The EUR/USD pair delivered a sharp bearish performance during Wednesday’s session, recording losses of -0.48% and extending the decline toward the critical 1.1517 support level. The pair is currently stabilizing near its lows, setting the stage, from a structural standpoint, for a potential bearish weekly close. The brokers at Arbitics provides a comprehensive breakdown of this topic in this article.

Across major FX trading platforms, the US Dollar Index (DXY) has shown a broad recovery, fueled by increasingly muted expectations that the Federal Reserve will approve additional U.S. interest rate cuts at its final 2025 meeting.

The newly released FOMC meeting minutes revealed deep divisions among policymakers. These divisions, centered on future rate-cut timing, have strengthened the greenback across the board.

In parallel, ECB projections continue to reflect a stable policy stance, with most expectations pointing to unchanged interest rates through 2026, supported by 2% inflation alignment, steady Eurozone growth, and historically low unemployment levels. The ECB, notably, held rates unchanged for the third consecutive meeting in October.

Technical Analysis of EUR/USD Today

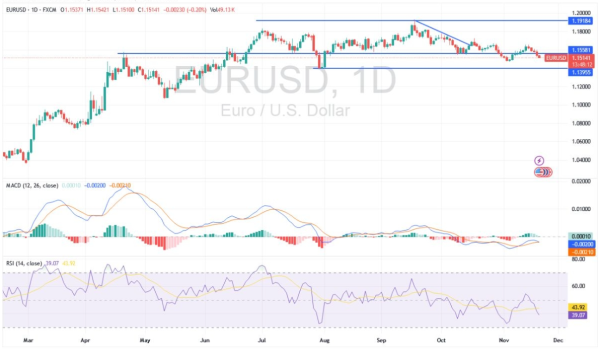

From a technical perspective, the EUR/USD breakdown below 1.1500 represents a pivotal development in short-term market structure. According to momentum readings, the 14-day Relative Strength Index (RSI) has retreated to 40, approaching oversold territory, which reinforces the implications of building bearish momentum.

Similarly, the MACD indicator shows steadily descending signal lines, indicating acceleration in downside pressure and affirming bearish sentiment dominance.

Price behavior clearly shows that market sellers (bears) managed to push the pair decisively below support, opening the door for deeper retracements. A continuation of the decline could expose further levels near 1.1450, followed by 1.1380, aligning with broader bearish channels visible on higher-time-frame charts.

From a trend-confirmation standpoint, any attempt at recovery remains structurally weak unless the pair reclaims the 1.1600–1.1700 area. A meaningful shift toward a bullish reversal on the daily chart would require a decisive move and sustained momentum above the psychological resistance at 1.1800. Without this, the overall directional bias remains firmly skewed toward the downside.

Bearish Signals for the Euro/Dollar Continue

Dear reader, based on FX market flow, the bearish breakout below 1.1500 strongly reinforces the negative trajectory for the EUR/USD pair. Sellers remain in control as long as downside pressure remains elevated and momentum indicators continue to weaken.

The steady decline of the RSI, paired with the downward-sloping MACD, adds to the evidence of a continuation pattern, especially amid the absence of any significant bullish catalysts. Traders are now closely monitoring the pair’s reaction to upcoming U.S. jobs data, an event that historically triggers notable volatility in the dollar markets.

The upcoming jobs release carries added importance after the longest U.S. government shutdown in history, which has complicated economic visibility and could influence the Federal Reserve’s upcoming policy decisions. Until fresh macroeconomic clarity emerges, the EUR/USD outlook remains decisively bearish.

Fundamental Drivers: Fed Divisions and ECB Stability

The core of the current EUR/USD dynamic is tied to the sharply diverging policy expectations between the Federal Reserve and the European Central Bank.

According to the Federal Reserve minutes, most policymakers expressed support for additional U.S. interest rate cuts, but not all members were convinced that such cuts should occur at the December 2025 meeting. A significant faction argued for keeping interest rates unchanged for the rest of the year, highlighting the sharp divisions inside the Fed regarding the path forward.

Fed Chair Jerome Powell emphasized these disagreements following the October 28–29 meeting, reflecting uncertainty among the 19 members of the policy-setting committee. The minutes also noted that participants held “sharply divergent views” on whether to cut rates at the December 9–10 meeting.

In recent months, the Fed has already reduced its benchmark rate to around 3.9%, down from 4.1%, marking its second cut of the year. Earlier projections indicated three total cuts for the year, scheduled for September, October, and December, which further complicates the current policy narrative, given the disagreements developing within the committee.

Meanwhile, the ECB presents a contrasting picture of policy stability, with no immediate pressure to adjust interest rates. This divergence in central-bank trajectories continues to offer structural support to the stronger U.S. Dollar.

Conclusion: What to Watch Next

With the EUR/USD pair trading firmly below 1.1500, the bearish structure remains intact. The technical indicators strongly favor further downside unless a clear bullish reversal takes shape above 1.1800. Fundamentally, the pair’s direction will be driven by the U.S. labor market data, evolving expectations for December 2025 Fed policy, and ongoing ECB rate stability.

For now, the signals point toward a continuation of the bearish trend, with the market preparing for potential high-volatility reactions in the sessions ahead.