Celsius Network and its crypto rewards platform have surpassed $2.2B in assets under management. Over the last six months, the company reported that their AUM has doubled. This milestone comes in the same year that Celsius became the first digital asset platform to breach $1B in AUM.

Celsius Crypto Holdings

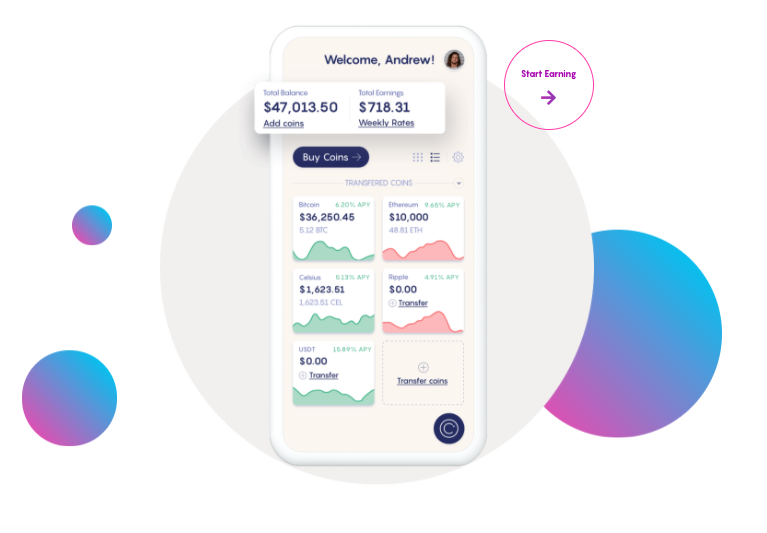

Celsius Network, a company disrupting financial services through crypto, recently announced the surpassing of $2.2B in assets under management. The crypto rewards platforms continues to see significant growth and has doubled its AUM over the last 6 months. With traditional banks pushing interest rates to nearly 0% , investors are flocking to Celsius, where they can earn much higher yields through the peer-to-peer lending platform. In a push to drive financial freedom through cryptocurrencies, Celsius became the first company in crypto to reach $1B in assets earlier this year.

During unprecedented times in 2020, the crypto lender has continued to experience exponential growth. Some of its milestones this year include:

- More than 215,000 active users on a global scale

- More than $80mm in crypto rewards have been shared with the community

- Celsius Network’s native token “CEL” has surged +4,529%

- The companies balance sheet is $680mm excluding AUM

Alex Mashinsky, the CEO of Celsius commented on the developments, stating that:

“Our incredible growth not just during the last year, but since Celsius was launched just over 2 years ago, proves that as we predicted, interest income is the new killer app for crypto. We created the concept of earning yield on your digital assets in kind or with a native token and launched the DeFi revolution. Since then we have created more income for our customers than any one else in DeFi or CeFi, and we have no plans on slowing down any time soon.”

How They Are Doing It?

Celsius Network believes its growth is directly related to the “community-centric” model that is deployed on a day to day basis. With Celsius sharing up to 80% of its revenue with clients, it is able to offer investors yields that are inconceivable in traditional banking. Through a diverse set of financial services, users can engage in activities such earning interest on their digital assets, or using their holdings as collateral to borrow cash or stablecoins.

Back in September of this year, Celsius announced that users could earn nearly 16% APY on 12 different stablecoins. Investors around the globe are interested in stablecoin interest, especially as a hedge against a devaluing dollar. Celsius is also offering up to 15% APY on more than 40 cryptocurrencies.

Further Diversification

For users interested in additional ways to diversify outside of stablecoins and individual cryptocurrencies, Celsius has recently given users the ability to earn interest on digital gold. With the addition of PAX Gold, users can earn up to 4.5% APY on a gold backed digital asset. Instead of going through a tedious process to purchase individual gold, Paxos Trust Company oversees PAX Gold, which is digital gold backed by one fine troy ounce of “London good 400oz delivery gold bars.”

Notice: Information contained herein is not and should not be construed as an offer, solicitation, or recommendation to buy or sell securities. The information has been obtained from sources we believe to be reliable; however no guarantee is made or implied with respect to its accuracy, timeliness, or completeness. Authors may own the crypto currency they discuss. The information and content are subject to change without notice. Visionary Financial and its affiliates do not provide investment, tax, legal or accounting advice.

This material has been prepared for informational purposes only and is the opinion of the author, and is not intended to provide, and should not be relied on for, investment, tax, legal, accounting advice. You should consult your own investment, tax, legal and accounting advisors before engaging in any transaction. All content published by Visionary Financial is not an endorsement whatsoever. Visionary Financial was not compensated to submit this article Please also visit our Privacy policy; disclaimer; and terms and conditions page for further information.