Bitcoin price, stocks, and gold all took a hit yesterday with Bitcoins price falling -8%. As discussed in previous reports, the US Dollar seems to be the leading catalyst, sending Bitcoin into sell-off mode. With Bitcoin recently rejecting key support levels, which price levels should be on watch in the short-term?

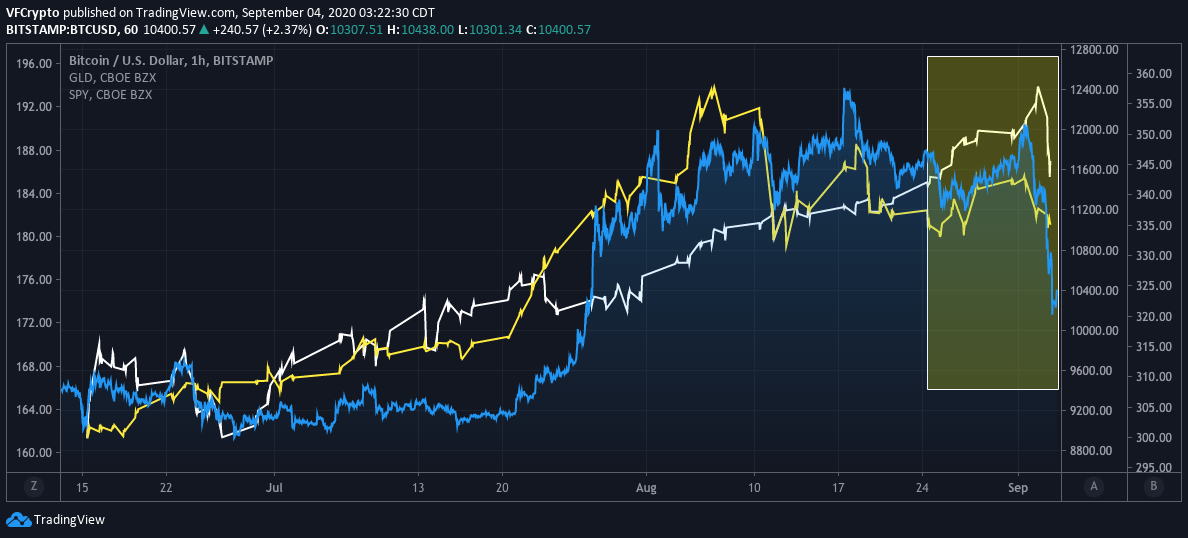

Bitcoin, Stocks, And Gold

In a rare event, global markets saw significant sell-offs in Bitcoin, stocks, and gold yesterday. Bitcoins price fell -8%, and the Dow Jones fell -807 points. In addition, gold was able to weather the storm, only falling about -0.50%.

On the traditional side of things, analysts were split in terms of their assessment from yesterdays activity. According to CNBC, analysts were relatively bullish, stating that the sell-off was resulting from profit taking and rebalancing going into September, which has historically been a slow month. Other analysts had a different viewpoint, connecting the market sell-off to news surfacing around China dropping US debt holdings from $1 trillion to $800 billion.

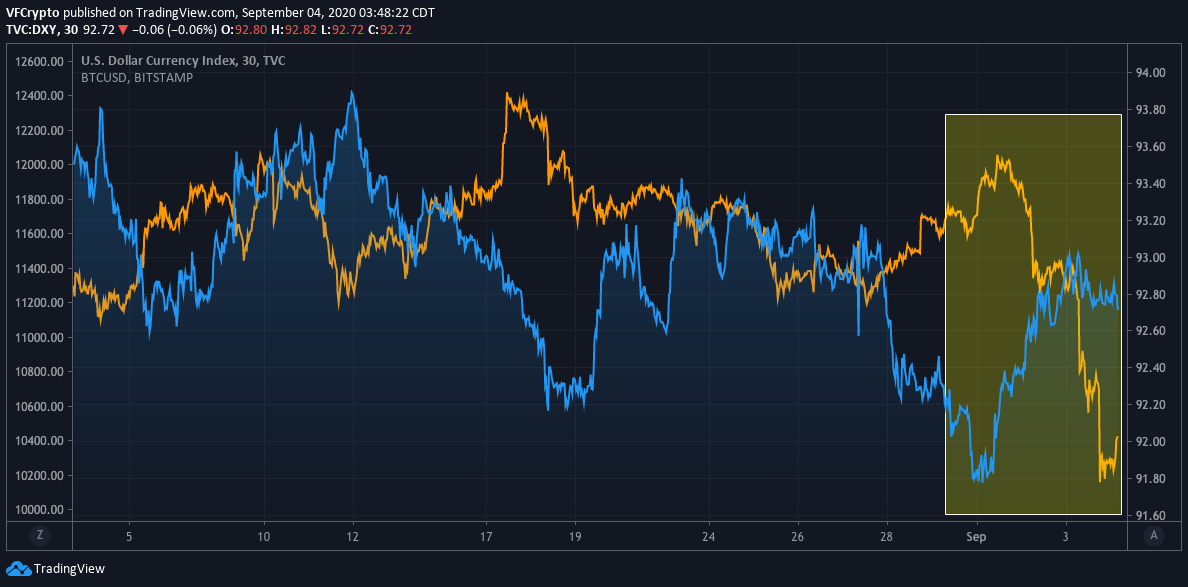

Bitcoin Triggers

Despite there being no direct catalyst, it is best believed that the US Dollar is causing Bitcoin to lose steam. Visionary Financial recently outlined the importance of keeping an eye on the US Dollar. As previously discussed, Bitcoins price has been highly uncorrelated to the US dollar for years. With the US Dollar recently hitting yearly lows, it was a matter of time until it gained upward momentum. We can see how uncorrelated Bitcoins price has been to the US Dollar from the chart below. As the Dollar is bouncing off yearly lows, BTC has been directly uncorrelated.

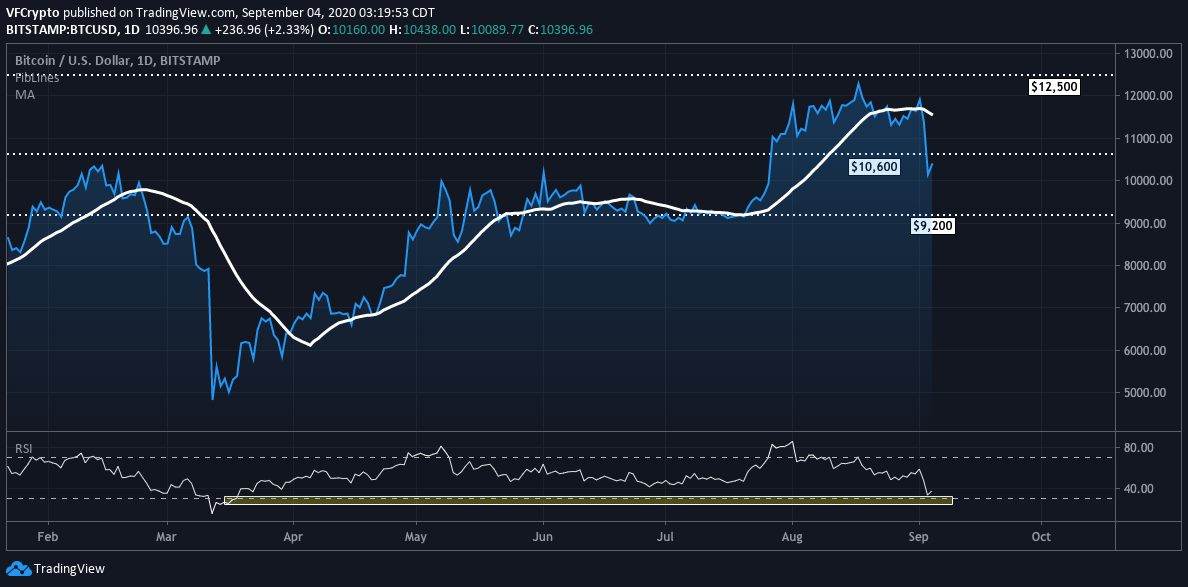

Bitcoin Technical Analysis

At the time of this reporting, Bitcoin is trading right around $10,400. Over the last 5 days, Bitcoins price has dropped nearly -1,000 dollars. During this time frame, BTC dropped below strong support levels, which will need to be maintained in the short-term.

We can see from the chart above that the recent sell-off sent Bitcoins price below the $10,600 support level. This was extremely bearish, especially since BTC was threatening to retest $12,500 resistance a few days back. In the short-term, traders will be looking for Bitcoin to hover back above $10,600 levels. If BTC can manage to do so, it should be able to gain some positive momentum. On the contrary, as long as Bitcoins price stays below $10,600 , it will continue to be controlled by bears. If BTC does not retest $10,600 in the short-term, it could very well test support at $9,200. As discussed above, if the US Dollar continues to experience bullish price action, this will most likely send Bitcoin to the $9,200 test. All eyes should continue to be on the US Dollar ( DXY ) to close out the week.

Image Source: Unsplash

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.