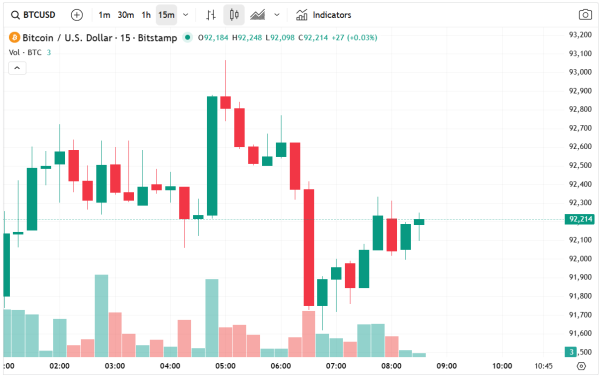

Bitcoin (BTC/USD) remained stable on Wednesday as investors seized the opportunity to buy the dip after the cryptocurrency recently slid into a bear market. The BTC price was hovering around $93,400 in the morning, just above this month’s low of $88,790, signaling a potential short-term rebound.

Fimatron experts deliver a detailed and insightful analysis of the subject in their latest piece. The digital asset remains in a bear market after falling by over 25% from the year-to-date high of $126,300, signaling ongoing market uncertainty but also potential opportunities for a relief rally.

Bitcoin Price Steadies Ahead of FOMC Minutes

The BTC/USD pair faces two primary market catalysts on Wednesday. The first is the release of the Federal Reserve minutes, which will shed light on the recent monetary policy decision, where officials opted to cut interest rates by 0.25% for the second time.

Investors are closely analyzing whether the Fed will continue its rate-cutting trajectory in the upcoming meetings. According to Polymarket data, expectations for a rate cut in the next Fed meeting have dropped below 60%, indicating some market skepticism. Historically, Bitcoin tends to perform well when the Fed is reducing interest rates, as looser monetary policy often supports risk-on assets like cryptocurrencies.

The second key catalyst is the upcoming Nvidia earnings report, which could influence the broader technology and cryptocurrency sectors. A strong earnings result from Nvidia may reflect positive momentum in the artificial intelligence (AI) industry, which has been a driver for crypto adoption through AI-related blockchain applications. If Nvidia delivers better-than-expected results, it could act as a bullish signal for Bitcoin price and the overall crypto market.

ETF Flows and Whales’ Activity Affect BTC/USD

Another critical factor shaping BTC/USD dynamics is the exchange-traded fund (ETF) inflows and outflows. Recent data indicate that American investors, particularly retail traders, have been selling Bitcoin. Bitcoin funds have seen net outflows exceeding $250 million this week, following losses of over $2.3 billion in the last two weeks.

Despite these bearish flows, there are early signs of renewed institutional interest. Whales, large holders of Bitcoin, have begun buying after several days of heavy selling, suggesting that these market participants anticipate a potential uptrend. Such activity often signals a possible short-term relief rally, as large purchases can create upward pressure on the BTC/USD pair.

BTC/USD Technical Analysis

The daily chart for BTC/USD shows sustained pressure over the past few months, with Bitcoin moving from the all-time high of over $126,000 to its current level around $93,600. However, the formation of a hammer candlestick suggests a potential bullish reversal, often observed after periods of significant selling.

Key technical indicators for BTC/USD are currently showing mixed signals. The pair remains below both the 50-day and 100-day Exponential Moving Averages (EMA), reflecting a prevailing downtrend. However, the Relative Strength Index (RSI) has dipped into oversold territory, suggesting that selling pressure may be exhausted and a short-term bounce could be possible.

Meanwhile, the Percentage Price Oscillator (PPO) continues to trend below the zero line, reinforcing the short-term bearish bias, though it also hints at potential room for a reversal if momentum shifts.

The support level at $88,790 is crucial. As long as the Bitcoin price holds above this point, the BTC/USD outlook remains bullish, with the potential to test the resistance at $100,000. A breakdown below $88,790 would invalidate the bullish scenario and could signal further downside risk.

Key Takeaways for Traders

Market catalysts such as the upcoming FOMC minutes and Nvidia earnings are expected to drive short-term volatility in BTC/USD. Interest rate expectations play a key role, as Bitcoin tends to benefit in a rate-cutting environment, making the Fed’s guidance particularly relevant for traders.

Meanwhile, ETF flows and whale activity are noteworthy; although retail selling persists, the return of whale purchases points to potential upward momentum. From a technical perspective, an oversold RSI and a hammer candlestick formation suggest a possible relief rally, though EMAs and the PPO signal caution.

Conclusion

The BTC/USD pair is at a key juncture, navigating through a bear market after losing over 25% from the year-to-date high. While short-term pressures remain due to retail selling and technical indicators, signs of whale accumulation, the potential Fed rate cuts, and strong tech earnings create the backdrop for a possible relief rally.

Traders should watch support at $88,790 closely. A sustained move above this level may offer short-term bullish opportunities, targeting $100,000 resistance, while a breach could signal renewed downside risk. The interplay of macroeconomic catalysts and technical factors makes Bitcoin one of the most closely watched forex and crypto pairs in the current market environment.