Mode, one of the fastest growing Bitcoin bank apps in London has started trading on the London Stock Exchange. The FinTech company issued 15M ordinary shares, resulting in a raise of £7.5m. Due to being oversubscribed, Mode has surpassed its original goal of raising £5.0m . Mode is fueling the progression into a digital economy, introducing next-gen banking infrastructure for money and Bitcoin.

Mode Starts Trading On The LSE

According to a recent report, Mode has started trading on the LSE ( London Stock Exchange ), in which it oversubscribed. The FinTech company behind a Bitcoin bank app originally was trying to raise £5.0m through LSE’s main market, but ended up solidifying £7.5m through 15M new ordinary shares.

Jonathan Rowland, the Executive Chairman stated that:

“Today marks a pivotal moment for Mode, as one of the first publicly listed financial services companies with a consumer focused digital asset offering to list on the LSE Main Market.”

Rowland also added that:

“Mode’s admission is a vote of confidence in our business strategy and our mission to reduce fragmentation and inefficiencies across the banking, payments, investment and loyalty industries.”

Mode Bitcoin Bank App

Mode continues to focus on the digital economy, creating a next-gen experience that commingles banking, payments, investments, loyalty, and digital currencies. With the Bank of England’s attentiveness to negative interest rates, it is believed that around 83% of BTC holders are looking for better interest bearing opportunities in the crypto markets. Aside from buying, selling, and sending Bitcoin, Mode is offering a lucrative interest rate environment for Bitcoin holders.

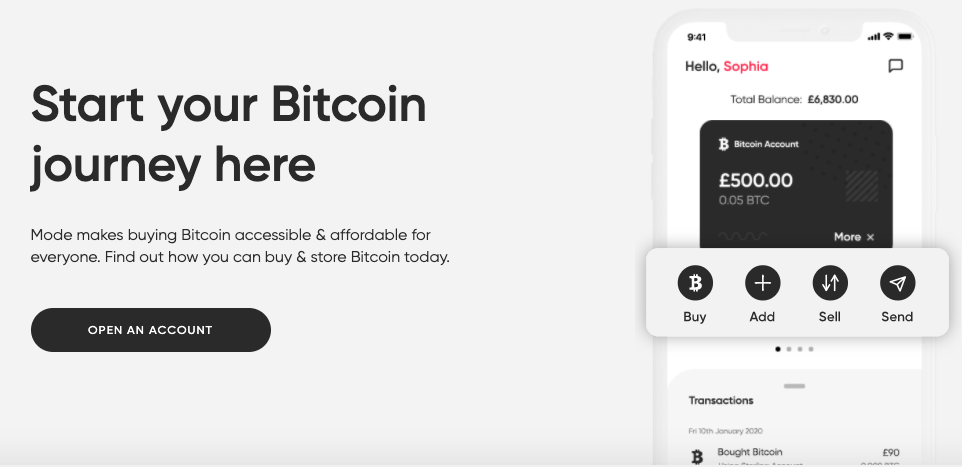

Buy, Sell, Hold, And Send Bitcoin

In a push to make Bitcoin more accessible and affordable to the masses, the Mode Bitcoin bank application create a seamless experience for buying, selling, holding, and sending Bitcoin.

By leveraging sterling and Euro funds, users on the platform can buy Bitcoin instantly. Unlike many other FinTech platforms, Mode also strives to keep prices at a minimum. If a user decides to purchase Bitcoin instantly, they will incur a small fee of 0.99% for buys and sells. It is important to note that there is no lockup period on the platform. If a user needs to access their Bitcoin, withdrawals will be instant and can happen at any time.

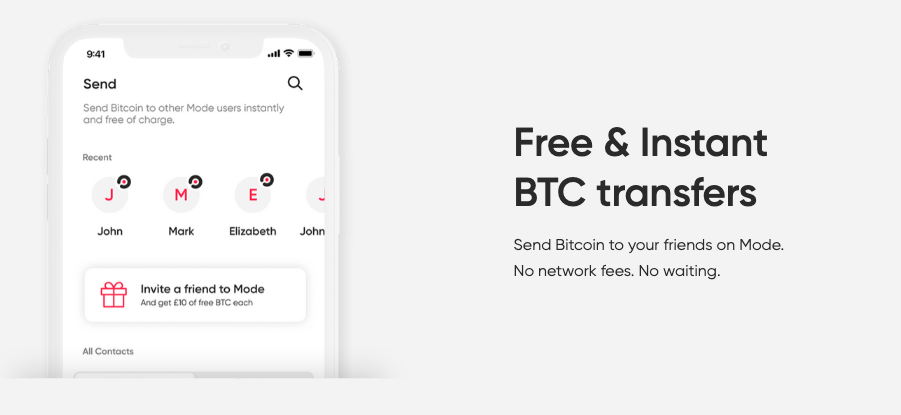

One of the many ways Mode is bringing Bitcoin to the masses is by introducing an interactive approach. As displayed above, the platforms allows for free and instant Bitcoin transfers to friends / family on the app. With many banking apps today, the process of “paying back” a friend can still be time consuming. With Mode, the experience is immaculate, creating an interactive platform with with no fees and no waiting.

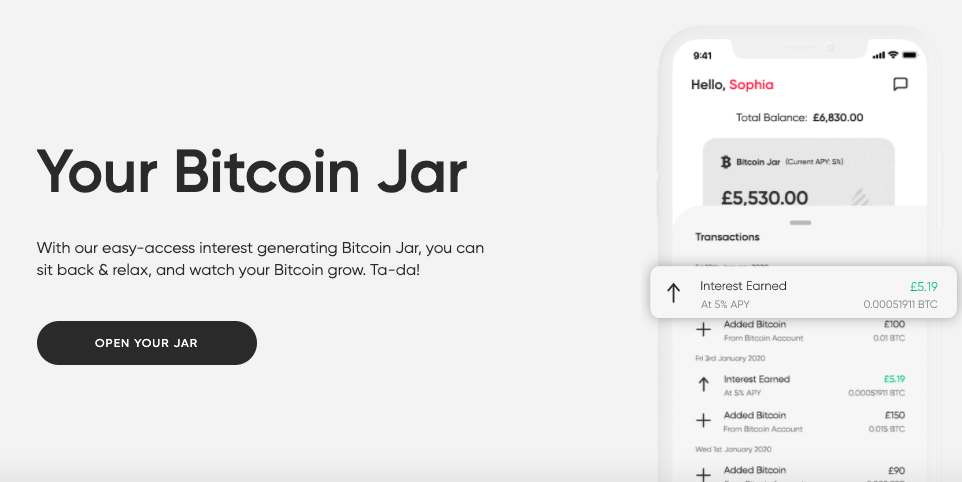

Bitcoin Interest

Mode’s “Bitcoin Jar” is a protocol that allows users to earn interest on their Bitcoin. As discussed earlier, in an environment where the Bank of England is exploring negative interest rates, it creates little opportunity for savers. Crypto markets on the other hand are capitalizing on this opportunity, and offering financial services that are nonexistent in traditional banking.

Mode currently offers 5% APY ( variable ) for Bitcoin holders. In traditional banking, the average savings account is yielding well below 1%. Regarding the 5% APY, yields are accrued daily, and are then compounded weekly. Savers on the platform are paid out weekly, in which earnings are applied to a users “Bitcoin Jar” every Friday.

Future Outlook

Following the LSE listing, Mode plans to continue building out its open banking platform. This includes the integration of loyalty and reward engines into the Mode app. The FinTech company envisions a world where consumers do not need a card to interact financially.

Account And Security

As the cryptocurrency markets still experience pre-maturation, users still place a lot of value on security and oversight. It is important to note that as of now, people in the United States are not allowed to use the Mode app. In terms of fund management, Mode works alongside BitGo to custody client assets. BitGo offers up to $100M in insurance for assets they hold in cold storage. Other frequently asked questions can be found on the Mode’s support page.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.