Microsoft completed a landmark restructuring agreement with OpenAI that places the tech company’s investment value at roughly $135 billion. The arrangement grants Microsoft a 27% equity position in the organization behind ChatGPT. This agreement settles almost twelve months of ambiguity between the two artificial intelligence leaders.

A senior broker at LFTrade evaluates how this transformative deal alters the AI investment environment moving forward.

Alliance Runs Through 2032

The revised arrangement keeps Microsoft as OpenAI’s sole cloud infrastructure partner until the firm reaches artificial general intelligence. Microsoft maintains full rights to OpenAI’s innovations through 2032. This encompasses any systems achieving AGI, meaning AI capable of human-level reasoning.

OpenAI underwent reorganization as a public benefit corporation called OpenAI Group PBC. The nonprofit OpenAI Foundation retains supervisory authority over profit-seeking operations. This framework satisfies regulatory requirements while enabling the organization to secure capital more readily.

Microsoft stock climbed 2.5% following the news, propelling the company’s total worth above $4 trillion once more. The transaction delivers roughly a tenfold profit on Microsoft’s $13.8 billion cumulative investment beginning in 2019.

Enormous Cloud Services Agreement

OpenAI pledged to acquire $250 billion in Azure cloud computing across upcoming years. This locks in Microsoft’s status as the main infrastructure supplier for ChatGPT and similar OpenAI offerings. Nevertheless, Microsoft relinquished its sole provider status for OpenAI’s cloud needs.

OpenAI gains permission to engage other cloud vendors for specific applications. API-based products stay Azure-exclusive. Non-API offerings can utilize any cloud service, creating possibilities for collaborations with firms like Oracle.

This arrangement provides OpenAI additional latitude while preserving Microsoft’s deep integration in operations. The $250 billion pledge by itself constitutes assured income for Microsoft across multiple years.

External AGI Assessment Group

An impartial expert committee will now judge when OpenAI genuinely attains artificial general intelligence. This supplants the former approach where OpenAI could unilaterally announce AGI achievement. The independent verification system introduces accountability to a benchmark carrying massive implications for both enterprises.

Microsoft’s technology rights exclude OpenAI’s consumer electronics initiatives. This provision matters given OpenAI purchased design icon Jony Ive’s company earlier this year for $6.5 billion. The firms are building AI-enabled consumer gadgets independent of Microsoft’s product ecosystem.

Profit Distribution Modifications

The existing revenue split arrangement persists until the expert committee validates AGI achievement. Following that confirmation, Microsoft’s profit participation terminates entirely. This fundamentally alters how the two organizations divide earnings from OpenAI’s offerings.

Microsoft can now develop its own AGI independently or through alternative partnerships. Should Microsoft create AGI leveraging OpenAI’s intellectual property first, substantial computing restrictions take effect. These boundaries far exceed requirements for current leading AI systems.

Foundation Receives Substantial Holdings

The nonprofit OpenAI Foundation now possesses a $130 billion position in the profit-seeking entity. This constitutes 26% ownership of the reorganized enterprise. Present and past employees alongside external investors control the additional 47% equity.

OpenAI’s foundation committed an initial $25 billion for medical research and AI safety initiatives. Greater commercial achievement by OpenAI increases the foundation’s holdings value proportionally. This establishes a straight connection between profitability and philanthropic resources.

OpenAI Chief executive Sam Altman will not obtain any ownership in the reorganized corporation. This contradicts previous conversations about awarding the founder meaningful equity participation. OpenAI additionally has no near-term intentions to pursue public market listing.

Regulatory Review Completed

California and Delaware authorities invested nearly twelve months scrutinizing this reorganization proposal thoroughly. Both jurisdictions obtained assurances that charitable resources serve proper purposes and safety stays paramount. OpenAI will remain based in California under the revised framework.

The transaction endured substantial examination given OpenAI’s unusual nonprofit heritage. The organization launched as a research institute emphasizing AI safety. Its remarkable commercial triumph with ChatGPT generated friction with that founding purpose.

Competitive Position Strengthened

This alliance solidifies Microsoft and OpenAI’s dominant standing in AI competition against competitors. ChatGPT serves 700 million users weekly as of September statistics. Microsoft’s exclusive API privileges guarantee it extracts considerable worth from OpenAI’s ongoing expansion.

The reorganization eliminates a critical limitation that restricted OpenAI’s capacity to attract external investment. Computing expenses for developing AI systems have skyrocketed as ChatGPT’s audience mushroomed. OpenAI required this transaction to obtain the resources necessary for sustained growth.

Future Implications

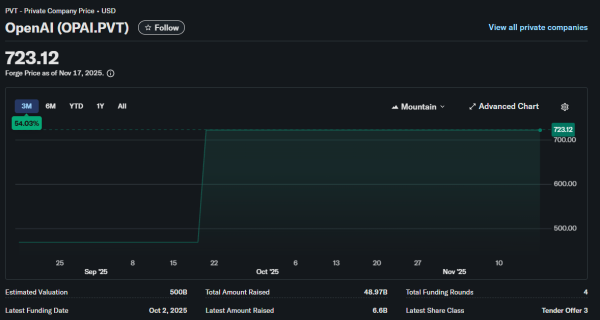

The $500 billion assessment of OpenAI Group PBC generates cascading effects throughout AI-focused investments. Microsoft’s capacity to preserve exclusive API privileges through 2032 delivers dependable revenue projections. The $250 billion Azure obligation constitutes considerable foreseeable earnings.

Financial markets will observe how this alliance affects infrastructure investment choices throughout the technology industry. Microsoft’s achievement securing extended access to advanced AI systems might establish patterns for subsequent agreements. Alternative cloud operators may require comparable strategic alliances to remain competitive.

The transaction demonstrates how greatly corporations prize commanding access to state-of-the-art AI capabilities. OpenAI’s $500 billion worth ranks it among the planet’s most valuable private enterprises. Microsoft’s 27% holding suits it optimally as AI revolutionizes enterprise software and cloud infrastructure.