Bitcoin, Ethereum, and XRP have all experienced strong upward momentum over the last week. With BTC inching closer to all-time highs, and both ETH and XRP putting in new yearly highs, what price levels are traders watching this weekend? Based on previous price analysis, it was a matter of time before the large-caps broke out. Due to recent parabolic moves, we have adjusted key price levels to watch.

Crypto Price Summary

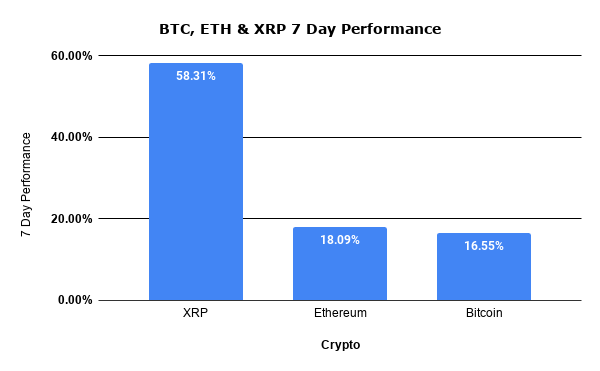

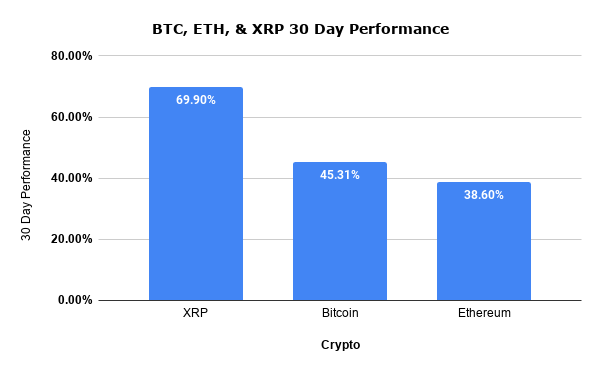

BTC, ETH, and XRP have seen strong rallies during the last week, with BTC continuing to inch closer to all-time highs. All eyes continue to be on XRP, which is outperforming on the weekly and monthly. Aside from Bitcoin approaching an all-time high retest, Ethereum and XRP have now powered through their yearly-highs, which should not go unnoticed. We break down some of the key performance metrics below.

Cryptocurrency 7 Day Performance

Cryptocurrency 30 Day Performance

Bitcoin Technical Analysis

All eyes are on Bitcoin as the largest digital asset by market cap attempts to retest its all-time highs. At the time of this report, BTC is currently trading at $18,528. Bitcoin last cracked its all-time high of $19,665 back in December 2017. There is no doubt that traditional market interest is driving BTC this year. From institutional to corporate, many parties have come out this year favoring BTC for various fundamental reasons. Due to this sentiment, BTC has surged +157% YTD during an unprecedented year for the global economy. Aside from the fundamentals, we will keep this report focusing on the technical factors.

In a previous report focusing on Bitcoin price analysis, we outlined that BTC could see another surge if the $15,800 resistance was breached. Price action played out as planned, and we witnessed strong upward momentum following the $15,800 acceptance. This rally has now pushed us all the way up to $18,500 levels. Based on the parabolic move, we have now adjusted key price levels to keep an eye on. If BTC truly plans to retest all-time highs around $20,000 – it will need to crack $18,800 resistance in the short-term.

Due to excessive demand, it will be interesting to see if it can power through that wall. If $18,800 is rejected, you could very well see a cool-off to $16,500 support. To manage risk, it seems like traders are placing buy orders a tad over $18,800 to avoid a potential bull trap. Right now Bitcoin still looks solid on the charts, but we are seeing more capital being deployed into alt-coins. We have to remember that a lot of FOMO is entering crypto right now. Many first time buyers have no idea that BTC can be purchased in fractional units. This drives up demand in altcoins, which can obviously be purchased for significantly less.

Ethereum Technical Analysis

Ethereum technicals have been bullish for a while, and we argue that more upside is brewing. Last week in ETH price analysis, it was noted that traders were looking for new yearly highs. Despite the short pull-back that ETH experienced recently, the technicals were pointing to more bullish momentum. A couple of days later, ETH powered its way through $490 levels to put in new yearly highs. With ETH currently trading around $540, we have updated key levels to watch.

Based on recent price action, $490 is now a key support level to keep on watch. As long as ETH hovers above $490, we argue that the digital asset will test $575 resistance in the short-term. As outlined in the chart above, ETH has lagged BTC and XRP over the last month. We think ETH could recapture this spread and outperform in the short-term. Despite not going into fundamentals, one can easily argue ETH having more use cases right now when you look at DeFi and the rollout of ETH 2.0. The rate of change, the indicator on the bottom of the chart, is also fairly low given the recent rally. This tells us that positive momentum is still in play.

XRP Technical Analysis

Lastly, we have been following the XRP technicals for months now, arguing that it was ready to take off. In the most recent XRP price analysis, we stressed the importance of $0.295 resistance levels based on historical price action. It was noted that if XRP could accept this level, it would most likely re-test yearly highs. XRP ended up accepting $0.295 resistance and currently trades at $0.447. XRP has now outperformed BTC and ETH on the weekly and monthly. Based on the strong momentum up, we have adjusted key price levels to watch.

XRP’s upward momentum right now is no joke. This is further supported by ROC, which is the indicator outlined at the bottom of the chart. The digital asset is witnessing some of the strongest momentum in years. Despite XRP getting very top-heavy on the momentum side of things, we have outlined price levels that should not be ignored. Right now, XRP will most likely retain bullish sentiment as long as $0.43 is not rejected. If this is the case, XRP will target resistance at $0.46 in the short-term. If $0.46 resistance is accepted, look for a quick move to $0.54 levels. This will be an important resistance for XRP to break. If $0.54 resistance can not be cracked, look for a short-cool off before the final year-end push to $0.85 and beyond.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.