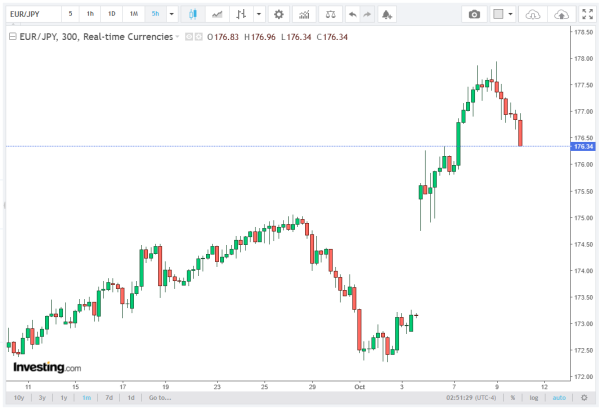

The EUR/JPY currency pair extended its decline on Friday, trading around 176.90 during Asian hours, following a retreat from Thursday’s record high of 177.94. The Euro (EUR) came under pressure amid growing political instability in France, while the Japanese Yen (JPY) faced limited upside potential due to expectations of continued fiscal stimulus and loose monetary policy in Japan.

In this article, Solancie brokers take a closer look at the key aspects of the topic. Traders have observed that EUR/JPY remains subdued for a second consecutive day as investors reassess positions after the all-time highs, with attention focused on geopolitical developments and central bank guidance.

Euro Under Pressure Amid French Political Turmoil

The Euro lost ground as France, the second-largest economy in the Eurozone, faced renewed political uncertainty following the resignation of Prime Minister Sebastien Lecornu. The resignation has heightened concerns about the French fiscal deficit, with markets closely watching ongoing negotiations between Lecornu and opposition parties.

President Emmanuel Macron is expected to appoint a new prime minister by Friday, but investor sentiment has already been impacted, leading to a pullback in EUR/JPY. The Euro slipped to an eight-week low of 1.1542 against the US Dollar, signaling that broader risk sentiment and currency weakness are influencing the cross-currency market.

Market participants remain wary, as France’s fiscal outlook may face further challenges if the political transition is protracted. Such developments typically weigh on EUR-based currency pairs, including EUR/JPY, which often react to shifts in Eurozone economic stability.

Japanese Yen Outlook: Loose Monetary Policy and Fiscal Stimulus

Despite the Euro’s weakness, the Japanese Yen has struggled to gain traction, largely due to expectations that Japan’s incoming Prime Minister, Sanae Takaichi, will pursue Abenomics-style fiscal stimulus while maintaining a loose monetary policy stance.

Takaichi emphasized that the Bank of Japan (BoJ) will operate independently, coordinating policy with government objectives to prevent excessive Yen appreciation. This suggests that any sharp Yen gains could be mitigated, keeping the EUR/JPY cross relatively supported on dips.

Market expectations have adjusted accordingly. The probability of a BoJ rate hike in December now stands below 50%, with traders anticipating that monetary tightening may only occur in March next year. Such a policy outlook reduces the safe-haven appeal of the Yen, limiting its ability to offset Euro weakness in the forex market.

Global Trade Developments and Economic Implications

Adding another layer of complexity to the EUR/JPY price action are recent trade developments. Japan’s chief tariff negotiator, Ryosei Akazawa, together with US Commerce Secretary Howard Lutnick, emphasized that the US-Japan trade pact is poised to bolster both strategic and economic relations between the countries.

While not directly influencing EUR/JPY, such developments impact global risk sentiment and may indirectly support risk-on trades, where investors favor higher-yielding or less stable currencies over the safe-haven Yen.

Technical Factors: EUR/JPY Price Action

The EUR/JPY pair faces immediate resistance at the all-time high of 177.94, which marks a key psychological level. Support is seen around 176.50, with traders closely monitoring daily candlestick patterns and moving averages for clues on the next directional move.

The recent retracement signals that profit-taking is occurring after the historic highs, while the longer-term trend remains influenced by macro fundamentals, including Eurozone political risks and Japanese fiscal and monetary policy.

Short-term traders may find range-bound opportunities between 176.50 and 177.00, while longer-term investors are likely to focus on fundamental catalysts that could push the cross higher or lower.

Market Sentiment and Risk Factors

Investor sentiment remains cautious as market participants weigh the Euro’s weakness against the possibility of a softer Yen. Key risk factors include ongoing political instability in France, which continues to pressure the Euro, alongside Japanese government stimulus measures that are influencing Yen supply.

Additionally, shifts in global trade agreements are affecting risk-on and risk-off flows, while guidance from the European Central Bank (ECB) and the Bank of Japan (BoJ) remains a critical influence on currency movements.

Given these factors, EUR/JPY is expected to trade with heightened volatility in the near term, and traders are advised to monitor economic releases, political announcements, and central bank communications closely.

Conclusion

In summary, EUR/JPY trades below 177.00 after pulling back from Thursday’s all-time high of 177.94, reflecting the interplay of Euro weakness and limited Yen strength. Political developments in France and monetary policy expectations in Japan are key drivers, while global trade agreements and investor sentiment continue to shape market dynamics.

Traders should watch support at 176.50 and resistance at 177.94, along with updates on French politics, BoJ policy, and risk-on market behavior, as these factors will determine the next directional move for the EUR/JPY cross.