Many people who own crypto do not understand or simply ignore their tax obligations. Failing to file taxes on crypto profits can lead to serious legal consequences, both civil and criminal. The Tax Law Offices of David W. Klasing recently explained what those legal consequences could be.

The IRS Is Actively Looking For Crypto Tax Evaders

According to the Tax Law Offices of David W. Klasing, they have noted increased enforcement activity by the IRS involving the Coinbase crypto exchange. The IRS has been aggressively pursuing Coinbase users that do not report their crypto tax profits.

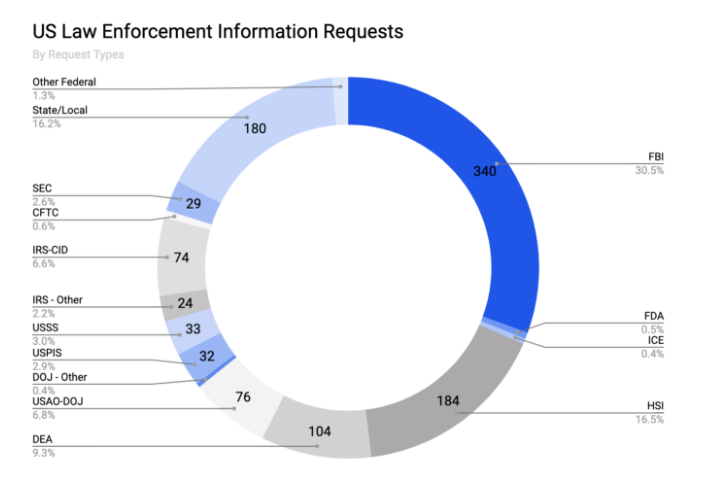

In October 2020, the Coinbase exchange released a transparency report. Anyone that deals in crypto should carefully look into the report. It is especially so if one does file crypto taxes. The report revealed that the IRS and its Criminal Investigation Unit constituted the biggest share of agencies requesting user details. Other agencies that requested significant amounts of data from Coinbase were the CIA and FBI. The requests made by the IRS clearly show that it wants to find who is not reporting their crypto tax profits. It was also reported that the IRS started cracking down more heavily in 2019 when they reportedly send out 10,000 letters to taxpayers requiring them to comply with guidelines regarding digital assets.

The Legal Consequences

For those who trade in crypto and do not file tax reports with the IRS, there could be serious consequences. The IRS is also interested in those who failed to file returns in the past, or they filed misleading or incomplete reports regarding their crypto holdings.

There is still an opportunity to act now and correct those reports. Once the IRS launches an audit or a criminal investigation, it will be too late to make corrections. If the audit has not started, there is still an opportunity to utilize the voluntary disclosure program. With the program, crypto traders can amend their returns if only a small amount of tax was unreported.

Seek Professional Assistance

For those who deal in crypto, making corrections on their own can be a daunting tax. However, using the services of professionals can help to correct the issue. It will ensure that they get the best possible assistance on how to correct the error. Additionally, it will help to mitigate any damage that has already occurred while also preventing future mistakes from occurring.

Those who use the services of skilled tax attorneys and CPAs at the Tax Law Offices of David W. Klasing will avoid future problems by adopting a system of best practices. They will receive guidance on how to keep track of their crypto activity, which must be reported when filing taxes involving crypto holdings in the future.

Crypto Taxation Is Complex

Crypto Taxation is complex, especially in the US. In October 2019, the IRS released further guidance on crypto taxation. Despite this, filing crypto taxes is still complicated for most ordinary traders. It is thus important to seek professional help, especially if one handles large volumes of crypto. Failing to do so can lead to huge fines and possibly jail time.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.