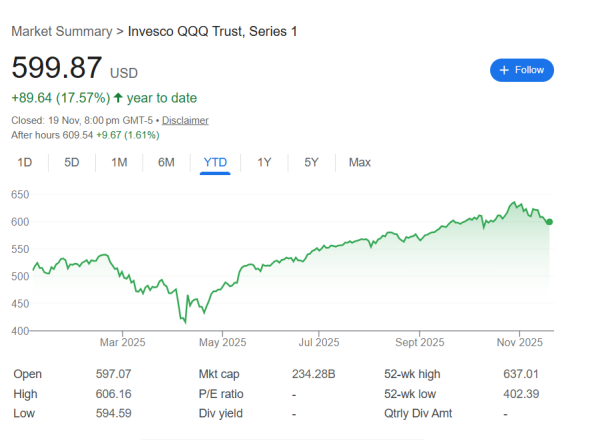

The Invesco QQQ Trust ETF (QQQ) has established itself as one of the most popular exchange-traded funds for investors seeking concentrated exposure to leading technology companies. Tracking the Nasdaq-100 Index, QQQ holds 100 of the largest non-financial companies listed on the Nasdaq exchange, making it a tech-heavy alternative to broader indices like the S&P 500.

Over the past five years, the ETF’s performance has been remarkable, reflecting both the strength of its constituent companies and the rising dominance of artificial intelligence (AI) across industries.

Brokers from Logirium will share their insights on the numbers that make Invesco QQQ Trust ETFparticularly appealing for long-term investors. A $1,000 investment in QQQ five years ago would now be worth over $2,100, representing a total return of 114% as of November 17. This return outpaces the S&P 500, which delivered roughly 100% over the same period, demonstrating the potential value of focusing on innovation-driven growth stocks.

Key Holdings Driving Growth

The success of QQQ is largely driven by its top holdings, which include Nvidia, Apple, and Microsoft. These companies are not only market leaders in their respective sectors but are also at the forefront of technological transformation.

- Nvidia has become synonymous with high-performance GPUs, powering gaming, data centers, and AI applications. Its products are critical for the development and deployment of AI systems, making it a strategic growth engine for QQQ.

- Apple, a consumer electronics giant, maintains a highly profitable ecosystem of devices and services. Its ongoing innovations in hardware, software, and digital services continue to drive revenue and support shareholder returns.

- Microsoft has expanded its leadership in cloud computing, enterprise software, and AI integration, giving it a durable competitive advantage and making it a consistent contributor to QQQ’s performance.

Together, these leading technology companies have propelled QQQ to outperform broader markets, reinforcing the ETF’s appeal as a technology-focused investment vehicle.

Exposure to Artificial Intelligence

One of the most compelling aspects of QQQ is its direct exposure to AI, a sector poised to transform multiple industries. Many of the ETF’s holdings are investing heavily in AI research and development, from machine learning platforms to cloud-based AI services, positioning them to benefit from the next wave of digital innovation.

Investors seeking to capitalize on AI trends without picking individual stocks can gain diversified exposure through QQQ, combining innovation-driven growth with reduced single-stock risk. This makes the ETF particularly attractive for those looking to participate in AI’s long-term growth story while maintaining a well-rounded portfolio.

Simplicity and Diversification

Investing in QQQ provides simplicity and efficiency. Rather than managing multiple individual stocks, investors can access a broad portfolio of 100 Nasdaq-listed companies. This provides exposure to the world’s most innovative firms while minimizing the complexity and monitoring required when investing in individual names.

Furthermore, the diversification within QQQ offers some protection against market volatility. While technology stocks can be sensitive to economic cycles, interest rate changes, and regulatory shifts, QQQ’s holdings include companies with strong fundamentals, high cash reserves, and durable competitive advantages, which can mitigate risks during turbulent periods.

Strong Historical Performance

The historical returns of QQQ underscore its strength as a long-term investment. Over the past five years, QQQ’s total return of 114% has exceeded broader benchmarks like the S&P 500. This performance is driven by both capital appreciation in leading technology stocks and the compound growth of innovative sectors.

Additionally, QQQ provides exposure to sectors poised for future growth, such as cloud computing, semiconductors, AI, and digital services. These industries are expected to continue expanding, providing the ETF with long-term upside potential for investors who can remain patient and focused on strategic growth trends.

Long-Term Growth Potential

Looking ahead, QQQ is well-positioned to continue benefiting from technology-led growth. AI adoption, cloud expansion, software integration, and digital infrastructure advancements are likely to drive the next phase of growth for many of its holdings.

Investors should monitor emerging technologies and individual company developments, particularly in AI, which could reshape revenue streams and profitability across sectors. By investing in QQQ, shareholders gain access to companies at the forefront of innovation, offering potential capital appreciation and total return over time.

Conclusion

The Invesco QQQ Trust ETF remains a compelling option for investors seeking concentrated exposure to leading technology innovators. A $1,000 investment five years ago would have more than doubled, highlighting both the strength of Nasdaq-100 constituents and the impact of technological transformation.

For long-term investors, QQQ combines growth potential, innovation exposure, and diversification, offering a powerful vehicle for capitalizing on technology trends and AI development. Its strong historical returns and the prospective growth of its holdings make QQQ a top choice for investors focused on long-term wealth creation.

By maintaining exposure to market leaders and innovation drivers, QQQ positions investors to benefit from technological disruption, providing a solid foundation for future portfolio growth.