The Cannyx Corporation announced a strategic merger with LevelBlox, Inc, an enterprise software developer. Details of the merger come a few months after the successful launch of Cannyx Markets, a global cannabinoid commodity trading platform. The strategic merger will make Cannyx Markets the leading infrastructure platform for the budding CBD sector.

Merger Details

Cannyx Corporation entered a letter of intent on June 27, 2020, to be acquired via a merger with LevelBlox Inc. The agreement stipulates that LevelBlox will issue shareholders of Cannyx Corporation new common stock or 60% of the expanded share capital. Its finalization is expected to take place simultaneously with the completion of private placement in Q4 2020.

Cannyx Markets Secured By The Blockchain

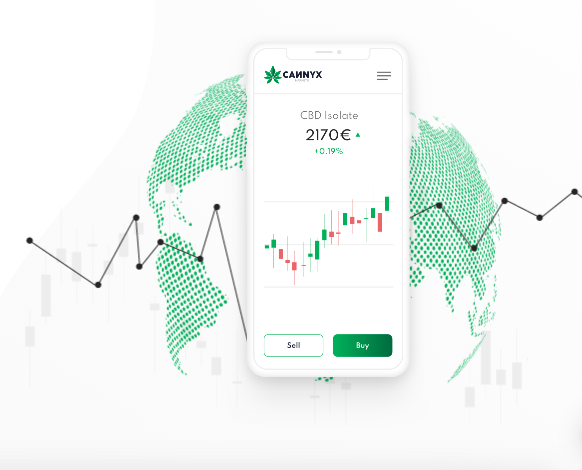

Cannyx Markets is built on a secure cloud supported by enterprise blockchain technology. It provides the crucial infrastructure needed to solve most of the problems facing the young CBD industry. These issues include increasing market liquidity, facilitating logistics, and offering businesses the tools they need to reduce risk across the supply chain.

Cannyx Markets is the gold standard. It offers participants access to professional tools that they can use to manage risk, ensure supply chain resilience, and improve the marketing of physical products to a global community. Members can access high-quality, authenticated, and certified CBD products such as isolates, distillates, biomass, and oils from trusted sources. Sellers benefit from increased liquidity and ease of trade.

The Role of LevelBlox In The CBD Sector

LevelBlox is a leader in the integration of technology-based solutions into the the cannabis industry. Their experience in this area will be pivotal to helping Cannyx Markets deliver on their promises.

The two firms’ combined technology will offer market participants cutting-edge technology such as compliance tools, market surveillance, track and trace capabilities, and access to real-time international market data.

Leadership Thoughts

While commenting on the proposed merger, Mahesh Jayanarayan, the CEO and founder of Cannyx Markets said that they were excited to reveal the merger. He added that they were looking forward to delivering the transparent infrastructure needed in the CBD sector. According to him, operating a global platform provided market participants with market intelligence, liquidity, and the scale needed to move the industry to the next level.

The LevelBlox CEO, Gary Macleod, on his part, said that the merger represented the continued use of Blockchain technology and distributed ledgers to secure and authenticate data. He also noted Cannyx Markets combined knowledge, strength, and market expertise in the financial and enterprise markets.

Macleod pointed to the combined expertise of the Cannyx Markets team in the Blockchain industry. He said that it would ensure their combined efforts to increase the reach of Cannyx in the Global CBD and Commodity Trading and Data services industry.

The CBD industry is still relatively young. It still faces many regulatory restrictions in many nations around the world, as well as other challenges. The incorporation of the blockchain into a relatively young industry could help to ensure it deals with any challenges efficiently. According to reports, more businesses in the Hemp space are starting to rely on blockchain technology for transparency and efficiency.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.