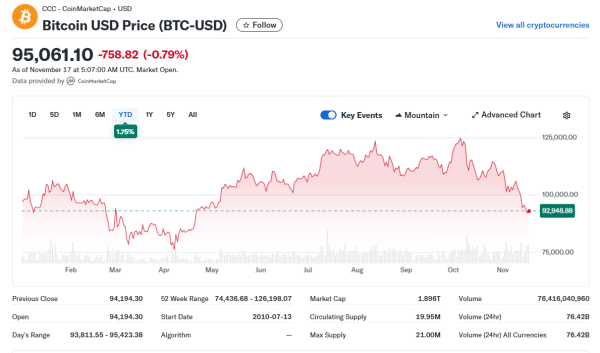

Bitcoin has staged an impressive rebound after briefly falling below the $90,000 mark earlier this week, renewing optimism among traders that the world’s largest cryptocurrency may resume its year-end rally. As BTC trades back near $92,000, analysts, including those at global banking giant Standard Chartered, believe the worst of the correction may already be in the rearview mirror.

Brokers and digital asset strategists at Logirium reviewed the latest market data and analyst commentary to break down whether Bitcoin is truly ready for its next leg higher.

Standard Chartered: “The Sell-Off Is Over”

Standard Chartered’s digital assets head, Geoffrey Kendrick, sparked renewed optimism by noting that Bitcoin’s latest decline mirrors previous corrections in the current market cycle. He believes the sell-off aligns with the third major pullback of the past two years and is therefore not a cause for alarm.

Kendrick highlighted several reset market indicators, including MicroStrategy’s modified net asset value multiple (mNAV), which compares the firm’s market value to its Bitcoin holdings and has returned to levels typically associated with market bottoms. The mNAV has dropped to 1.0, a level associated with previous market bottoms.

Kendrick noted that recent market resets indicate Bitcoin’s downturn is likely finished, potentially undermining the idea that its price still hinges on halving cycles. He anticipates renewed upside into the year-end. This view aligns with Standard Chartered’s broader conviction that accelerating blockchain adoption could ultimately shift all global transactions onto decentralized networks..

On-Chain Metrics Strengthen the Bull Case

Market sentiment is strengthening as several on-chain indicators signal a potential bottom. Crypto analysts pointed to the traders’ realized loss margin, which historically marks capitulation when it falls below -12%. This week, it hit -16%, indicating deeper-than-normal selling pressure and a possible setup for recovery.

Another bullish signal is Bitcoin’s Relative Strength Index (RSI), now at 26, placing it firmly in oversold territory. The last time RSI dropped this low, Bitcoin rallied from $76,000 to $120,000. If similar conditions play out, BTC could be poised for a powerful rebound and potentially new highs.

Why This Pullback Mirrors Prior Cycles

Bitcoin’s major corrections often follow a predictable logic: rapid climbs trigger overheated conditions, followed by sharp but temporary resets. These resets cool leveraged positions, absorb speculative excesses, and allow long-term holders to accumulate coins at discounted prices.

The latest correction behaved similarly:

- Funding rates reset across major derivatives platforms.

- Short-term holders capitulated, per on-chain wallet flow data.

- Long-term holders remained steady, signaling confidence.

- Liquidity pockets near $89K helped stabilize price action.

From a structural standpoint, nothing in the recent drawdown indicates a breakdown of the macro bull trend.

Could Bitcoin Hit $100,000 Again Soon?

With Bitcoin stabilizing and reclaiming upward momentum, analysts see a renewed path toward the six-figure mark. The psychological $100K threshold has acted as both a magnet and a resistance zone this cycle, but many experts believe Bitcoin could retest it quickly if macro conditions cooperate.

The next major catalyst appears to be the Federal Reserve’s upcoming December meeting. If recent economic data, especially weakening employment indicators, encourage the Fed to resume rate cuts, risk assets like Bitcoin could benefit.

Lower interest rates:

- Increase liquidity

- Lower borrowing costs for traders

- Boost investor appetite for high-growth or alternative assets

- Historically correlate with crypto bull phases

Given Bitcoin’s oversold technical posture, even modest improvements in macro sentiment could accelerate the next leg up.

What Traders Should Watch Next

Analysts note several key metrics that will help confirm whether the recovery is sustainable:

1. RSI Normalization

A move from 26 back to the neutral 40–50 range often marks the beginning of a meaningful uptrend.

2. Reclaiming the $95,000 Resistance Zone

This region acted as a structural support earlier this cycle. Flipping it back to support would be strongly bullish.

3. Futures Open Interest Behavior

Ideally, futures interest should rise in tandem with spot price gains, signaling fresh confidence rather than short-term speculation.

4. On-Chain Accumulation by Whales

Large wallets have been quietly rebuilding positions, a sign that the “smart money” expects higher prices.

Conclusion: A Bullish Setup, But Not Without Risk

All signs indicate that Bitcoin may indeed be forming its year-end bottom, with strong institutional commentary and on-chain metrics reinforcing the bullish case. While a swift return to $100K remains speculative, the pathway looks clearer than it has in weeks.

Still, traders should approach with discipline. Crypto’s volatility means that even in bullish cycles, retracements are normal and can be sharp.

For now, though, the momentum appears to be shifting back in Bitcoin’s favor, and analysts suggest the rally may only be getting started.