Strong rallies in Bitcoin, Ethereum, and XRP have come to a halt this weekend. After BTC attempted to re-test all-time highs, the largest digital asset witnessed strong selling-pressure that triggered similar sentiment in altcoin markets. With major cryptocurrencies entering correction mode, what price levels will be on watch in the short-term?

Crypto Markets

Bitcoin experienced strong upward momentum last week, as the largest digital asset by market cap attempted to re-test 2017 highs. With BTC price hitting $19,391 last week, it was about ~ 0.50% away from December 2017 all-time highs. BTC FOMO died down overnight and saw strong selling pressure on Thursday. Over the last 24 hours, BTC has now retraced -8.76%. Altcoins have lost momentum as well with many large-cap altcoins seeing heavier selling pressure. At the time of this report, here is how large digital assets have been doing over the last 24 hours:

- Bitcoin: -8.76%

- Ethereum: -9.12%

- XRP: -14.38%

- Bitcoin Cash: -14.63%

- Chainlink: -11.92%

- Litecoin: -14.12%

- Cardano: -11.99%

Bitcoin Technical Analysis

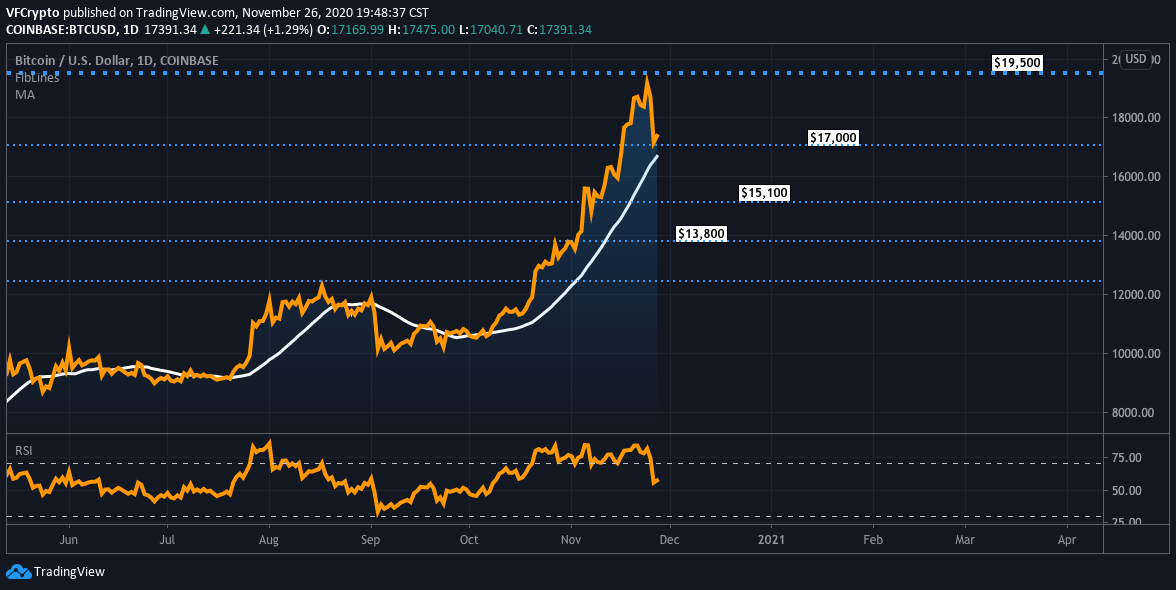

As mentioned above, BTC got very close to re-testing all-time highs last week. These were levels that have not been visited since December 2017. Ever since early October, Bitcoin has rallied from $10.5K levels all the way to mid $19K. As BTC inched closer to all-time highs, it was also getting into overbought territories. It seems like the sell-off yesterday was natural price action to normalize the technicals. We still believe that BTC will take out all-time highs before year-end. Check out what price levels we are watching below.

Based on current technicals, $17,000 remains a strong support level. As long as Bitcoin holds above this support, the sentiment will remain bullish. In this event, we believe it could result in BTC retesting the all-time high. On the flip side, if $17,000 is rejected, we expect bears to take control. If $17,000 is rejected, we will be looking for BTC to test $15,100 on the downside.

Ethereum Technical Analysis

Over the last 24 hours, Ethereum has been highly correlated to Bitcoin price action. As outlined above, both have seen about ~ 9% sell-offs and are attempting to reverse sentiment. ETH recently put in new yearly highs around $610 and will look to retest that in the short-term. We outline key levels to watch in ETH below.

The key level to watch for Ethereum will be $530. ETH will need to power past and hold this resistance level to maintain bullish momentum. Many traders seem to be stacking up buy orders above $530 which makes this argument stronger. If ETH can accept $530 and hold it, we argue that the digital asset could see another leg up and take out yearly highs. If ETH fails to accept $530, we also argue that more downside pressure could push it to $450 support levels.

XRP Technical Analysis

In a recent XRP analysis, it was outlined that $0.43 was a level to keep on watch. It was mentioned that positive sentiment should continue if XRP price held these levels. This played out well, as XRP continued to experience strong upward momentum and ended up testing new yearly highs around $0.70. Following this parabolic move, XRP followed Bitcoins sentiment to the downside. With XRP currently trading at $0.53, what levels will traders be watching going into next week?

Based on recent price action, $0.55 will be a key support level to keep on watch. As long as XRP maintains above this region, it appears that bullish momentum could be surfacing again. As long as $0.55 levels are maintained, XRP price should test $0.66 resistance in the near term. If that were to happen, the digital asset will look to take out the yearly highs. On the contrary, there should be more downward momentum if $0.55 support is rejected. Look for $0.48 and below if this occurs.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.