For extended periods, market observers struggled to identify catalysts capable of derailing equity momentum. November shattered that complacency on Wall Street.

The technology-laden Nasdaq Composite declined approximately 3.5% month to date, positioning for its first negative monthly performance since March concluded. Financial analysts at Unirock Gestion evaluate whether this represents a genuine technology sector crisis or merely a healthy market recalibration.

The Nasdaq eliminated roughly $1.74 trillion in aggregate market value across two weeks as participants liquidated technology holdings aggressively. The S&P 500 retreated 1.6% over the equivalent timeframe, terminating three consecutive weeks of advances. Despite these losses, the S&P 500 maintains 15% gains for 2025, while the Dow climbed 11% and the Nasdaq surged 19% year to date.

AI Skepticism Takes Hold

Two primary culprits shoulder responsibility for the downturn based on analyst assessments. Mounting skepticism regarding artificial intelligence technology positioned at the rally’s foundation emerged as the predominant concern.

Simultaneously, recognition that the Federal Reserve may sustain elevated interest rates longer than many projected also pressured valuations across growth-oriented segments.

Market advances this year concentrated heavily among a small cohort of technology behemoths known collectively as the Magnificent Seven. This group encompasses Alphabet, Amazon, Apple, Meta, Microsoft, Tesla, and Nvidia. Concerns surrounding artificial intelligence applications and monetization threw cold water on these names in recent sessions, triggering meaningful price adjustments.

Technology companies committed hundreds of billions toward building computing capacity, developing proprietary models, and acquiring specialized hardware. These investments appeared justified during periods of peak enthusiasm. Now investors demand evidence that these expenditures will translate into revenue growth and margin expansion rather than merely consuming capital without adequate returns.

Valuation Concerns Mount

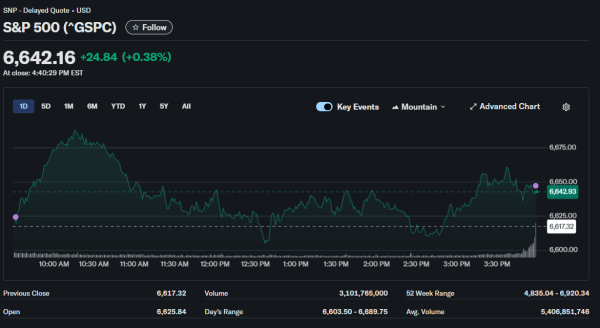

U.S. equities closed sharply lower for consecutive sessions on Tuesday as selling pressure intensified. The S&P 500 registered its fourth straight day of decline, marking the longest losing streak since August. The Dow Jones Industrial Average surrendered 1.1% or 498.50 points, settling at 46,091.74. The S&P 500 dropped 0.8% or 55.09 points, finishing at 6,617.32 by session close.

Technology and consumer discretionary sectors led declines as participants rotated away from growth-sensitive areas. The Technology Select Sector SPDR declined 1.6% while the Consumer Discretionary Select Sector SPDR fell 1.9% during trading. Six of eleven benchmark index sectors managed positive territory, illustrating selective rotation rather than indiscriminate selling across all market segments.

The fear gauge, CBOE Volatility Index, jumped 10.32% reaching 24.69, signaling elevated anxiety levels among options traders. Trading volume totaled 18.66 billion shares on Tuesday, running below the trailing 20-session average of 20.2 billion. On the Nasdaq exchange, a one-to-one ratio between advancing and declining issues showed balanced participation despite negative headline indexes.

Individual Stock Moves

Technology equities persisted under pressure as participants fretted about lofty valuations assigned to artificial intelligence-related companies. The leading AI chipmaker extended prior session losses, declining an additional 2.8% by market close. The stock dropped more than 10% during November before Wednesday’s earnings announcement provided some relief from selling pressure.

Meta Platforms shares have retreated 23% since reaching a record high during mid August peak. Nvidia shares fell 10% from late October record levels established before recent volatility emerged. Palantir shares dropped 16% since the November 3 peak, demonstrating weakness spread across multiple AI-focused names rather than isolated to one company.

Rotation Into Defensives

According to a portfolio strategist at a major investment manager, November has been characterized primarily by investors rotating capital out of technology holdings into alternative sectors. The recent pullback resembles “investors trying to protect profits after a really healthy run” from April lows rather than panic-driven liquidation signaling fundamental deterioration.

The benchmark S&P 500 declined 1.55% month to date, while the Dow retreated 0.87% over the equivalent period. The S&P 500 eliminated more than $1.3 trillion in market capitalization across slightly over two weeks as it retreated from late October record highs. This represents meaningful but not catastrophic wealth destruction relative to total market size.

Forward Looking View

Despite acknowledging recent turbulence, market analysts expressed confidence about the trajectory moving forward. One strategist projected the S&P 500 would finish the calendar year advancing from current levels near 6,700 to approximately 7,000. He attributed this optimism to expectations of sustained artificial intelligence adoption and resilient economic performance underlying recent volatility.

While employment gains moderated in recent months, the U.S. economy continued adding jobs and maintaining steady GDP expansion. The fundamental economic backdrop remains supportive even as financial markets experience periodic turbulence. Consumer spending, though shifting toward necessities, hasn’t collapsed entirely.

Markets occasionally advance excessively, triggering panic reactions during inevitable pullbacks. Sometimes the market gets ahead of itself and everybody panics, creating opportunities for patient capital. The critical question involves determining whether current volatility represents healthy profit taking after substantial gains or signals something more troubling for 2026 investment prospects.