Crypto regulation was addressed by the SEC in Nigeria yesterday, as the region continues to be one of the fastest growing crypto markets. On September 15, 2020, the Securities Exchange Commission in Nigeria covered regulatory guidelines pertaining to cryptocurrencies. Aside from historically warning people about the risks of digital assets, this is the first time that the SEC in Nigeria has taken a public stance on cryptocurrencies.

Crypto Regulation – Statement On Digital Assets

On September 15, 2020, it was a an important day for crypto users in the Nigerian region. Historically, investment regulators in Nigeria have never taken a public stance on digital assets. They have warned the general public of the risks associated with cryptocurrencies, but September 15, 2020 marked the first time that regulators went public. The statement by the SEC covered digital assets, specifically their classification and treatment. Since no laws have been signed yet, the statements by the SEC were intended to inform the public on their views and how they plan to regulate the digital asset industry.

Crypto Securities And Nigeria

According to the SEC, most crypto assets will be categorized as securities, but there will be some exceptions involved. To begin with, the Commission in Nigeria is under the impression that virtual crypto assets are securities unless explanation shows otherwise. The “issuer or sponsor” of these projects would have to supply informative information if they want to be exempted from Nigeria securities laws. Obviously this information would have to be reviewed by regulators before being granted any special status.

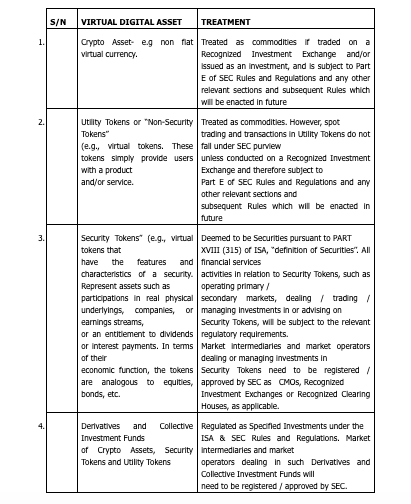

Issuers or sponsors would be responsible for filling out an “initial assessment filing form” if they want to prove that their digital assets are not considered securities The one exception is that regulators in Nigeria will treat utility tokens or “non-security tokens” as commodities. In addition, non fiat virtual currencies will be treated as commodities if they trade on recognized investment exchanges in the region. More information on the classifications from the statement can be seen below.

Crypto Services In Nigeria

Despite the statement not being 100% transparent, it seems as if Nigeria plans to impose regulatory approval for anybody that is affiliated with crypto related platforms. If this is the case, then it would be expected that all crypto wallets and exchanges would require regulatory approval. According to the statement, the Nigeria SEC saids the following parties must be registered with the Commission:

“services include, but are not limited to reception, transmission and execution of orders on behalf of other persons, dealers on own account, portfolio management, investment advice, custodian or nominee services.”

As mentioned above, it is important to note that the statements issued by the SEC are still very foreign. Until there is concrete laws shared with the public, many questions will continue to surface on these statements being presented.

How Crypto Regulation Can Impact Nigeria Moving Forward?

According to a recent report, Nigeria is witnessing some of the fastest growth in crypto markets. Over 200 million people are involved in Bitcoin transactions, which fuels peer-to-peer transactions in the region. In Q2 of 2020, Nigeria carried out $34.4 million dollars in peer-to-peer Bitcoin transactional trades. This was ahead of South Africa who saw $15.2 million dollars in transactions. In addition, Blockchain.com conducted research showing that its wallet app was experiencing the most activity in Nigeria from April to August of this year. Nigeria has been a prime candidate to adopt digital assets, especially in an environment where their local currency is extremely weak.

Crypto Regulation Moving Forward

With the SEC in Nigeria coming out and saying they basically plan to regulate most crypto services in the region, it will be interesting to see how it affects peer-to-peer crypto exchanges and other services that aid in the transaction of digital assets. With Nigeria representing one of the top 10 peer-to-peer crypto economies, it will be crucial for regulators to take a visionary stance, and not stifle growth opportunities in the region.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice. This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.