During a series of market reviews this week, brokers from Nexdi examined one of the most unexpected market moves of the month: Micron’s double-digit slump despite bullish signals from major Wall Street institutions.

Investors watching the chipmaker were caught off guard as the stock tumbled sharply, even though broader tech sentiment was mixed and one of the world’s most influential investment banks raised its outlook on the company. With AI demand still shaping semiconductor valuations, and macro uncertainty intensifying market swings, the sharp decline in Micron’s stock price left many wondering whether this was panic selling or a meaningful shift in fundamentals.

The Steep Pullback That Caught Investors Off Guard

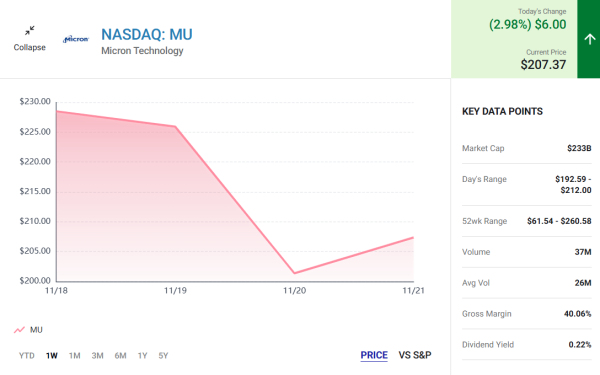

Micron shares sank 16 % in a single week, a drop that stood out even among the market’s most volatile names. This decline arrived despite only modest downturns in key indexes, with the S and P 500 falling 2 % and the Nasdaq Composite slipping 2.7 %. The size of Micron’s pullback relative to the broader market indicates that investors were largely reacting to sector-specific dynamics rather than to macro factors alone.

As brokers noted, the sell-off was fueled by concerns that the wave of enthusiasm surrounding artificial intelligence stocks might finally be cooling. This theme, which has shaped trading behavior for more than a year, resurfaced with sudden intensity and sent many growth-dependent AI plays into retreat.

Why Investors Rotated Out of AI Stocks

Concerns over a potential AI stock bubble pressured the semiconductor sector early in the week, as valuations appeared disconnected from historical norms. The turning point came with Nvidia’s third-quarter earnings, which reported stronger than expected revenue, profit, and guidance, initially boosting AI stocks including Micron.

Investors interpreted Nvidia’s momentum as validation of continued demand for advanced memory chips. However, optimism was short-lived, as sentiment reversed on Thursday with doubts over whether Micron and other AI suppliers could sustain growth implied by valuations. A partial rebound on Friday occurred amid expectations of a Federal Reserve rate cut, but Micron still ended the week deeply down.

A Bullish View Emerges Amid the Sell-Off

While many investors rushed for the exits, one major financial institution delivered a notably optimistic update. On Thursday, UBS raised its price target on Micron from 245 dollars to 275 dollars, maintaining its buy rating. This upgrade was not subtle. It signaled that UBS sees the recent weakness as temporary rather than structural.

UBS analysts highlighted one of Micron’s most powerful growth drivers: high bandwidth memory, or HBM, which is essential for AI data centers. Demand for HBM products has surged dramatically as companies worldwide race to build systems capable of powering large language models, generative AI platforms, and advanced analytics.

UBS argues that Micron is positioned to capitalize on this trend and could see substantial earnings expansion as HBM capacity ramps. The combination of stronger end-market demand, tight supply, and premium pricing has created a favorable environment for memory producers.

This bullish outlook stood in stark contrast to market behavior, creating a disconnect that brokers spent time analyzing. If demand remains strong, the sell-off may represent a temporary emotional overreaction rather than a durable reassessment of Micron’s long-term prospects.

Was This a Correction or Something Deeper?

Brokers noted that Micron’s decline was likely exaggerated by profit taking, macro uncertainty around Federal Reserve policy, and sector volatility after Nvidia’s earnings. Importantly, Micron’s fundamentals remain strong as a key supplier of memory products critical for AI infrastructure, with its long-term growth supported by powerful secular demand.

The main question is whether investors will return once sentiment stabilizes. Historically, high volatility in chipmakers often creates opportunities for long-term buyers, especially when the underlying demand drivers for products like advanced memory remain robust.

What Investors Should Watch

There are several catalysts that could influence Micron’s trajectory in the coming months. These include:

• Momentum in AI infrastructure spending

• Further clarity on Federal Reserve interest rate policy

• Pricing trends in HBM and DRAM markets

• Potential supply constraints that could strengthen margins

• Broader performance of semiconductor peers

If AI spending remains robust and memory prices rise, Micron could quickly recover lost ground. Alternatively, if macro uncertainty increases, volatility may persist.

Final Thoughts

Micron’s 16 % plunge was dramatic, but not necessarily rational. The sharp sell-off appears driven more by shifting sentiment and sector-wide anxiety than any change in Micron’s fundamentals. With UBS raising its price target and AI infrastructure demand showing no signs of slowing, the long-term outlook remains compelling for investors willing to embrace volatility.