Chamath Palihapitiya, a venture capitalist and former Facebook executive, recently appeared on CNBC’s Squawk Box, in which he discussed the future of the Dollar. Based on the current environment, Chamath does not believe a Trump ticket or a Biden ticket will cure a struggling Dollar. He has turned to Bitcoin, calling it an “insurance policy” against the Fed moving forward.

U.S. Dollar

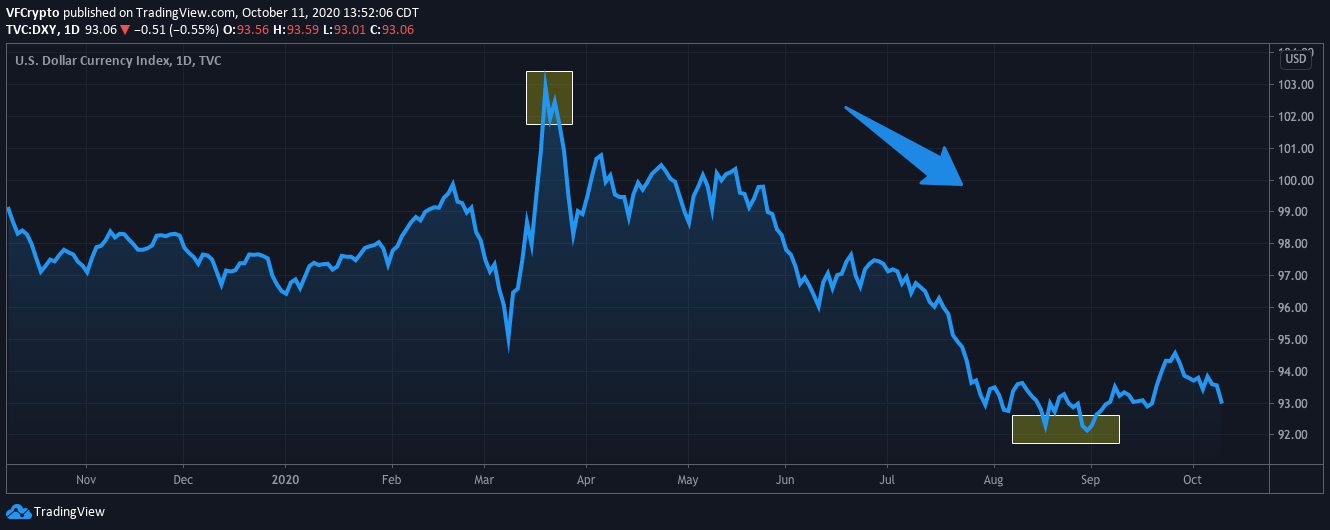

The U.S. Dollar has had a rollercoaster year, fueled by the carnage that COVID-19 has caused the economy. In the beginning of the year, the Dollar Index hit yearly highs, but this quickly diminished as COVID19 surfaced. As we can see from the chart below, the Dollar Index cracked 103 in Mid March, but started to see significant pressure as COVID-19 worsened around the globe. By late August, the Dollar Index put in new yearly lows at 92, and the Dollar has had a difficult time recovering due to on-going uncertainties.

Chamath Palihapitiya Shares His Thoughts

Chamath Palihapitiya, the CEO of Social Capital and former Facebook exec, recently shared his gloomy outlook on the U.S. Dollar moving forward. During an appearance on CNBC’s Squawk Box, Chamath mentioned that the behavior by the Federal Reserve and U.S. Treasury was not going to end well for the Dollar. In a push to keep the economy afloat, these entities have injected trillions of dollars out of thin air this year. Chamath believes this will result in continued asset price inflation as we progress forward.

It does not matter who wins the upcoming election

Palihapitiya stressed the fact that a Trump or Biden ticket was not going to make a big difference in terms of the Dollar’s standing. Under both administrations, it is believed that similar behavior would resume, especially in a low interest rate environment.

Bitcoin is the insurance policy against the Fed

With Bitcoin being non-correlated to the Dollar and stock market, Chamath stated that he is investing in Bitcoin as an “insurance policy” against the economy. In terms of his current allocation, he went on to say:

“I still think that what I talked about sort of eight or nine years ago still holds, which is a 1% hedge in our portfolio.”

It is important to note that Chamath is not your “typical investor” that wants to get rich off Bitcoin. He has stated numerous times that he is investing in the digital asset with the intention of never touching the allocation. In the event he did sell his Bitcoin, it would be in a scenario where the traditional economy is experiencing fundamental chaos. Unlike many investors who hope to sell Bitcoin for a massive gain, Chamath does not hope that the economy is ever in the position that he needs to sell his Bitcoin.

Bitcoin Vs The U.S. Dollar

In previous reports, it has been outlined that Bitcoin and the Dollar have been non-correlated for years. With investors starting to realize this inverse relationship, traditional financial firms, institutional investors, and high net worth investors have expressed new interest in Bitcoin this year. In a market where many uncertainties exist, a small allocation in Bitcoin continues to make sense, especially when looking at historical price action.

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.