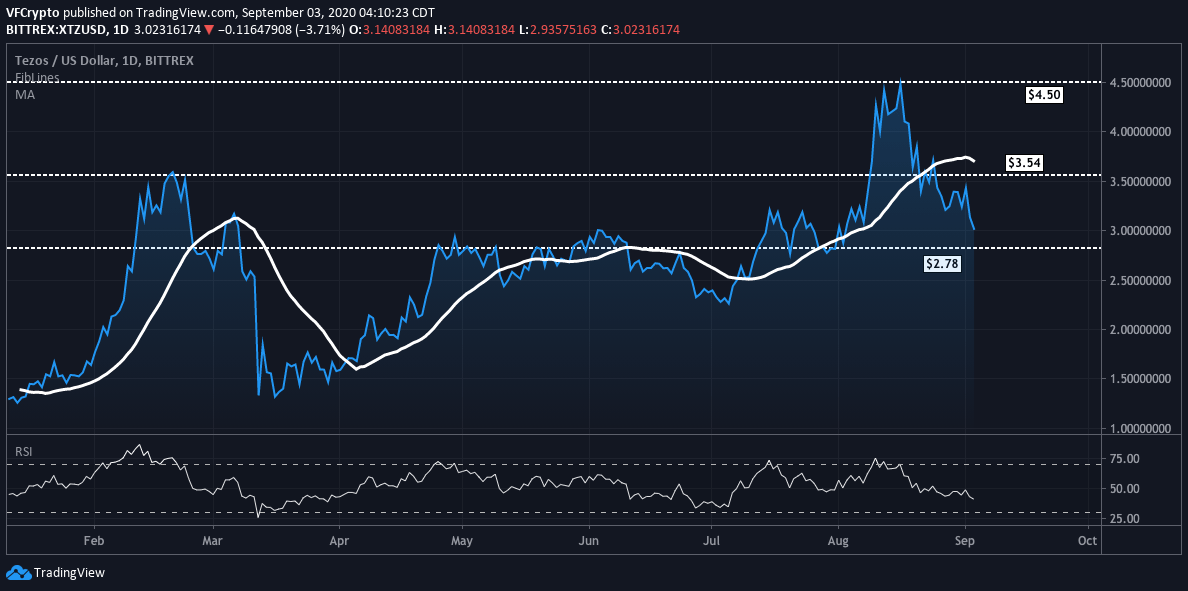

Tezos Technical Analysis

Despite Tezos price being down -17% over the last couple weeks, XTZ is still up +185% the last year. Most recently, Tezos strong sell-off occurred right after it failed to accept resistance at $4.50 levels. Since then, the digital asset has sold off to $3.00 levels.

Tezos price had a strong rejection at $3.54, and has since spiraled down to $3.02 ( at the time of this reporting). Tezos is witnessing similar price action to VeChain, in which Visionary Financial was bearish on yesterday, calling for a -11% drawdown. Right now Tezos is positioning itself to test support at $2.78, which would be 8% additional downside from current levels. In the short term, Tezos will not want to drop below that support at $2.78. If it does so, traders will be looking for a much larger leg down. In terms of building bullish momentum, watch for Tezos to retest support at $2.78 and build momentum off that level. As discussed above, if Tezos fails to do so and rejects $2.78, it could result in a much larger drawdown.

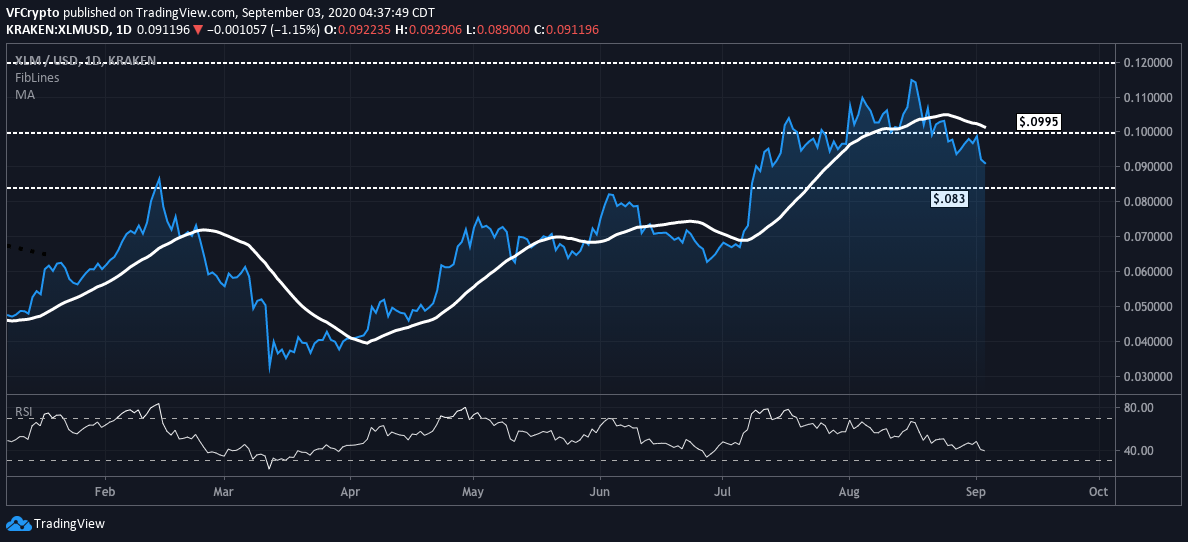

Stellar Technical Analysis

Stellar has failed to build any positive momentum the last month, falling around -13%. On August 25th, Stellar ( XLM ) rejected support at $.0995 which had bears in control.

Based on current price action, Stellar price seems to be eyeing the $.083 support level. If XLM retests this level, it would experience a -9% drawdown from current levels. Similar to Tezos, XLM also runs the risk of another leg down if it fails to hold support at $.083. Bulls will be looking to take control when XLM reverses sentiment, and is able to power its way through $.0995 resistance.

What Started The Market Sell-Off?

As many investors can tell by now, altcoins are highly correlated to Bitcoin. In a recent report, it was outlined that Bitcoin and the Dollar Index have historically been uncorrelated. With the Dollar experiencing an unexpected rally yesterday, it was the obvious catalyst behind the Bitcoin sell-off. All eyes will be on the Dollar this week to determine how Bitcoin will close the week. Despite some altcoins showing a sign of reversal, expect a majority of them to follow Bitcoin price action to conclude the week.

Image Source: Unsplash

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.