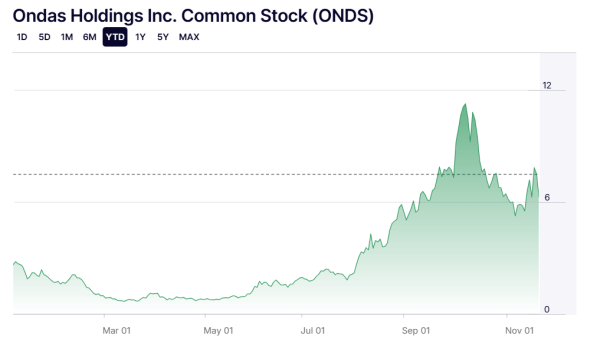

The accelerating convergence of autonomous systems, defense spending, and industrial digitalization has created one of the most powerful investment backdrops of the decade. Brokers at Aurudium note that few companies embody this momentum as clearly as Ondas Holdings, a stock that has surged nearly 1,000% over the past year as markets recognize its potential in counter-drone solutions and industrial wireless systems.

Amid rising geopolitical tensions and escalating UAS threats, investors are reassessing the technologies that will shape military readiness and critical infrastructure resilience. Ondas sits in the middle of these unfolding trends, offering exposure to fast expanding defense and industrial markets.

A Dual Platform Strategy Targeting High-Growth Markets

Ondas Holdings operates through two key business segments that align with major technology transformations. Ondas Networks provides private industrial wireless infrastructure built for mission-critical applications.

Its systems support rail networks, utilities, and critical infrastructure operators that require secure, dedicated spectrum for smooth operations. This puts Ondas in the path of widening digital transformation efforts across sectors that cannot rely solely on public networks.

The second pillar, Ondas Autonomous Systems, focuses on advanced drones and counter-unmanned aerial systems capabilities. This segment expanded its reach with the acquisition of Sentry CS Ltd., an Israeli company specializing in cyber counter-UAS technology. The combination of autonomous platforms and defensive infrastructure positions Ondas in a strategically vital segment of the defense supply chain where demand continues to intensify.

The results speak for themselves. Third quarter revenue surged to 10.1 million dollars, compared with 1.48 million dollars in the prior year, reflecting accelerating commercial traction across both arms of the business. Defense operators are allocating more capital to counter drone technology as low-cost unmanned systems proliferate across global conflict zones. At the same time, industrial clients are embracing dedicated wireless networks to support increasingly complex and connected operations.

A Financial Foundation Built for Expansion

Ondas enters this period of growth with an unusually strong balance sheet. As of the end of the third quarter, the company held 451.6 million dollars in cash and just 11.3 million dollars in debt. Following an October equity raise, pro forma cash totals roughly 840 million dollars, creating a financial fortress that provides years of runway for operational scaling, acquisitions, and product development.

This capital strength is a meaningful competitive advantage. The company can invest aggressively at a time when many early-stage peers face tighter funding conditions. Ondas can pursue complementary acquisitions, expand manufacturing capabilities, and accelerate its commercial rollout without worrying about near-term liquidity constraints.

Dilution is a concern often raised by investors, given the 352% increase in the share count over the past year. While this weighs on short-term sentiment, it also reflects management’s choice to prioritize growth during an extraordinary window of opportunity. With defense budgets expanding globally and critical infrastructure operators increasing spending on UAS protection, capturing market share quickly is more valuable than avoiding dilution.

Valuation Mirrors the Company’s Explosive Growth Potential

The stock trades at over 25 times forward sales, a valuation that indicates strong investor conviction in its long-term prospects. While that premium may appear steep, the company’s revenue trajectory reinforces the growth narrative. Third quarter revenue increased 582% year over year, and the addressable markets for defense technology and autonomous systems span hundreds of billions of dollars.

Demand for counter-UAS systems is accelerating due to growing national security concerns. From battlefield applications to the protection of airports, power plants, and borders, the need for advanced drone detection and neutralization continues to scale. In parallel, industrial wireless infrastructure is becoming essential as rail, utility, and energy operators modernize legacy systems.

Ondas currently generates 24.7 million dollars in trailing twelve-month revenue, a tiny share of its potential markets. The central question for investors is not whether the stock is expensive today but whether the company can effectively execute and capitalize on its enormous long-term opportunity. If management delivers, the valuation could prove justified.

Opportunity for Growth Investors, With Risks to Consider

Ondas delivers many qualities that attract growth-oriented investors. It is positioned ahead of powerful secular trends, demonstrates early commercial momentum, and holds a balance sheet capable of supporting years of expansion. The acquisition of Sentry CS Ltd. strengthens its technological capabilities, while rising defense budgets provide durable tailwinds for counter-drone demand.

However, execution risks remain. Integrating acquisitions, scaling production, and managing rapidly evolving competitive landscapes can challenge even well-capitalized companies. Operating losses mean profitability is not imminent, and any slowdown in contract wins could weigh on sentiment.

Despite these risks, the opportunity remains compelling for investors seeking exposure to next-generation defense and industrial technologies. Ondas operates at the intersection of national security and digital infrastructure modernization, two areas unlikely to lose relevance in the years ahead.