The nation’s largest home improvement chain delivered disappointing results Tuesday that sent shares tumbling and raised fresh concerns about consumer spending patterns. The retailer reported earnings that fell short of analyst projections while simultaneously reducing profit expectations for the full fiscal year. Senior finance analysts at Unirock Gestion examine what this earnings miss reveals about household financial health and discretionary purchase trends.

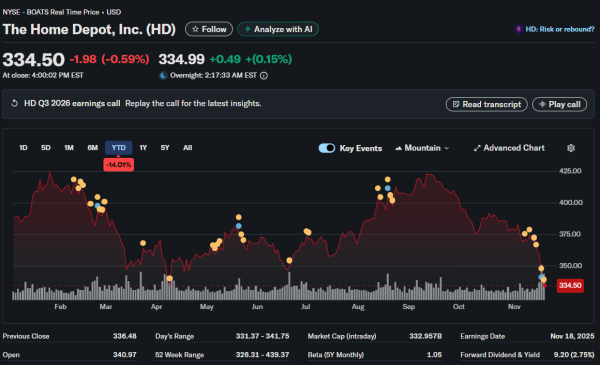

Shares plummeted 6% following the announcement, representing one of the worst single-day declines for the stock in recent months. The company reported third-quarter fiscal 2025 earnings of $3.74 per share, missing the consensus estimate of $3.81 per share that Wall Street had anticipated. This shortfall came despite the retailer’s historically strong execution and market-leading position.

Weak Forecast Compounds Disappointment

Beyond the current quarter miss, management’s guidance for full-year profitability sparked additional concern among investors. The company reduced expectations, citing multiple headwinds including weakening consumer demand, elevated interest rates affecting home purchases, and ongoing challenges in professional contractor segments. This conservative outlook suggests management sees limited near-term catalysts for improvement.

Home improvement retailers typically benefit from housing market activity and homeowner investment in property upgrades. Current dynamics show both new home sales and existing home transactions facing pressure from mortgage rates that remain elevated despite recent Federal Reserve rate cuts. Higher borrowing costs discourage home purchases and major renovation projects simultaneously.

The earnings miss carries particular significance given the retailer’s position as a bellwether for consumer discretionary spending. Home improvement purchases represent classic discretionary expenditures that households defer when financial conditions tighten. Weakness in this category suggests consumers are prioritizing essential spending over optional home upgrades.

Third-quarter results covered the period when many homeowners traditionally undertake projects before winter weather arrives. The disappointing performance during what should represent a seasonally strong period raises questions about demand trajectories in the coming quarters when seasonal tailwinds diminish further.

Broader Retail Implications

This earnings disappointment arrives during a critical week for the retail sector reporting. Multiple major chains announce quarterly results spanning the back-to-school period through early fall shopping patterns. Collectively, these reports provide insights into consumer health entering the crucial holiday season that determines annual profitability for many retailers.

The home improvement chain’s struggles mirror challenges facing other discretionary-focused retailers. Consumers facing elevated prices for necessities, including food and fuel, have less disposable income available for optional purchases. This creates a bifurcated retail environment where essential goods providers capture spending while discretionary categories suffer.

Professional contractor demand, which historically provided stability for home improvement retailers, also softened during the quarter. This segment typically exhibits less volatility than do-it-yourself consumers since contractors work on committed projects. Weakness here suggests the pullback extends beyond just consumer caution into business investment decisions.

Major kitchen and bathroom remodeling projects have declined notably as homeowners defer expensive renovations. These big-ticket purchases carry high margins for retailers, making their absence particularly impactful on profitability. Smaller maintenance projects continue, but don’t generate equivalent revenue or profit per transaction.

Economic Context Matters

The disappointing results occur against a backdrop of mixed economic signals. While headline GDP growth remains positive, momentum derives primarily from business investment in technology infrastructure rather than consumer spending. Household consumption, which drives approximately 70% of economic activity, shows signs of moderating.

Employment gains decelerated meaningfully during recent months. Layoff announcements have increased substantially year over year, creating uncertainty among workers even if unemployment rates haven’t spiked dramatically yet. This employment anxiety prompts cautious spending behavior as households build savings buffers against potential job loss.

Inflation, while moderating from peak levels, continues running above the Federal Reserve’s 2% target. Persistent price pressures erode purchasing power, particularly for lower and middle-income households that spend disproportionate portions of income on necessities. This leaves less available for discretionary categories, including home improvement.

The housing market itself remains challenged by the collision of elevated prices and higher mortgage rates. This combination priced many potential buyers out of markets entirely. Existing homeowners with low-rate mortgages feel locked in, reducing mobility and associated home improvement spending that typically accompanies moves.

Looking Ahead

Market experts note that home improvement retailers face several quarters of challenging comparisons. The sector benefited enormously from pandemic-driven spending on homes as people invested in properties where they spent unprecedented time. Those tailwinds have fully reversed, creating difficult year-over-year comparisons.

Housing market dynamics will significantly influence category performance. Any improvement in affordability through declining mortgage rates or moderating home prices would support demand. Conversely, sustained elevated rates and prices keep potential buyers sidelined and discourage major renovation projects among existing homeowners.

The upcoming holiday season will test whether consumers maintain spending discipline or splurge on year-end purchases. Home improvement retailers typically see modest seasonal benefits from holiday-related projects and gift purchases, though nothing approaching the impact on general merchandise retailers.