According to a recent story by the Irish Times, Revolut is warning customers that the XRP crypto coin could become worthless. The warning by Revolut, which is a leading UK fintech firm, was issued just two weeks after the US SEC charged Ripple for a $1.3 billion unregistered securities offering.

XRP Value Tumbles Amidst SEC Controversy

On December 22, 2020, the SEC announced that it was charging Ripple and two executives at the company for conducting an unregistered securities offering worth $1.3 billion. According to the SEC’s announcement, Ripple, the Ripple CEO, Bradley Garlinghouse, and Ripple’s executive chair Christian Larsen, began raising funds for Ripple starting in 2013 via an unregistered securities offering.

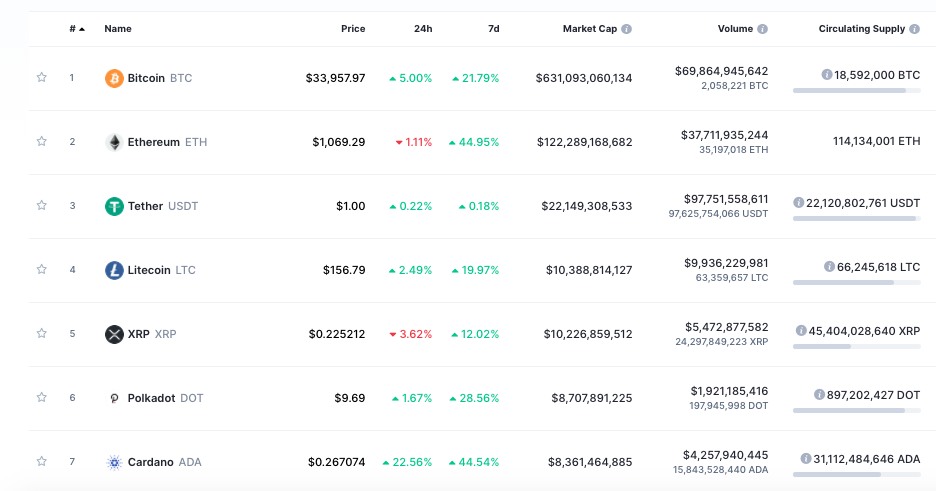

Before the SEC announcement, XRP was the third-largest crypto coin by market valuation. Since the SEC announcement, XRP has lost over half of its value. It has since dropped to the fifth position by market cap.

On January 1, 2020, several XRP investors filed a writ of mandamus against the SEC chair Elad Roisman. In the petition, the investors want the SEC’s complaint amended so that their Ripple investments would not be considered securities.

Revolut Warns Customers About XRP

According to the Irish Times, Revolut sent a note to its customers warning them about XRP. The company said that while customers could still trade in XRP on the platform, some exchanges were delisting XRP. Revolut’s note described the price of XRP as volatile. It added that if one of its partner exchanges delisted XRP, it might have to do the same.

The note by Revolut said,

“We might also have to halt trading with very little notice if the liquidity on our partner exchanges drops and we can no longer buy or sell XRP. This would mean you might not be able to sell your XRP balance and could be stuck with a holding for which the price could drop to zero, in a worst-case scenario.”

Revolut does not currently offer a service that lets users withdraw their XRP to an external wallet. The fintech added that it would strive to give users advance notice if it decided to suspend trade in XRP. However, there was no guarantee that would be possible.

In its note, Revolut states that it was important for users to reassess their crypto holdings. It was especially so regarding XRP. Revolut said that customers should assess whether they were comfortable with the risks associated with holding onto the coins. According to Revolut, users should conduct regular checks of their buy and sell orders, including recurring buys and auto-exchanges that they may have created. Customers should do this to ensure they were still comfortable following the Ripple / XRP legal developments.

Number Of Affected Users

Revolut currently has over 8 million users globally. The company said that it would continue to monitor the situation closely and any actions taken by partner exchanges. At the end of 2019, the company held around $120 million worth of crypto, which was up 152% from 2018. The company first began offering crypto services in 2017 when it added support for BTC, ETH, and LTC.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.