Bitcoin has remained the largest cryptocurrency in the world, currently maintaining a market capitalization of $193 billion. With millions of wallets holding Bitcoin, how does one categorize a “Bitcoin whale?” In addition, how has the Bitcoin whale activity looked so far this year?

What Are Bitcoin Whales ?

In traditional markets, investors are always interested in seeing where the big players are putting their money. In terms of assessing “whales,” many people will look at insider ownership and institutional activities. In the event that institutional buying is increasing, many investors view this as a bullish indicator for future outlook.

With Bitcoin, the process of identifying “whales,” is similar, but we look at different metrics to assess the fundamentals. Unlike the stock market, there is little transparency in terms of wealthy entities reporting their Bitcoin exposure. Despite institutional investment skyrocketing this year in Bitcoin, the general public has little idea what individuals or entities are deploying capital to Bitcoin. This is why we shift our focus and look at Bitcoin addresses.

Bitcoin Addresses

Since inception, Bitcoin addresses have gone parabolic with more people investing in cryptocurrencies year over year. Each person or entity has digital wallets that have addresses affiliated to them. Bitcoins blockchain is a public ledger that records bitcoin transactions. In doing so, the blockchain is able to track Bitcoin distribution. Unlike traditional markets, we can not see who is investing in Bitcoin, but we can track every address and see how much they own.

Bitcoin Whales And Distribution

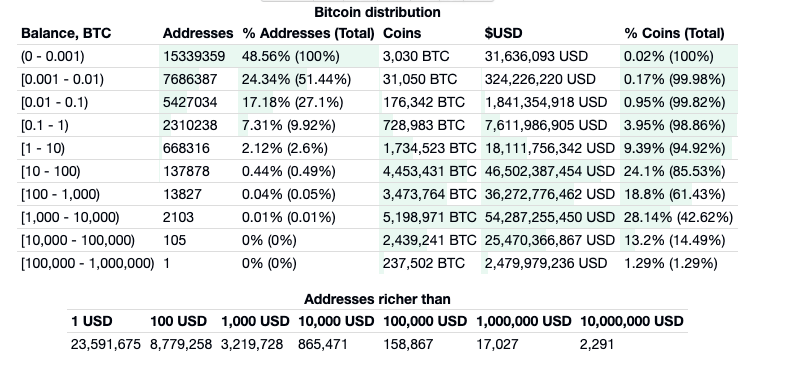

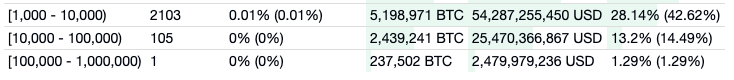

By following the chart above, we can see data for 10s of millions of Bitcoin addresses globally. Even though we do not see names, the addresses represent the individuals and entities involved in Bitcoin. Historically speaking, Bitcoin whales are any addresses that hold more than 1,000 Bitcoin. The data above shows us that more than 2,000 wallets are holding in excess of 1,000 Bitcoin. At a current market price of $10,400 , this would mean that somebody holding 1,000 Bitcoin would have a $10.4 million dollar position. There is even 1 address that currently holds around $2.5 billion in Bitcoin. It is important to note that some cryptocurrency exchanges are the entities holding significant Bitcoin. They do so to maintain custody for their user base.

Investor Sentiment

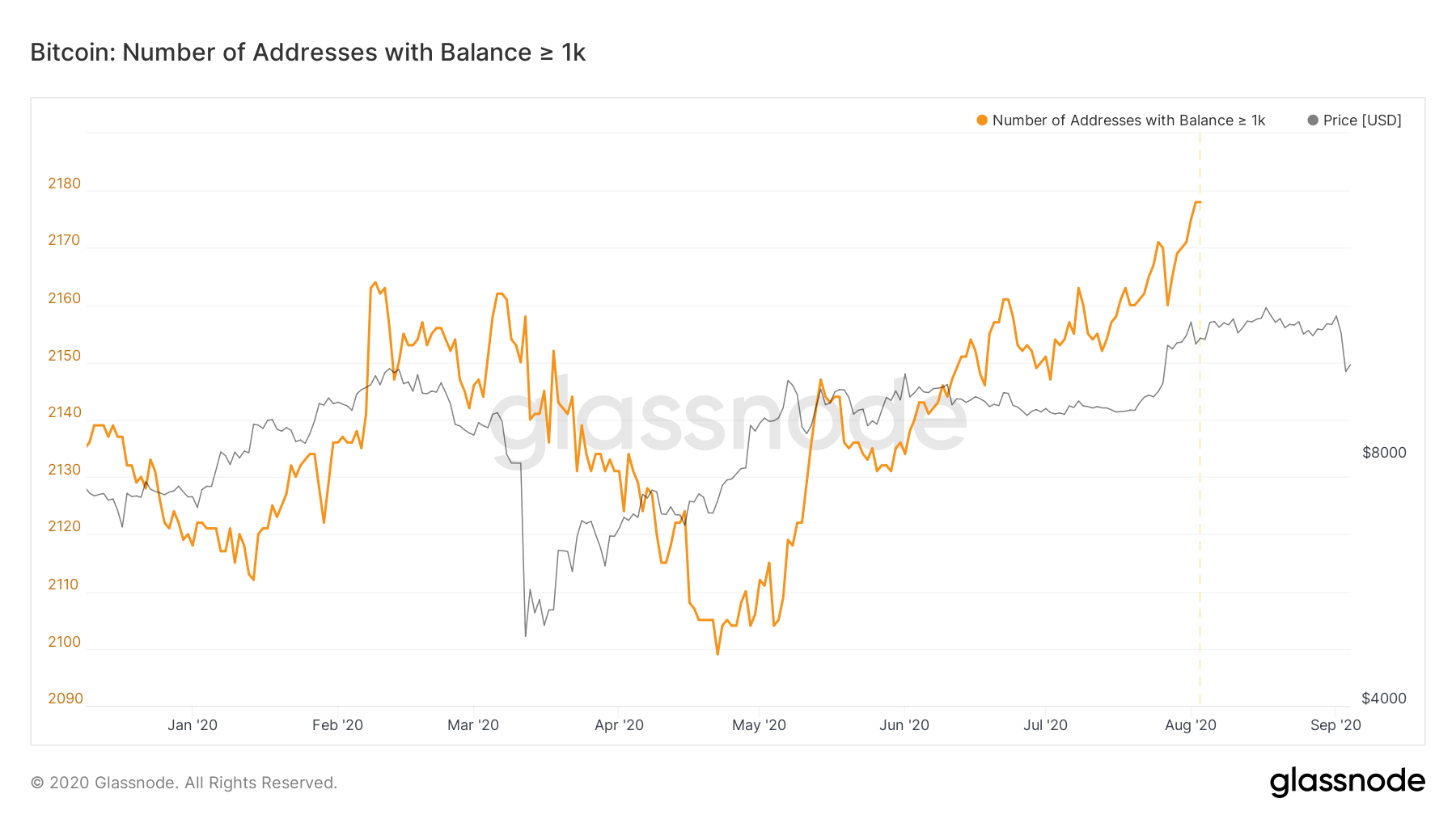

As discussed above, it was reported in May that Grayscale Investments was seeing record growth in institutional adoption. Monitoring Bitcoin whale addresses can also help us identify on-going sentiment. There have been many scenarios where Bitcoin experiences a large sell-off, but whale addresses is increasing. This tends to be a bullish indicator for long-term investors.

According to Glassnode, there were about 2,178 Bitcoin addresses in late August that were considered Bitcoin whales. We can see the direct correlation to Bitcoin whales and Bitcoins price. As the number of whales went up, so did the price of Bitcoin. If we fast forward to this month, we will quickly see that Bitcoin whales have actually increased. At the time of this reporting, there are 2,209 addresses holding over 1,000 BTC.

The Recent Sell Off

Monitoring Bitcoin addresses can play a crucial role during market turmoil. Over the last week, Bitcoins price has fallen -1,000 dollars as the market quickly turned bearish. With BTC price and whales being highly correlated, many are watching this fundamental closely. As discussed above, large holders have actually increased since last month which is a positive sign. Bitcoin whale addresses at 2,209 represents an all-time high. With this activity occurring, it is best believed that whales still have positive long-term sentiment despite the short-term price corrections. This is essentially no different than a scenario where institutional investors are increasing their stake in a stock as the stock is experiencing a price correction.

Image Source: Unsplash

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.