RioDeFi incubator provides interoperable blockchain solutions between traditional and decentralized finance. RioDeFi’s applications provide financial services with lower transaction fees, fast confirmation times, and a global reach. James Anderson, Katerina Volkova, Stephane Laurent Villediue, and Calvin Ng are the visionaries behind the RioDefi solutions.

To bridge the gap between traditional and decentralized finance, RioDeFi has launched its first-ever DeFi incubator hub. The team hopes to bring viable changes to the Blockchain industry starting with its three pilot projects in the DeFi ecosystem in Asia.

This hub helps projects with a proven path to success and drives them towards imposing results, along with the support in technicalities and fundraising aspects.

“In the last couple of months, the DeFi market has seen a lot of spikes, and more of its projects are NFT’s. But simultaneously, this industry is still lacking insights on regulations, user protection, and proper governance of the projects. We want to take over this by legitimizing DEFI projects from the very beginning and drive it safely to mainstream finance and its audience,” said James Anderson.

As said, The pilot projects of the hub are revolutionizing the DeFi eco-system in these particular areas, and they have raised over $15million in funding so far. The three dApps include:

- Lepricon: A gamified DeFi prediction market that gives developers, stakers, and gamers the ability to leverage decentralized finance in a gamified manner.

- LABS: World’s first Blockchain-based real estate ecosystem. The LABS utility token drives the ecosystem, fueling utility and rewards through token issuance, lending, rewards, and the LABS exchange.

- MANTRA DAO: A community governed platform focusing on staking, lending and governance. The ultimate goal is to bring back financial control so people can store and grow their wealth together.

“In the fast-moving DeFi industry, agility is critical. Incubating within an interoperable ecosystem enabled us to quickly develop a compliant, regulated and sustainable DeFi use case. The blockchain space is maturing and I anticipate that RioDeFi’s approach of incubation will become the norm sooner rather than later,” said John Patrick Mullin, Council Member at MANTRA DAO.

Stephen Browne, the COO of Lepricon also stated that:

“Incubation hubs provide a remarkable opportunity and exposure for the project to industry experts, Investors, Industry geeks, and the community as well. RioDeFi has supported incredibly and allowed us to sustainable and successfully.”

RIODEFI has Prioritized the security, speed, and scalability aspects of Lepricon, LABS, and Mantra DAO. Also, these are the first of many projects to leverage the benefits of Riochain’s Interoperability, low fee, and fast transactions.

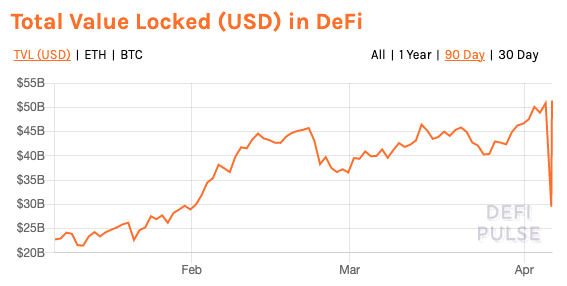

The rapid development of the DeFi industry must be compatible and should enhance the features of sustainability and security at any cost. But during its maturation, the industry has been suspectable to hacks and rug-pulls that will need to be corrected to scale into new horizons. This is considered the weaker part of this industry. Regardless of this, the DeFi ecosystem has multiplied its value enormously over the last few years. According to DeFi Pulse, there is about $51 billion locked in various DeFi protocols. In quick comparison, this value has surged in the last year, in which $690 million was locked into DeFi just a year ago.

The RioDefi’s hub is one of the binding plugs to this ecosystem. DeFi projects can have the end-end support including payments process, exchange operations, KYC compliance frameworks, and Token developments, which act as a trusted pillar for new-age projects coming into this ecosystem.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however, no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the cryptocurrency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal, or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal, and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.