The XRP Ripple lawsuit has been one of the most closely watched legal battles in the cryptocurrency industry. Ripple Labs, the company behind XRP, has been embroiled in a legal dispute with the U.S. Securities and Exchange Commission (SEC) since December 2020. The outcome of this case has significant implications not only for Ripple but also for the broader cryptocurrency market. In this blog post, we will provide an update on the current status of the XRP Ripple lawsuit as of June 2023.

Background

To provide some context, the SEC filed a lawsuit against Ripple Labs in December 2020, alleging that the company had conducted an unregistered securities offering by selling XRP tokens. The SEC argued that XRP should be classified as a security, similar to stocks or bonds and that Ripple Labs should have registered the token with the commission.

Recent Developments

- SEC’s Motion for Summary Judgment: In March 2023, the SEC filed a motion for summary judgment, seeking a ruling in their favor without going to trial. The SEC argued that there were no genuine issues of material fact and that Ripple’s sale of XRP constituted an unregistered securities offering. Ripple, in response, filed a cross-motion for summary judgment, disputing the SEC’s claims.

- Court Hearings: In April 2023, the court held hearings to consider the motions for summary judgment. Both Ripple and the SEC presented their arguments before the judge. The hearings focused on the key question of whether XRP should be classified as a security. Ripple’s legal team argued that XRP is a digital currency and does not meet the definition of a security under existing securities laws.

- Regulatory Clarity: In May 2023, the SEC issued a statement providing some clarity on its position regarding digital assets. The SEC emphasized that not all digital assets would be classified as securities, stating that the determination would depend on the facts and circumstances of each particular case. This statement raised hopes among Ripple supporters that the SEC might reconsider its classification of XRP.

Current Status

As of June 2023, the court has not yet issued a ruling on the motions for summary judgment. The judge is carefully reviewing the arguments presented by both parties before making a decision. The outcome of this ruling will determine whether the case proceeds to trial or if a settlement is reached between Ripple and the SEC.

Impact on Ripple and the Crypto Market

The XRP Ripple lawsuit has had a significant impact on Ripple’s business operations and the broader cryptocurrency market. Following the SEC’s lawsuit, several cryptocurrency exchanges delisted or suspended XRP trading, causing its value to plummet. Ripple Labs also faced challenges in securing partnerships and expanding its use cases due to the regulatory uncertainty surrounding XRP.

If the court rules in favor of Ripple, it could provide a major boost to the company and the XRP token. It would likely lead to increased adoption, renewed investor confidence, and potentially pave the way for Ripple to resume partnerships and expand its services. On the other hand, if the court rules in favor of the SEC, Ripple may face substantial penalties, and XRP’s status as a security could have broader implications for other cryptocurrencies as well.

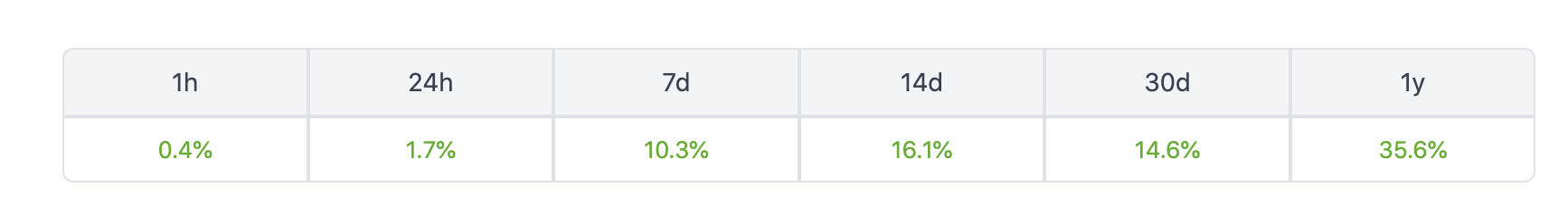

XRP Price

Conclusion

The XRP Ripple lawsuit continues to be a significant event shaping the cryptocurrency industry. As of June 2023, the court’s ruling on the motions for summary judgment is eagerly awaited by market participants. This ruling will not only impact Ripple and the future of XRP but also provide important guidance on how digital assets are classified and regulated.

The outcome of this case has the potential to reshape the regulatory landscape for cryptocurrencies and influence the investor sentiment and market dynamics moving forward. As we await the court’s decision, it is important to recognize that regardless of the outcome, the XRP Ripple lawsuit has already sparked conversations around regulatory clarity and investor protection in the crypto space.

The case has highlighted the need for clear guidelines and regulations to govern the issuance and trading of digital assets. Regulatory bodies around the world are closely observing the proceedings, as the outcome may set a precedent for future legal battles involving cryptocurrencies.

In the meantime, Ripple has been actively engaging with regulators, industry stakeholders, and the wider crypto community to address concerns and promote dialogue around regulatory frameworks. The company has made efforts to improve transparency and compliance within its operations, demonstrating its commitment to working within existing regulatory frameworks.

Ultimately, the resolution of the XRP Ripple lawsuit will have far-reaching implications, not just for Ripple and XRP, but for the entire cryptocurrency ecosystem. It will shape how cryptocurrencies are classified, traded, and regulated, providing a framework for future legal battles and potentially paving the way for greater mainstream adoption of digital assets.

As we look ahead to the court’s ruling, market participants need to stay informed, engage in constructive discussions, and adapt to the evolving regulatory landscape. Regardless of the outcome, the XRP Ripple lawsuit serves as a reminder of the importance of compliance, transparency, and responsible innovation in the cryptocurrency industry.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article. Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.