Exchange Tokens Overview

In the cryptocurrency industry, it is always difficult to properly provide accurate valuations for digital assets. Currently, there exists no uniform industry standard or completely reliable valuation method to discover the true value of digital assets. A lot of cryptocurrency exchanges issued their platform tokens which directly relate to their platform. The exchange tokens (exchange based token), as a unique category of digital assets, can be fairly evaluated due to inherent properties of “stable currency flow”, allowing the foundation of a fair price.

Correct and reliable analysis of the digital asset industry can provide intuition for the overall industry. According to data provided by TokenInsight, we have found that the transaction amount on exchanges is highly correlated to the market, directly affecting the income of each specific exchange. We have developed a simple quantitative method to construct the valuation of exchange tokens structure.

Leveraging its exchange token valuation structure based on the individual exchange, we can now perform standardized analysis for exchange tokens based on the exchange, and report the actual value behind each exchange.

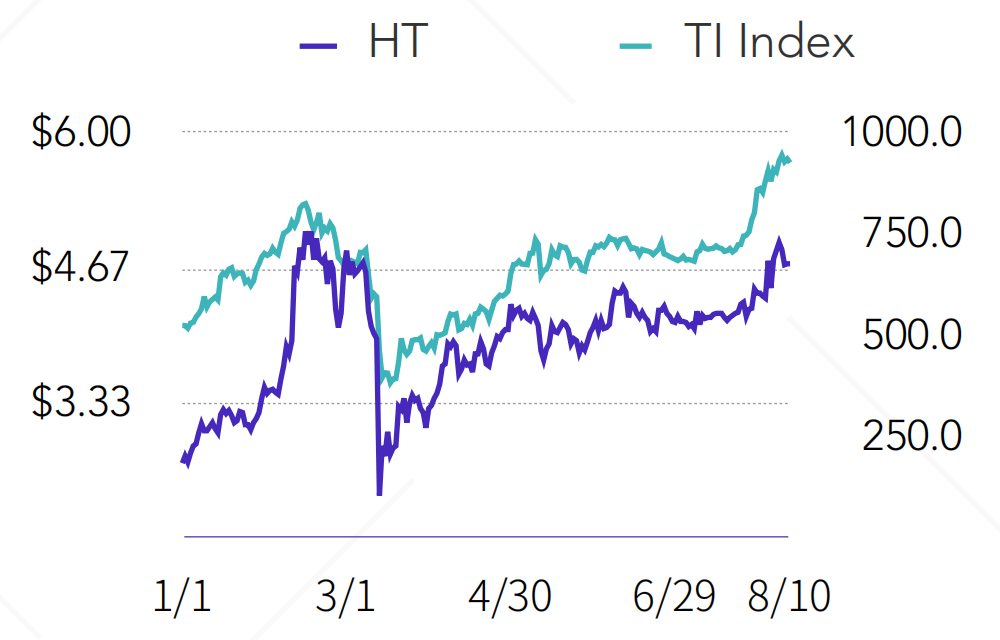

We can see that within the timeline assessment period of our first exchange tokens valuation report, most of exchange tokens tend to follow the price estimate interval developed by TokenInsight Research. We are pleased to see that the digital asset market is growing rapidly into a financial system that can be accurately evaluated its company, or the intrinsic value of its exchange token through both basic and quantitative methods.

In our evaluation, we found out that from optimistic growth in the digital asset market as a whole, most of the exchange platform tokens are still on their upward slope and are considered to be underestimated; some are within the normal interval, operating steadily.

The rise of the DeFi Industry has created optimism for investor and has helped the transition for major amounts of assets such as BTC and ETH. Meanwhile, the market for financial derivative products is also expanding, offering new opportunities for platform and transactional development.

Exchange based tokens are a scarce value asset in the market, and TokenInsight hopes to offer professional observation and analysis in this category. Meanwhile, we are open to any suggestions from the market. Due to the digital asset market being in its early stages, there must be a lot of unpublished data or data that is incomplete. We welcome any opinions or suggestions from your readers, discussion is encouraged. You can get in touch with us using the email address on the cover or by scanning the QR code.

1. Glossary

1.1 Introduction to Valuation Metrics

Due to the nature of the cryptocurrency market, we leverage multiple metrics to provide a reference for“fair price” on exchange-based tokens. The metrics used are Discounted Cash Flow method, Price to Earnings ratio, Earnings Yield, Price/Earnings to Growth (PEG), Price to Burn ratio, Burning Yield, MarketCap/Earnings, Implied Enterprise Value, Implied Enterprise Multiple and Network to Transaction Ratios.

[1]TokenInsight does and seeks to do business with companies covered in TokenInsight Research. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of TokenInsight Research. Investors should consider TokenInsight Research as only a single factor in making their investment decision. For other important disclosures, refer to the disclosure section, located at the end of the report.

Discounted Cash Flow Method

The discounted cash flow method is used to estimate the value of the exchange-based token. DCF analysis attempts to figure out the current value of the token today, based on projections of how much revenue the exchange will generate in the future, according to the buy & burn data released publicly by the exchanges.

1.2 Price to Earnings

Price to Earnings Ratio (P/E, Earnings Multiple)

The ratio for valuing an exchange based token that measures its current token price relative its per token earnings, also known as the price multiple or the earnings multiple.

The ratio is calculated as the current price (Valuation date)/ last Quarter Earnings derived from buy & burn data provided by the target exchange.

Earnings Yield

Defined as the reciprocal of the P/E ratio, expressed as a percentage.

Price/Earnings to Growth (PEG)

The exchange token’s P/E ratio divided by the growth rate of the exchange earnings. It determines a token’s value while also factoring in the company’s expected earnings growth and is thought to provide a more complete picture than the P/E ratio.

1.3 Price To Burn

Price to Burn Ratio (P/Burn, Burning Multiple)

The ratio for valuing an exchange based token that measures its current token price relative its per token burning value, also known as the burning multiple.

The ratio is calculated as the marketcap (Valuation date) divided by $ dedicated towards token burn derived from buy & burn data provided by the target exchange.

Burning Yield

Defined as the reciprocal of the P/Burn ratio, expressed as a percentage.

1.4 Earnings

MarketCap/Earnings

Current floated market cap/last quarter’s earnings in USD.

Implied Enterprise Value

Diluted market cap divided by % of profit split accrued to tokens.

Implied Enterprise Multiple

Implied Enterprise Value divided by last quarter’s earnings in USD.

1.5 Token Onchain Fundamental

Network to Transaction Ratio

Defined as the network value (Marketcap) divided by the daily USD volume transmitted through the network or total supply divided by daily token volume transmitted through the network.

2. Valuation Assumptions

· Bimonthly valuation

· There are mainly 5 different categories of the growth rate assumptions,

- Short term supernormal growth rate (High)

- Short term supernormal growth rate (Low)

- Mid term normal growth rate

- Long term sustainable growth rate (High)

- Long term sustainable growth rate (Low)

· The average required rate of return of venture capital has been used as a proxy to be the AAA benchmark required rate of return (r) of the exchange token in the cryptocurrency industry.

· Risk premium build-up method has been used to estimate the required rate of return of the target token based on TokenInsight exchange rating model.

· The risk premium method uses the exchange’s rating rather than the exchange based token rating to reflect business operation risks.

· TokenInsight in house risk premium transition matrices has been used in this valuation model to reflect the transition risk premium of an exchange.

· Simple interest is used in the model for simplicity.

· The exchange published buy & burn data in USD has been used when available, otherwise we calculate the buy & burn figures in USD as the average price of the token in the specific period.

· The industry average figures in the comparable analysis have been bucketed based on the market capitalizations of the exchange based token.

· Above (Higher) average P/E might indicate growth token, below (low) average P/E might indicate value token.

· The current valuation framework does not consider additional benefits for holding the exchange token such as rewards, etc.

· Profit split accrued to tokens is calculated as the average fees discount rate across X years defined by the target exchange.

· All the required valuation figures are extracted from exchange official announcement pages, CoinMarketCap, Coin Metrics, Messari, Etherscan, and TokenInsight.

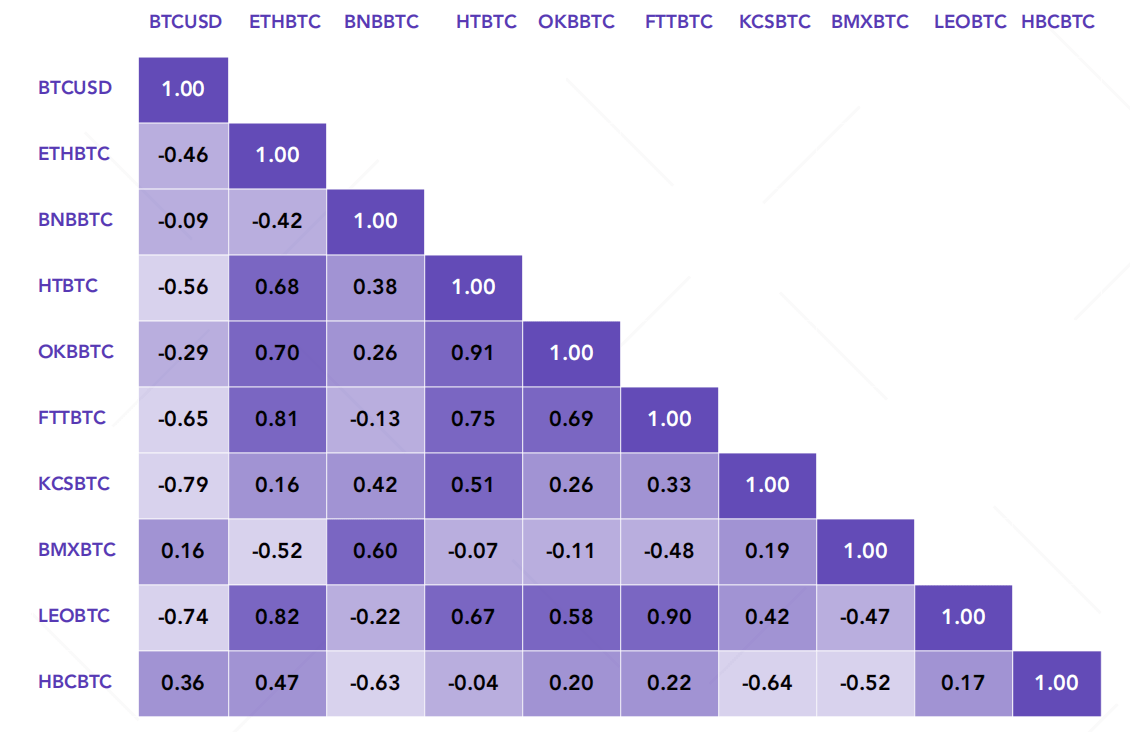

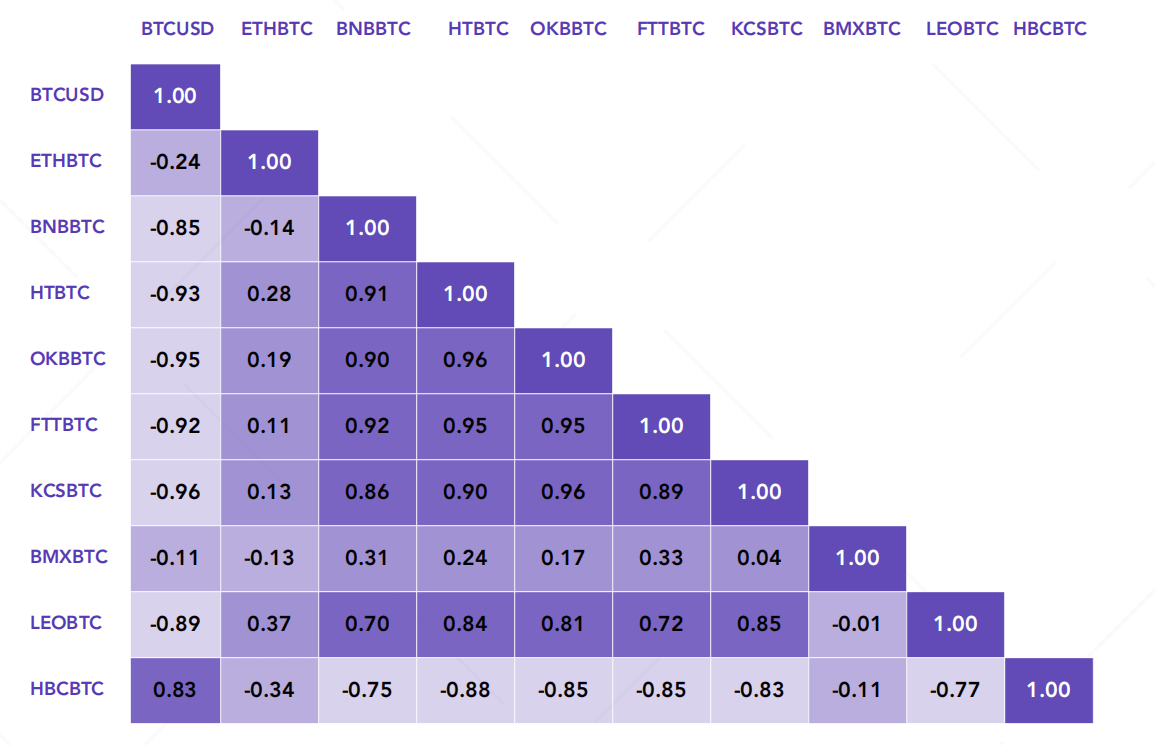

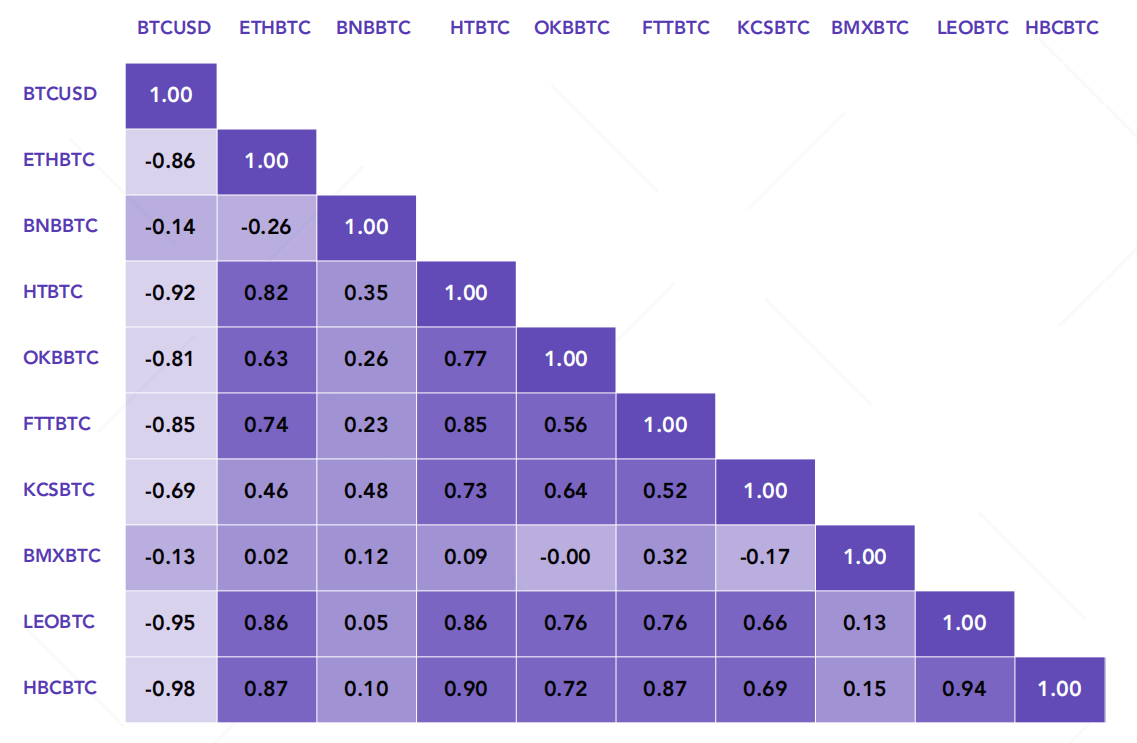

3. Correlation Analysis

3.1 Year to Date

3.2 Q2 2020

3.2 Rolling 30 Days

The three correlation matrices above show the related data between the price of BTCUSD and exchange token BTC pair.

Through data analysis, we found out that the majority of results between the price of exchange token BTC pair and the price of BTCUSD are showing a negative correlation, and the Q2 negative correlation is stronger than the rolling 30 Days correlation.

Each exchange based token has relatively little correlation with ETH and is affected by the heat of the market, the rolling 30 Days shows a highly positive correlation.

BNB has a very strong positive correlation with the majority of exchange token in Q2 2020, but the rolling 30 Day correlation with other exchange tokens has dropping significantly. On the contrary, HBC shows an extremely negative correlation with the majority of others in Q2, the rolling 30 Day has changed to almost all strong positive correlation intervals.

HT, FTT, HBC, and LEO have a relatively high rolling 30 Day correlation.

Simple correlation analysis can be further expanded to including multiple correlation analysis, developing from multiple element models to major component analysis, to study market performance based on exchange tokens.

TokenInsight does and seeks to do business with companies covered in TokenInsight Research. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of TokenInsight Research. Investors should consider TokenInsight Research as only a single factor in making their investment decision. For other important disclosures, refer to the disclosure section, located at the end of the report.

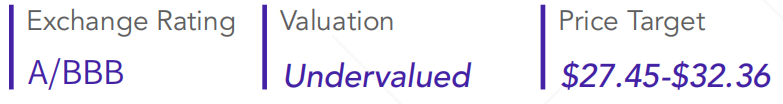

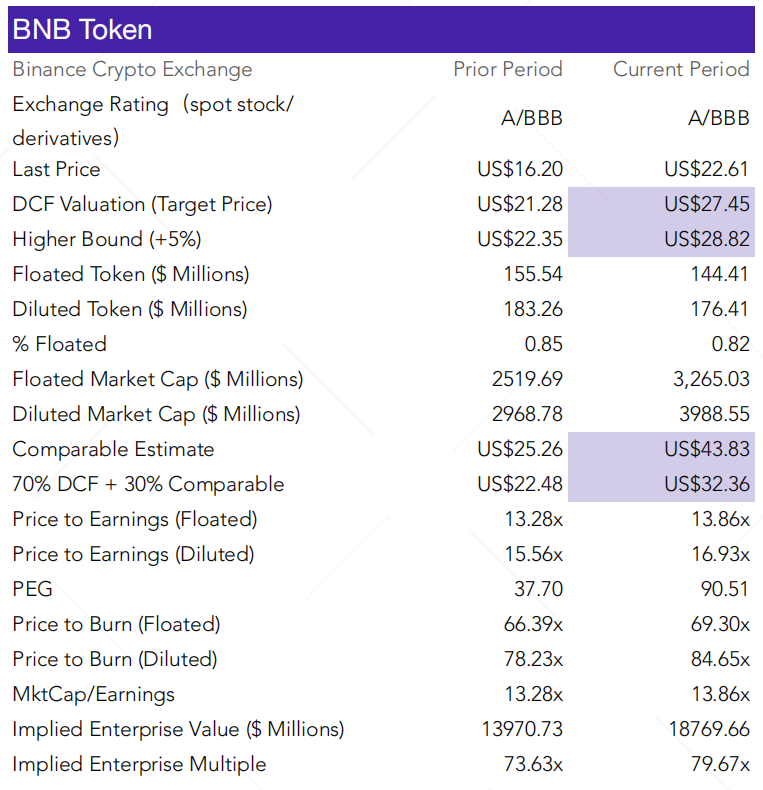

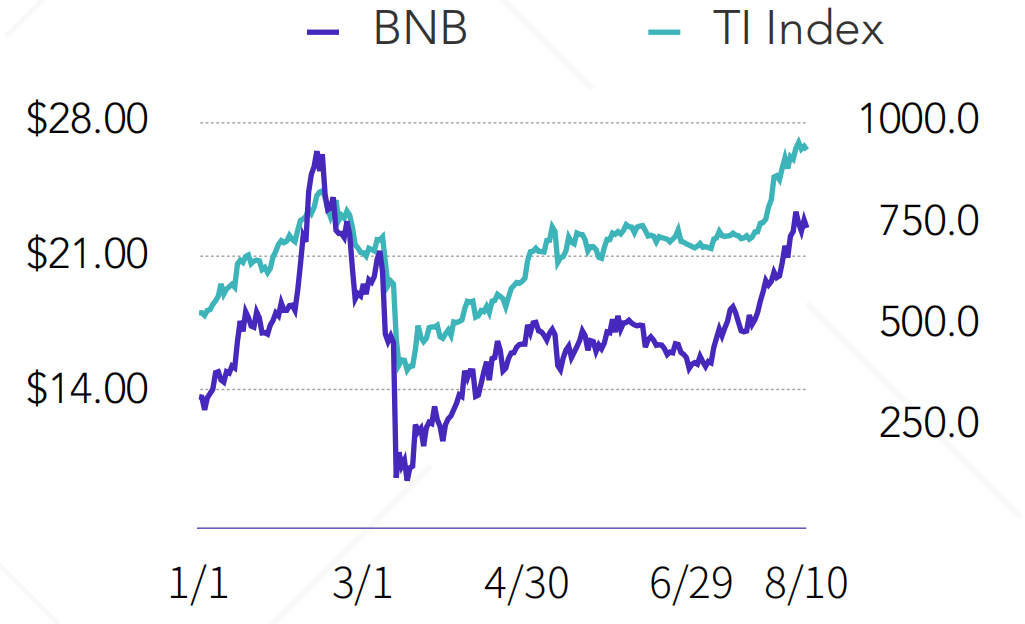

4. Binance Coin (BNB)

Binance Continues its Journey to Expand the Market Globally

Binance is going to continuously expand its ecosystem layout. In Q2 2020, Binance declared the acquisition of CoinMarketCap (CMC), and launched Binance Smart Chain and Binance mining pool. The price of BNB has been rising since Binance started to expand its ecosystem domain.

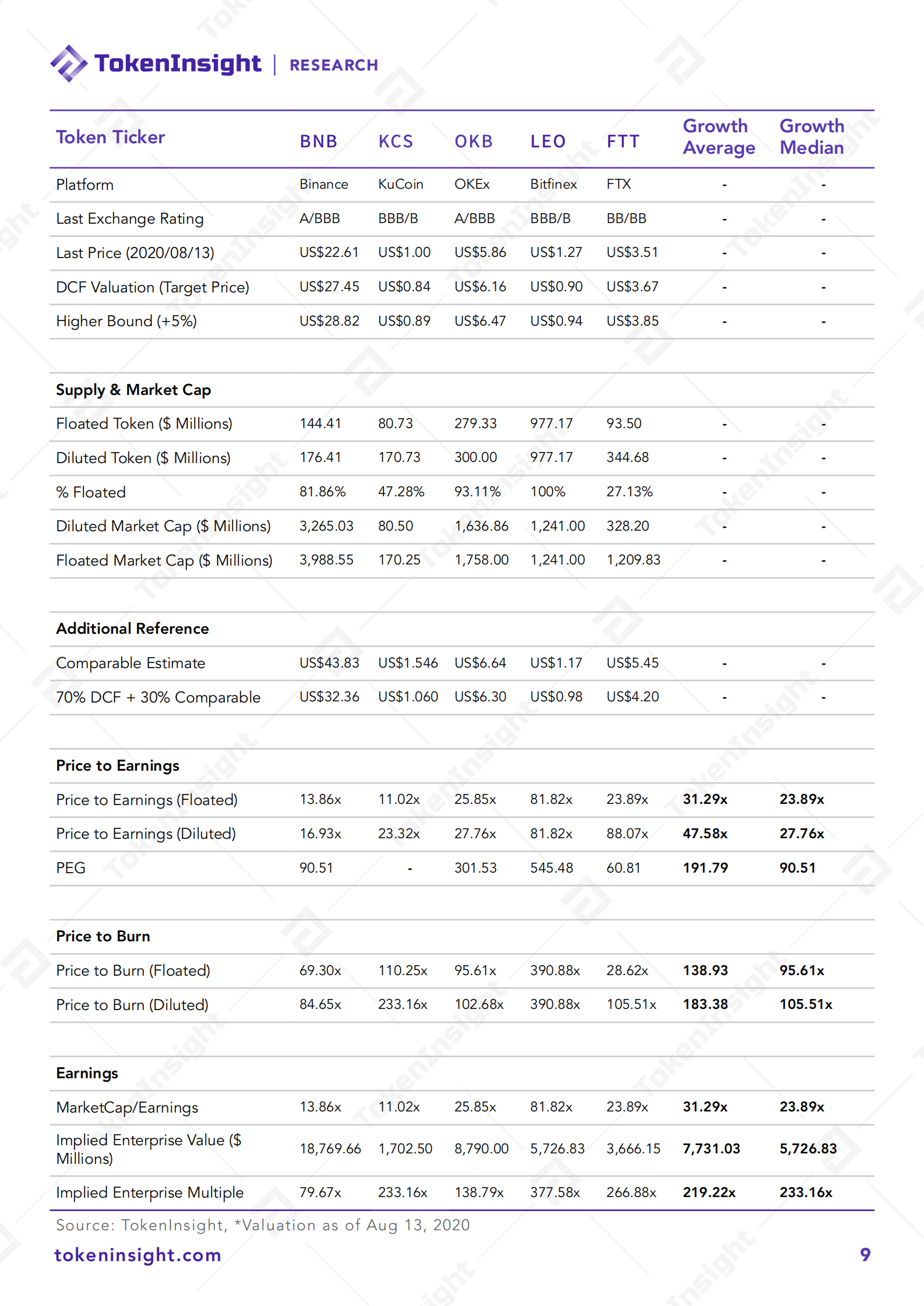

Comparable Analysis

The analysis demonstrates that Binance Coin is overall undervalued. P/E, P/Burn, Implied enterprise multiple is under growth average, indicating the market mis-pricing of Binance Coin resulting in an undervalue of the BNB from its fair price.

Risks

Binance Coin is still risky in terms of its operation status in Mainland China. Government-run media indicated that Binance Coin has operated illegally in several instances.

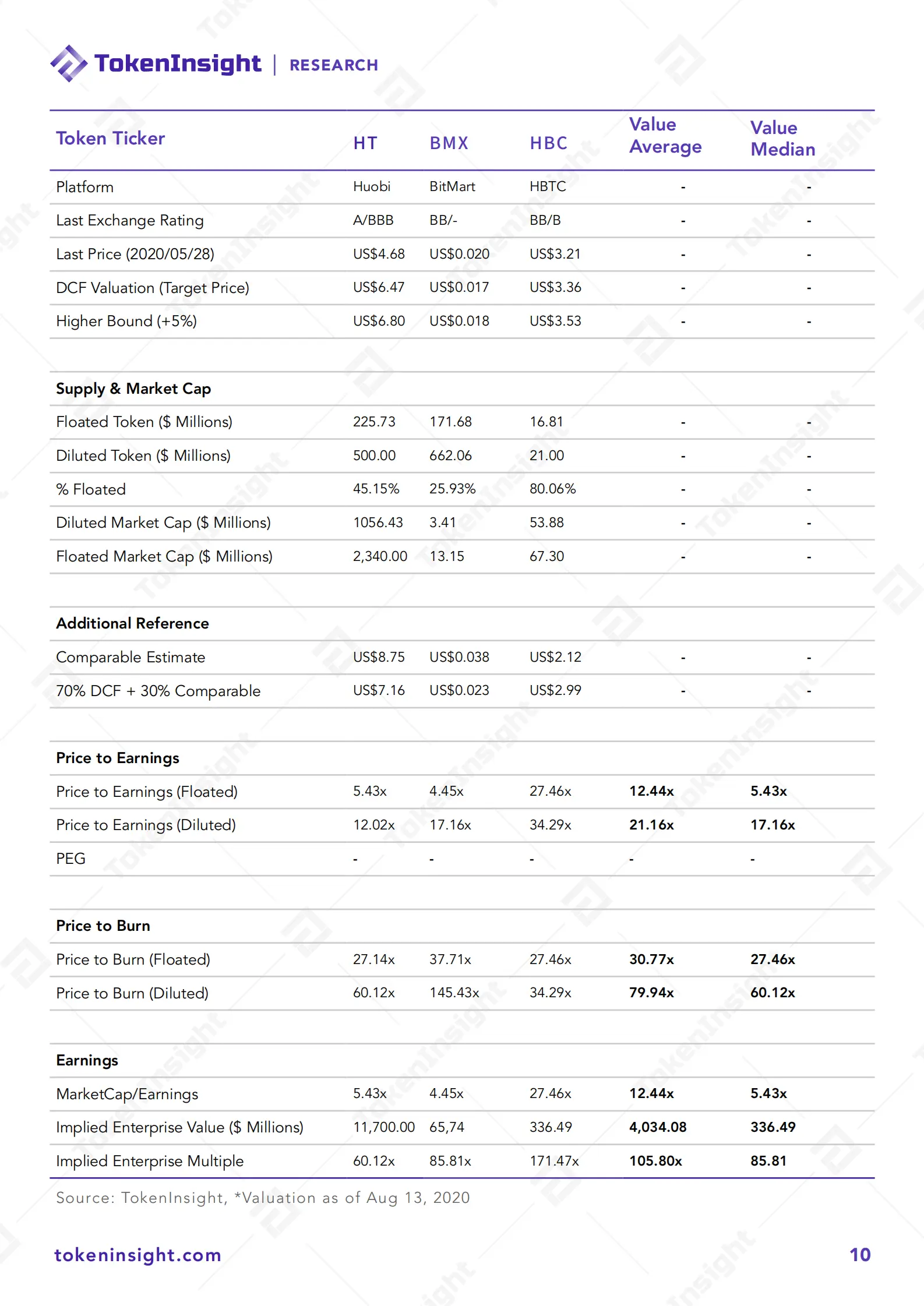

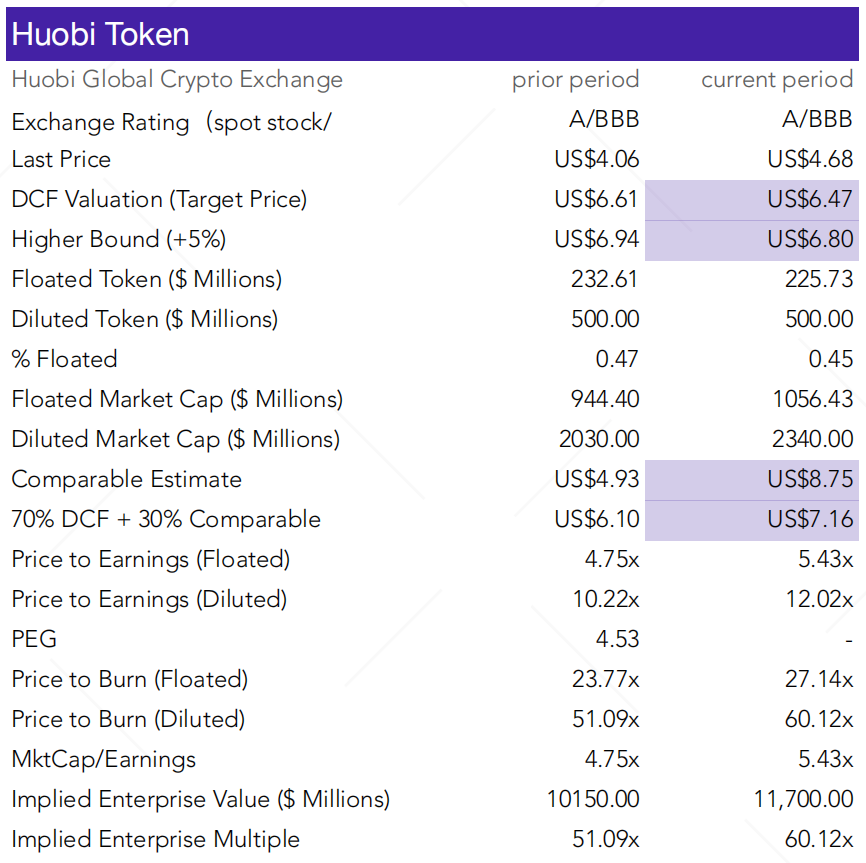

5. Huobi Token (HT)

HT Derivative Shows Prominent Market Result

Since the beginning of 2020, major exchanges continuously shifted the focus of their business to derivative transactions, Huobi contracts were highly recognized in the market after it was first offered. The transaction method of separated deposits has successfully met the market needs, causing a huge flow of users into the Huobi transaction platform.

In Q2, 2020, Huobi global station/Huobi contract derivative/spot stock ratio increased by 3.7 times, reaching 7.26 times.

Comparable Analysis

The P/E and Implied Enterprise Multiples are lower than the value token average, almost equal to the median, consistently reflecting that Huobi token is undervalued at the current market condition.

Risks

The imbalance of Huobi’s global strategy slows down its operation growth. Binance and other exchanges have started to offer delivery contract products.

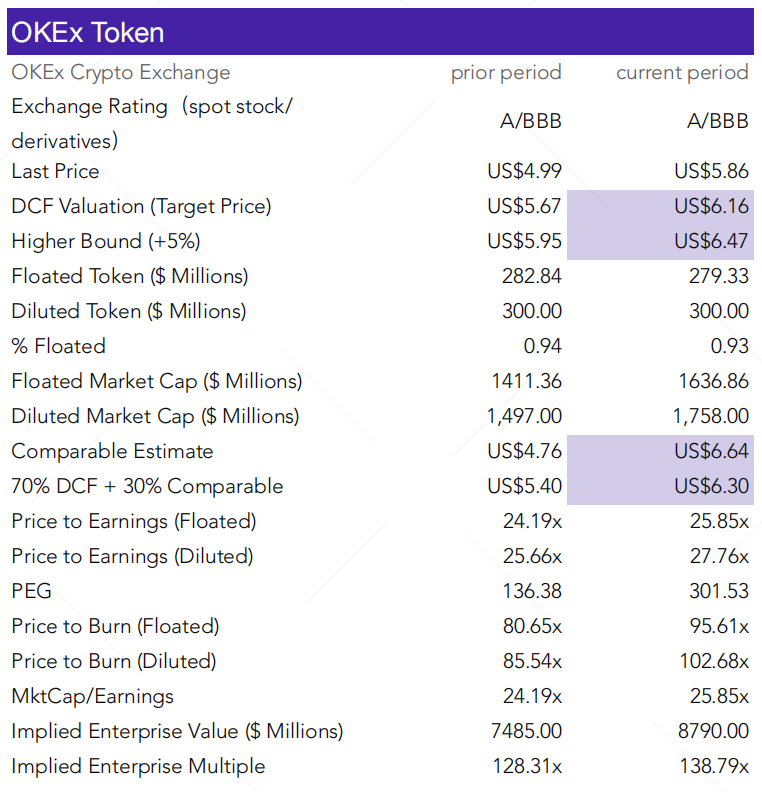

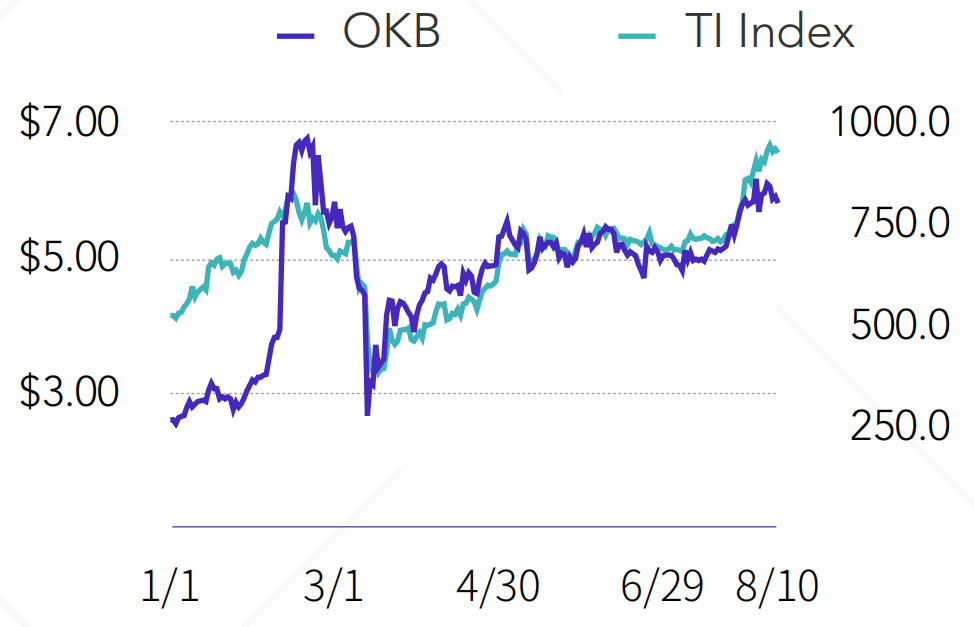

6. OKEx Token (OKB)

The Existing User Base of OKEx Provides Strong Support for the Long-Term Price Increase of OKB.

From the beginning to the end, OKEx has had a relatively high user base and a high proportion of loyal users, providing great support for the long-term price increase of OKB.

As for global ecosystem construction, OKB developed 19 partners altogether, covering a variety of popular fields, providing support for the realized value of OKB.

Comparable Analysis

The P/E, P/Burn, and Implied Enterprise Multiple reflects that OKB is undervalued when benchmarking against the growth token average and median. Overall, the comparable analysis demonstrates that the OKB token is undervalued when benchmarking against the industry average and median.

Risks

The quality of the underlying digital asset in the spot market may negatively affect the long-term market confidence of OKB. Moreover, OKEx is not good at attracting and keeping talents.

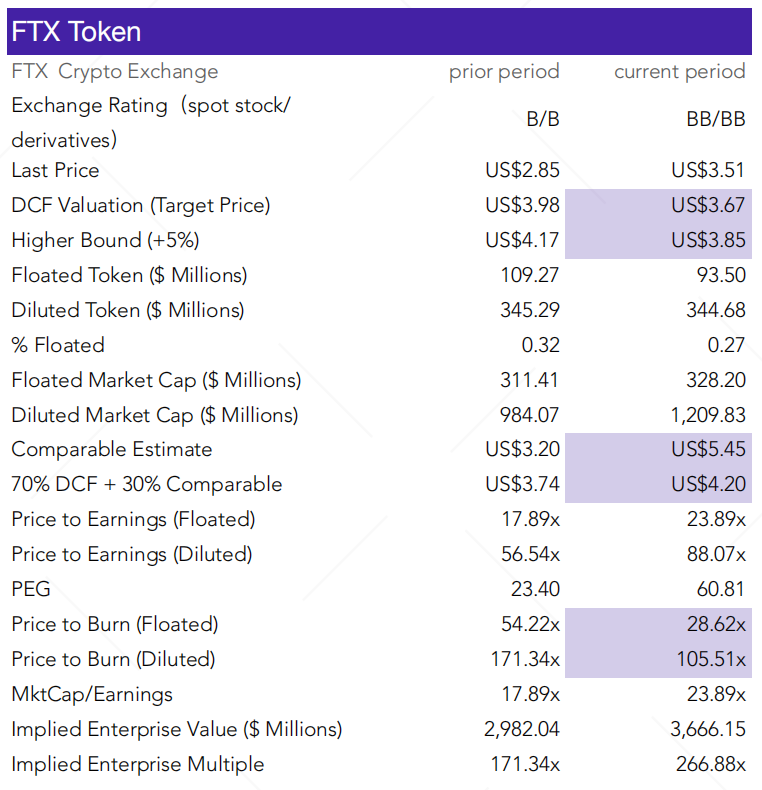

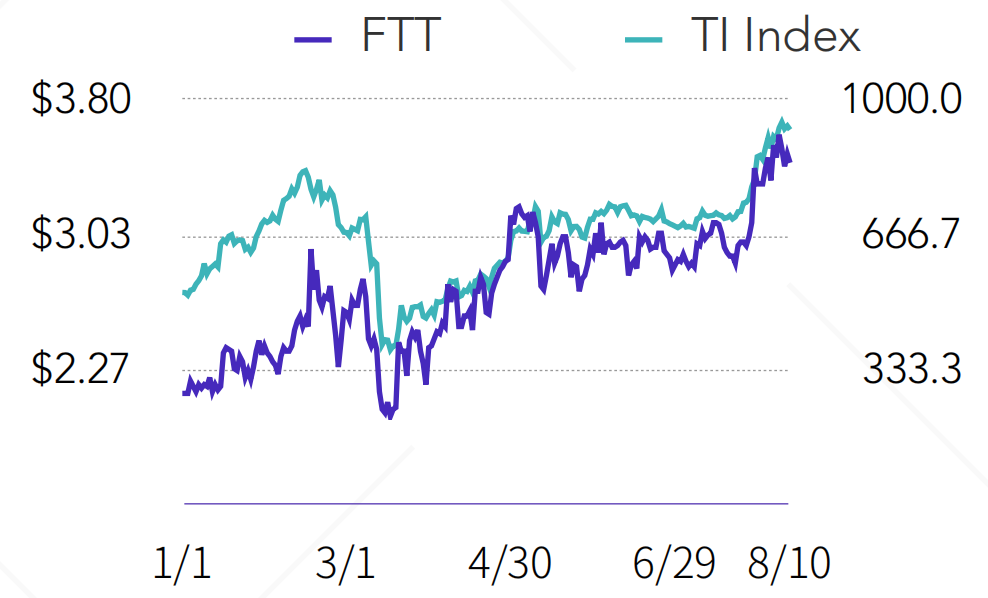

7. FTX Token (FTT)

Benefiting From its Unique Advantage, FTX Stands Out From Many Derivative Exchanges.

The derivative market is growing rapidly as expected, and FTX derivative transactions are also recognized by the market. In Q2 2020, the FTX exchange offered contracts including the bitcoin hash rate future contract and the DeFi index contract. Meanwhile, it also planning to offer FTX. US, the spot exchange.

After the first phase of market testing, TokenInsight has upgraded the rating of FTX derivative exchange to BB.

Comparable Analysis

In the comparable analysis, FTT is undervalued when benchmarking against the growth token average.

Risks

There is no clear future need for low-liquidity cryptocurrencies. Some products on FTX severely lack liquidity.

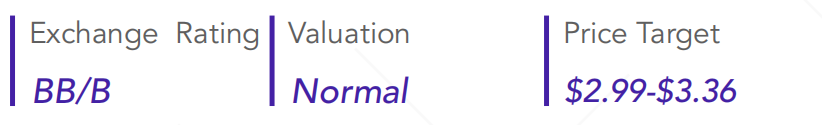

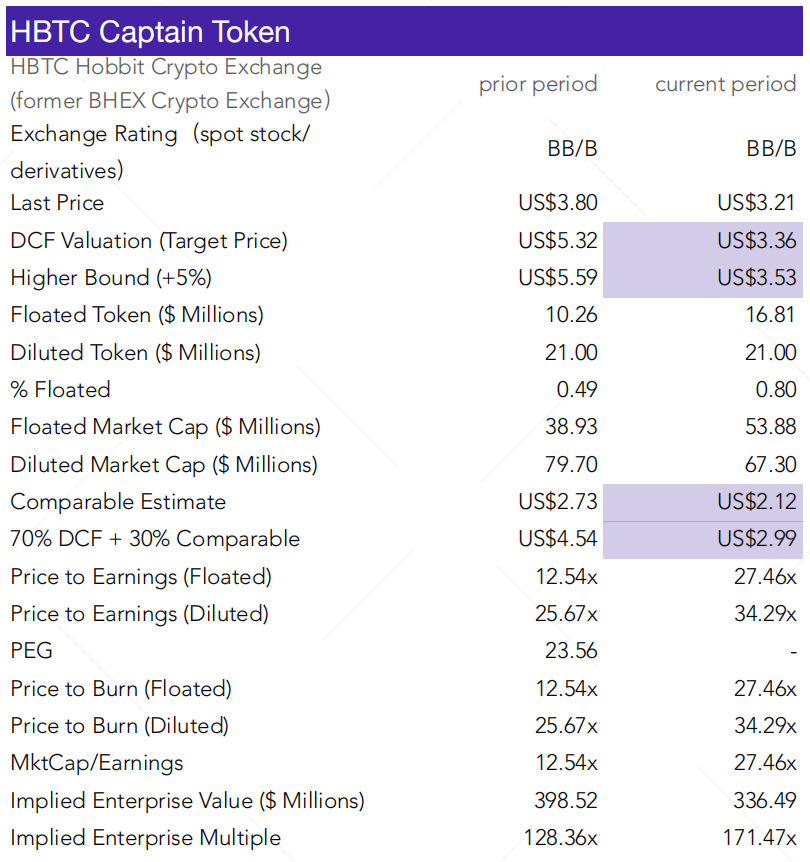

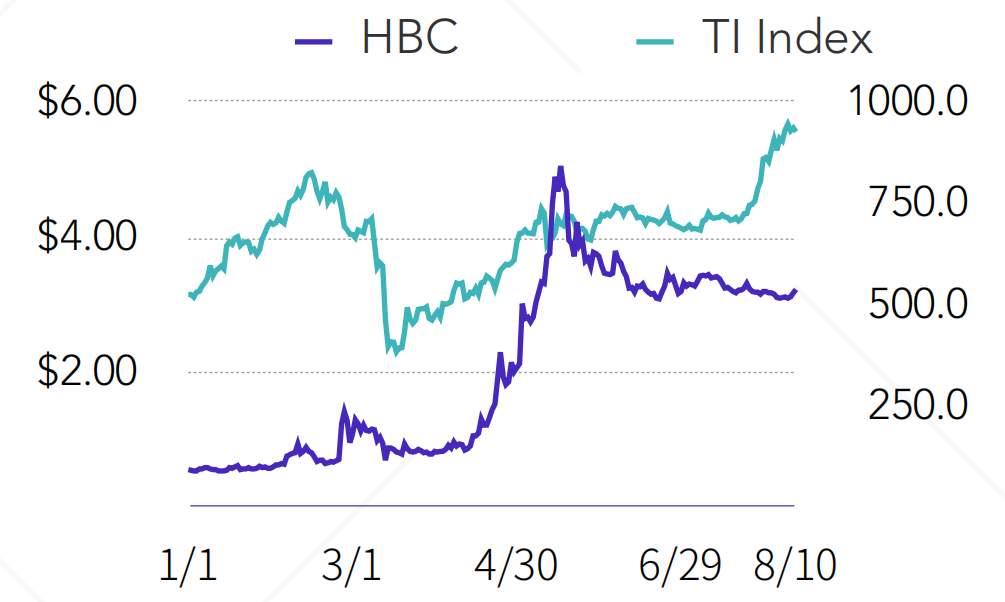

8. HBTC Captain Token (HBC)

HBTC Improves Liquidity by Relying on Crowdfunding Liquidity Currency

To solve the problem of low liquidity in the secondary market, HBTC Captain Token offers a crowdfunding liquidity currency. Meanwhile, the Hobbit chain has entered the auditing phase of its public chain code for testing, examining the functions of online cross-chain rapid exchange and heterogeneous cross-chain asset mapping.

Comparable Analysis

When benchmarking against the value token average, HBC is currently normally valued.

Risks

The valuation of HBC still refers to part of the original exchange token information, BHT on the BHEX exchange for baseline estimation. Additional observation and testing are needed.

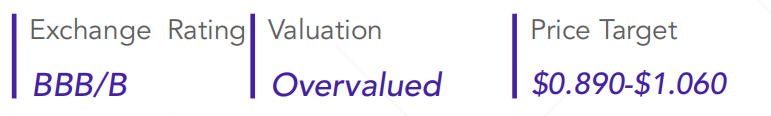

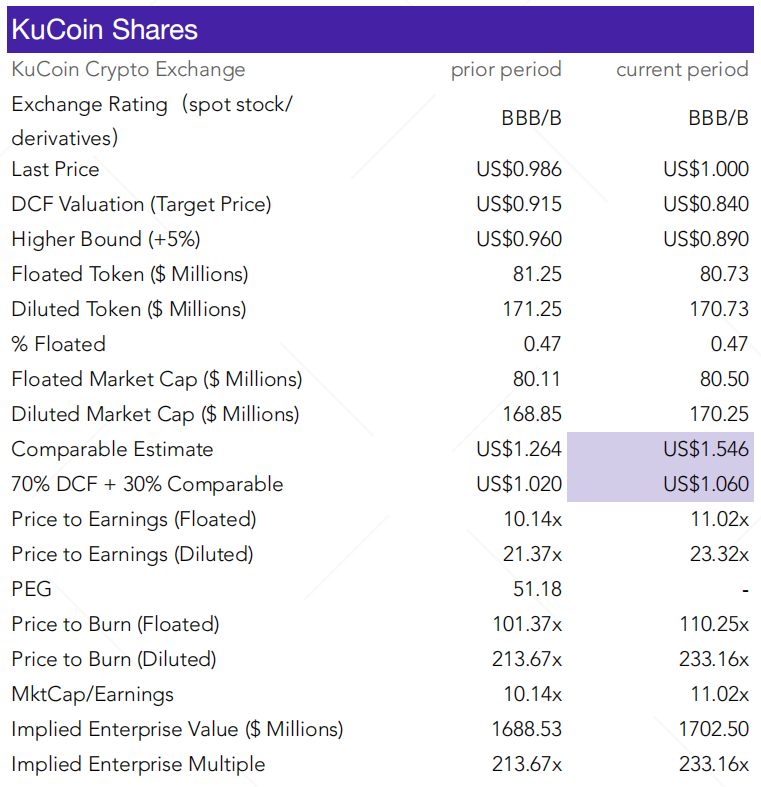

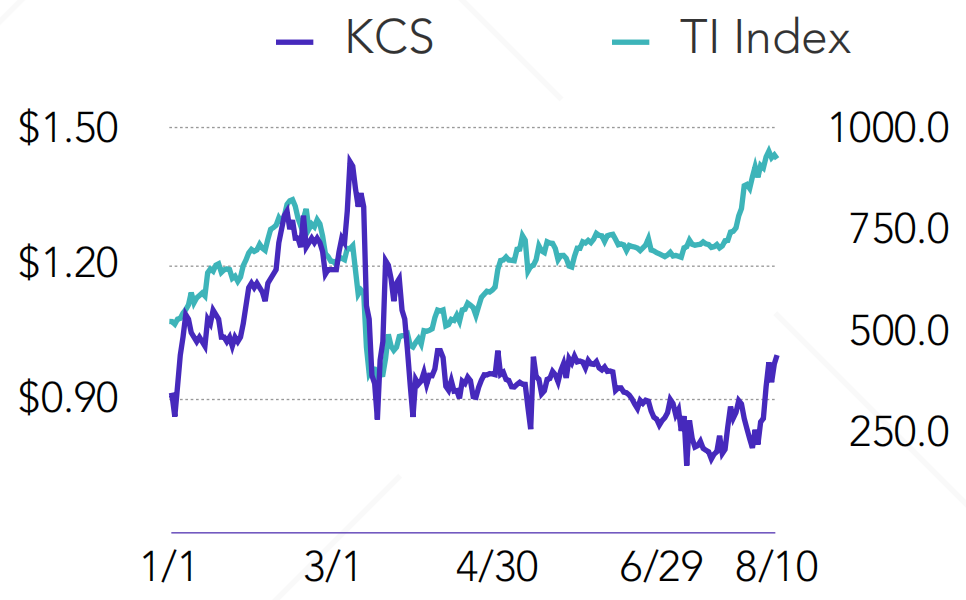

9. KuCoin Shares (KCS)

KuCoin Exchange Offered Public Chain Focusing on Decentralized Finance

KuCoin started its operation in the field of DeFi this year, its public chain testing network, Kratos Betanet, has been publicly tested in the second quarter. Kratos built four levels of network technology design according to the needs in the fields of Defi and DEX, creating modularized design among multiple protocols and functions.

Comparable Analysis

In comparable analysis, KCS is normally valued when benchmarking against the growth token average.

Bull Case (>$1.02)

The public chain of KuCoin Exchange has good liquidity, but still faces problems such as a shortage of users and high costs of attracting new users within the Defi project space.

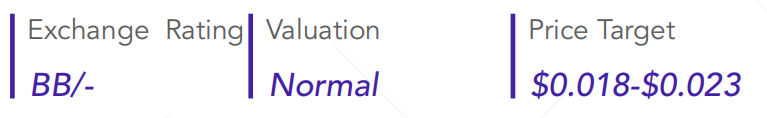

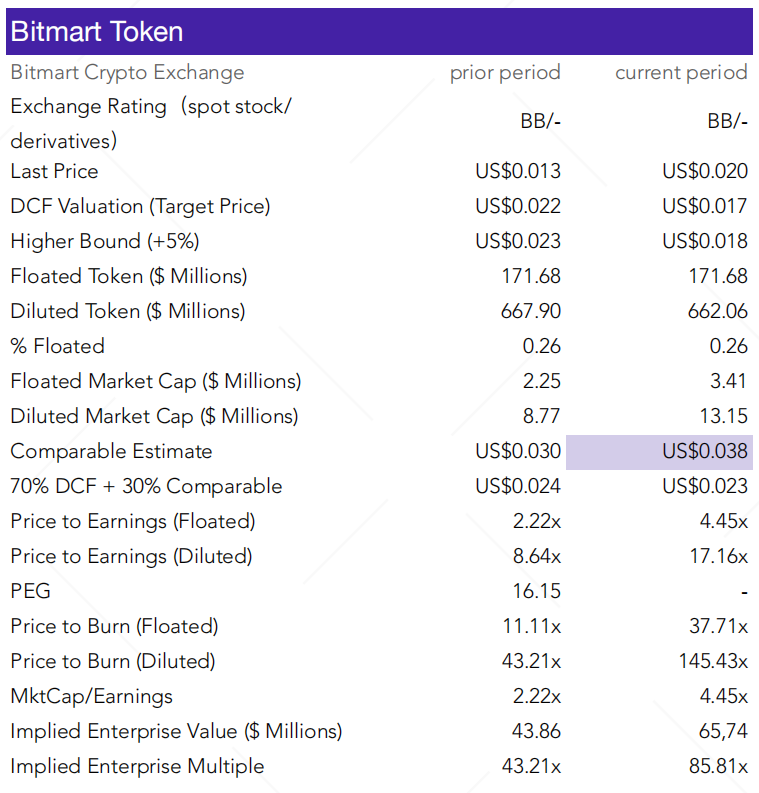

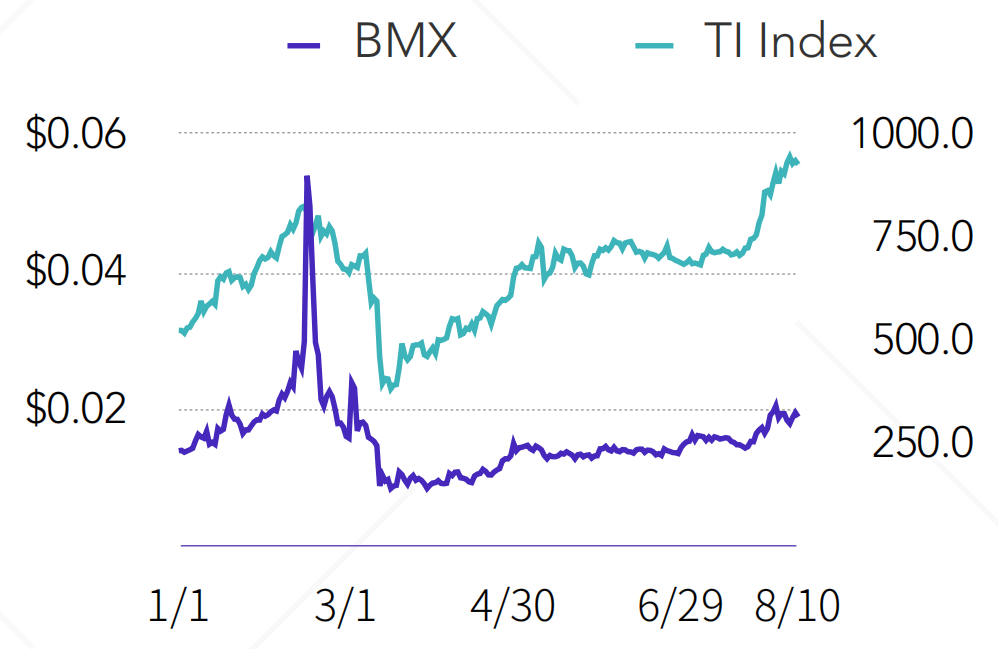

10. BitMart Token (BMX)

BitMart Features for its Compliance, Providing Reliability for Transactions

As an exchange with a legally issued stock token in the U.S. market, BitMart focuses on providing a digital asset transaction environment with compliance, security, and convenience. It set up BitMart Labs, an incubation platform for block chain projects, aiming to assist the settlement and incubation of outstanding blockchain projects and propelling their global development.

Comparable Analysis

In the comparable analysis, MBX is normally valued when benchmarking against the value exchange average.

Bull Case (~$0.024)

In terms of risks, BitMart is a relatively new exchange, it will need more time for testing and there may be fluctuation in earnings of users.

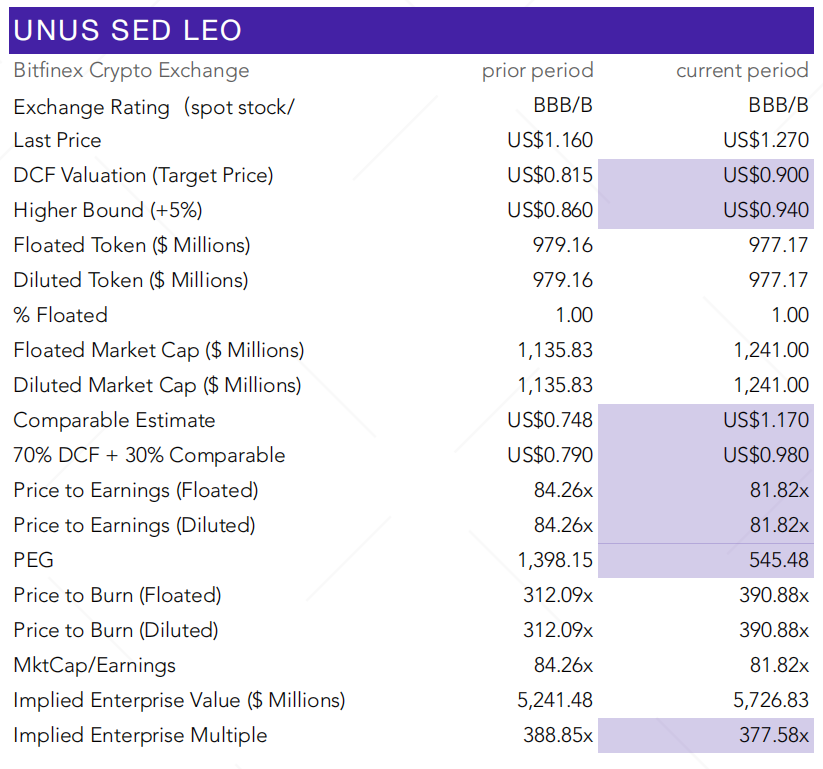

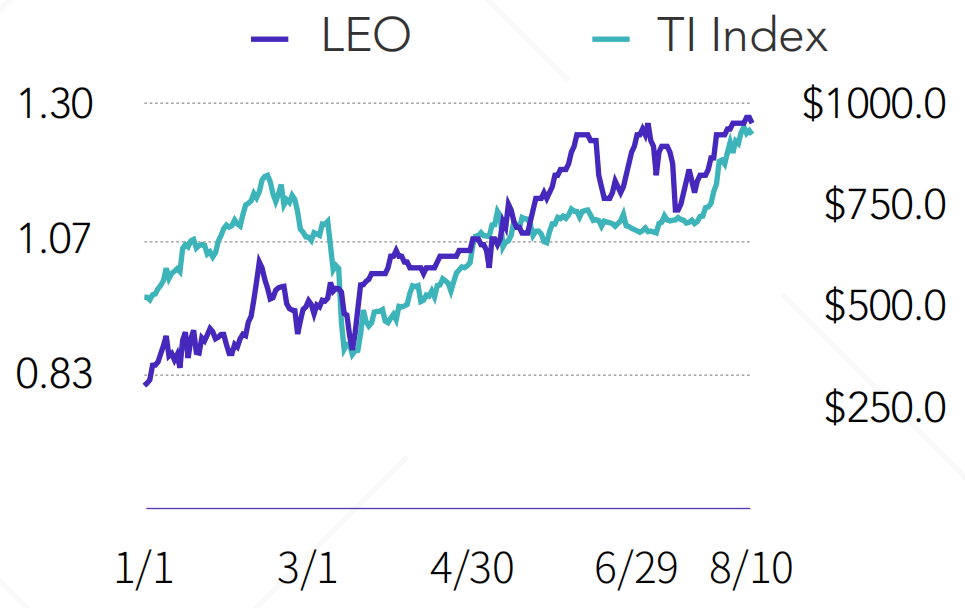

11. UNUS SED LEO (LEO)

Bitfinex Maintains the Strong Position in the Cryptocurrency Exchange Sector

As one of the most established exchanges in the industry, Bitfinex has a great many loyal users. Meanwhile, cooperating with Koine, the cryptocurrency trust service provider, offered a post-transaction service for institution users, enabling investors to lower the counter-party risk.

Comparable Analysis

In the comparable analysis, all of the key parameters reflect that Leo is overvalued when benchmarking against the value exchange average.

Risks

Affected by the historical factors, there has been a credibility problem in Bitfinex. In July, The Superior Court of New York dismissed the appeal submitted by Crypto Exchange Bitfnex against the management authority of New York attorney general (NYAG). In August, there was a performance reduction problem in Bitfinex, interrupting transactions for more than four hours.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.