TaxBit, which is based in Utah, has apparently secured $5 million in its latest seed funding round. It intends to use the funds to upgrade its crypto tax compliance platform. Some of those who took part in the seed-funding round include TTV Capital, Winklevoss Capital, Dragonfly Capital Partners, and Valar Ventures.

This news comes at a time when the IRS has prompted US citizens to report their crypto earning via the 1040 long form. Citizens are asked whether they have taken part in the crypto market and made a profit or a loss. This inquiry by the IRS indicates that it is taking crypto taxation seriously. It had earlier sent warning letters to 10,000 people around the US who had not declared their crypto earnings.

What the TaxBit CEO had to Say

According to Austin Woodward, the TaxBit CEO, crypto has become too big for authorities to ignore the sector. He added that there’s misconceptions that users can conceal their crypto earnings; thereby avoiding paying taxes. However, he noted that there was still a lot of confusion when it came to tax compliance for those participating in the crypto market.

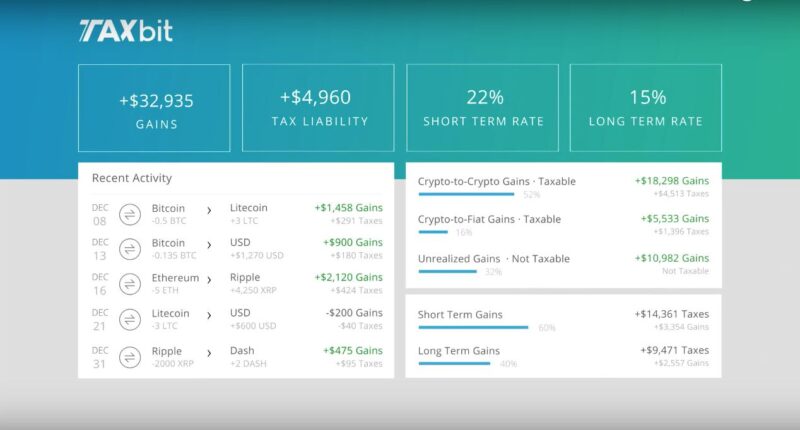

According to the CEO, TaxBit is working to eliminate this confusion using its platform. To use its platform, all that users have to do is integrate TaxBit into their digital wallet or their account on a crypto exchange. TaxBit is then able to generate tax reports for the users.

Since the service was launched in 2019, it has helped crypto users to fulfill their tax obligations. Besides that, it has created enterprise-grade products for crypto firms, exchanges, and merchants that accept payments in crypto.

As the crypto market grows bigger and generates more profits, many governments around the world are looking for how they can generate revenues from the sector. Various nations around the world are currently amending their tax laws or have already made such amendments to accommodate the crypto sector.

In December, South Korea was apparently looking to impose taxation on the crypto sector. However, the law has not yet passed. For now, South Koreans are exempt from paying taxes in the nation. However, the government plans to pass a law that will soon make it mandatory for its citizens to pay taxes.

Dealing with Crypto Taxation

Crypto taxation laws around the world are still in their infancy. However, if you live in the US, it is important to pay your taxes. The IRS has been looking into ways to make it possible for citizens to pay their tax including collecting data from crypto exchanges.

While it is important to pay taxes, you need to ensure that you are paying your fair share. There are various methods, which you can use to ensure that you are not paying more than you should. The TaxBit platform is definitely a move in the right direction. It will help to reduce the risk that comes with reporting incorrect figures while taking part in the crypto sector.

Image Source: TaxBit Youtube Snapshot

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.