Bitcoin IRA conducted a client survey in September that showed increasing investor sentiment going into Q4. Compared to the same survey that was conducted in June of this year, investors are placing more value on long-term investing in cryptocurrencies. With the global pandemic raising a lot of uncertainties around debt and inflation, investors are diversifying in digital assets, with the hopes of off-setting traditional market risk in the long-term.

Sentiment Survey

Bitcoin IRA, a digital asset IRA tech platform, has recently announced the results of client surveys that were conducted in September. Bitcoin IRA is revolutionizing the retirement industry, giving 50,000+ account holders the ability to purchase cryptocurrency and physical gold in self-directed retirement accounts.

Passive Investing

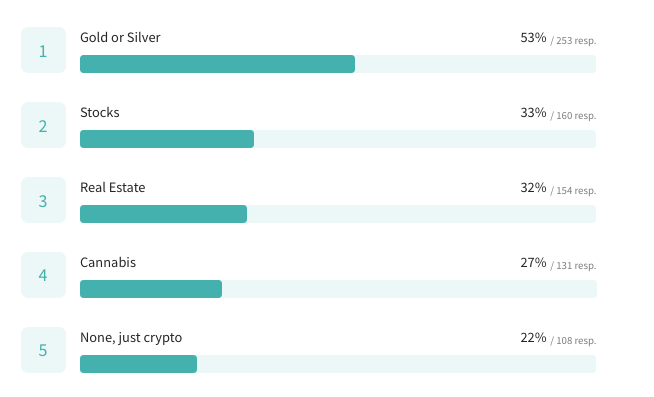

According to the results, investors have more interest in passive investing compared to the same survey that was conducted in June. Aside from cryptocurrencies, Bitcoin IRA clients have elevated interest in other “uncorrelated” assets such as Silver and Gold. Back in June of this year, investors were also hunting for yield, due to limited opportunities in traditional finance.

Interest Rates

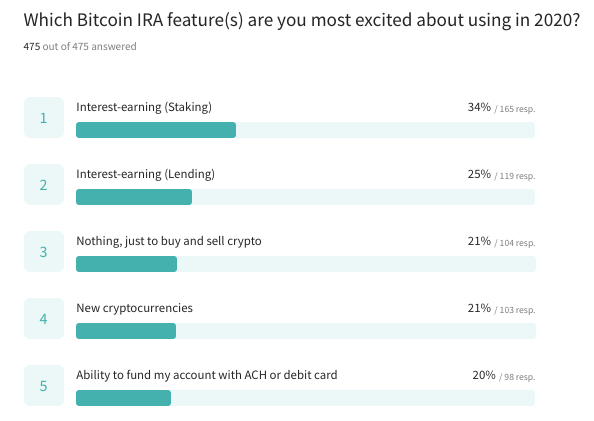

With the Federal Reserve planning to keep interest rates near 0% until 2023, investors are coming to the realization that digital asset markets are creating better alternatives for yield. In the most recent Bitcoin IRA survey, investors were showing more interest in Staking, which is a way to earn yield on crypto asset holdings.

Change In Investor Sentiment

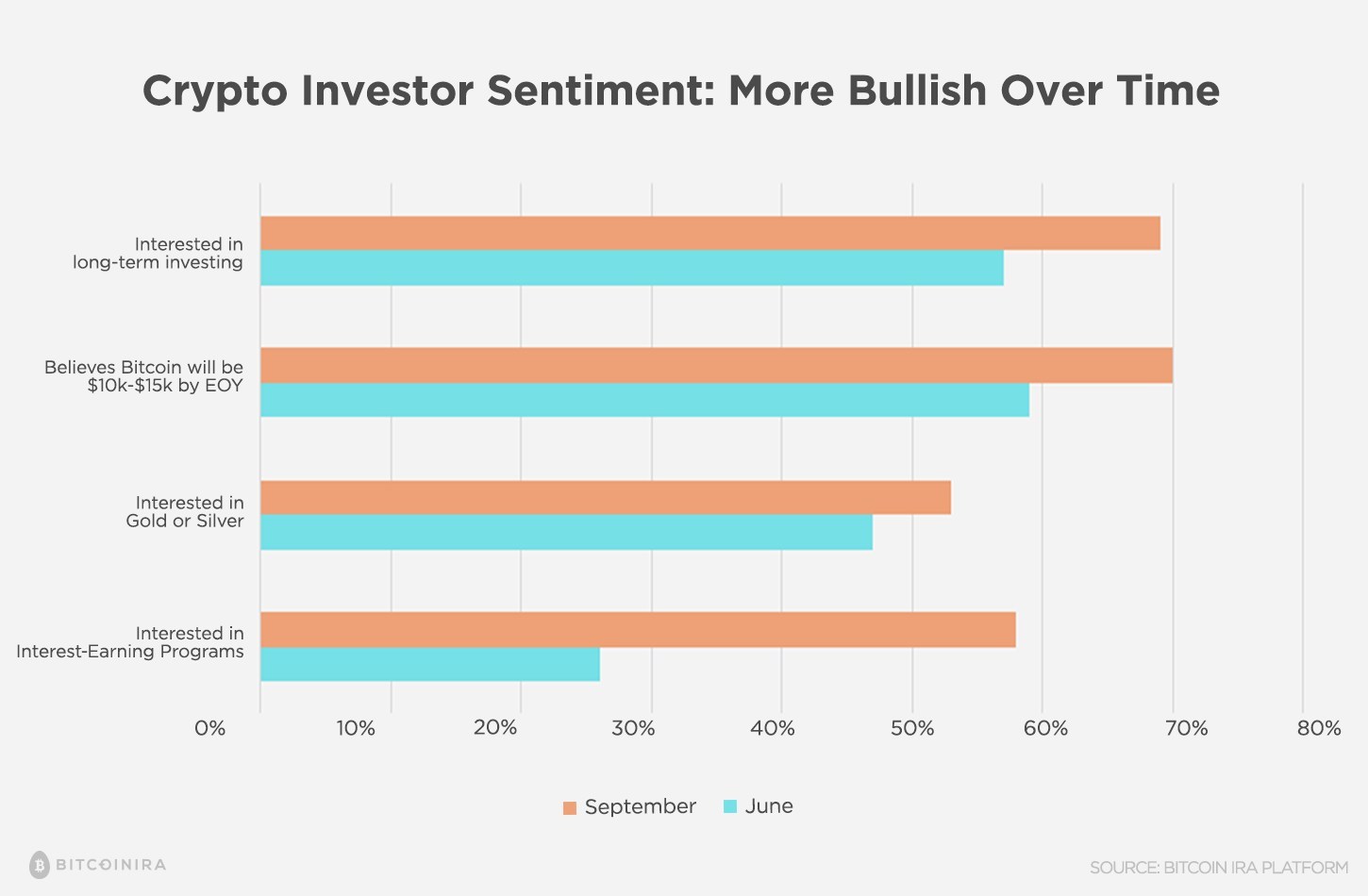

Based on the feedback from September’s survey, here is how investor sentiment has changed since June of this year:

68% of investors in September planned to buy and hold cryptocurrencies for the long term, opposed to 57% in June.

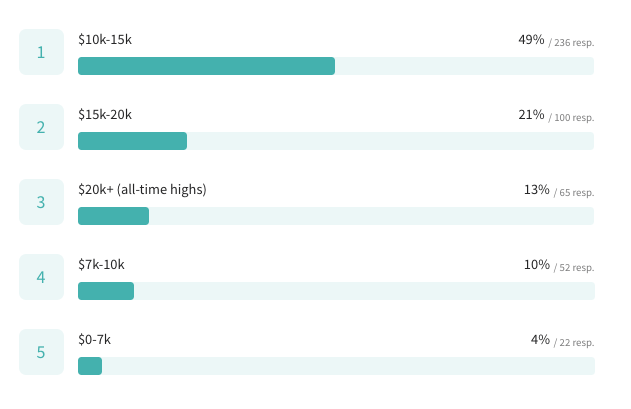

By the end of the year, 49% of respondents believe that Bitcoins price will be between $10,000 and $15,000. Back in June, 40% of respondents had this outlook.

In September, 53% of respondents had increasing interest in uncorrelated assets like Silver and Gold. Back in June, less attention ( 47% ) was being allocated to Gold and Silver markets. This shows growing uncertainty in traditional markets as the year progresses.

60% of respondents are fascinated in interest bearing opportunities in crypto. Despite this only being up from 53% in June, most of the growing sentiment is in staking, which saw a +30% jump in respondent interest levels.

What Is The Number 1 Cryptocurrency?

In June, Bitcoin IRA investors were highly bullish on altcoin markets, in which many believed would outperform Bitcoin. To an extent they were right, as many altcoins have done better than Bitcoin on a year to date basis.

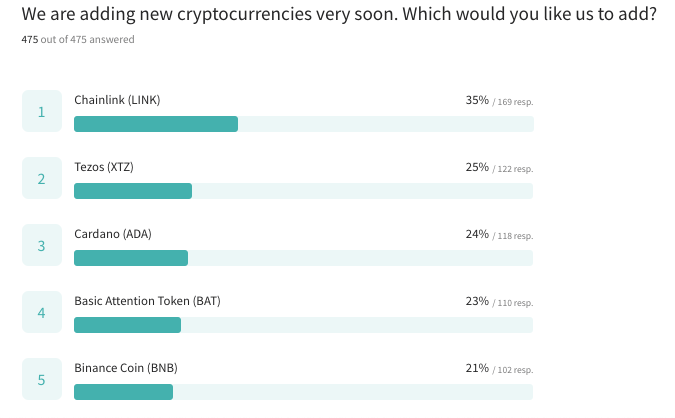

Aside from Bitcoin and Ethereum, investors were showing the most interest in Chainlink moving forward. It is important to note that Chainlink has seen exponential growth over the last year, surging +449%. Unlike many other cryptocurrencies, Chainlink managed to create new all-time highs this year, cracking $19.83 in mid August.

More On Bitcoin IRA

Bitcoin IRA powers a trading platform for self-directed retirement accounts. Investors across the globe have the ability to rollover their existing IRA’s, and diversify into cryptocurrency and investment grade physical gold.

To date, Wall Street firms still lack the proper infrastructure to provide digital asset exposure to their client base. As more traditional market uncertainties come to fruition, investors are looking for proven uncorrelated asset exposure. Bitcoin IRA is servicing this market, processing over $400 million in investments since 2016.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.